| 📅 Monthly Subscription | No, $0.00/month |

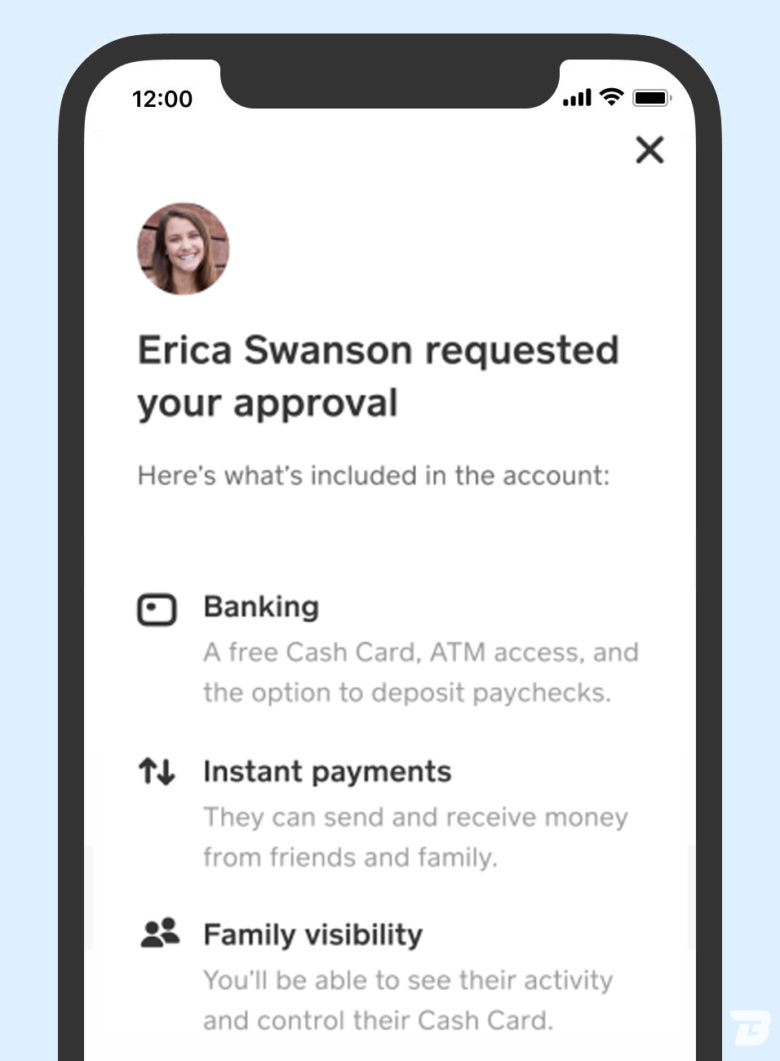

| 👪 Approval Required | Yes, Parent |

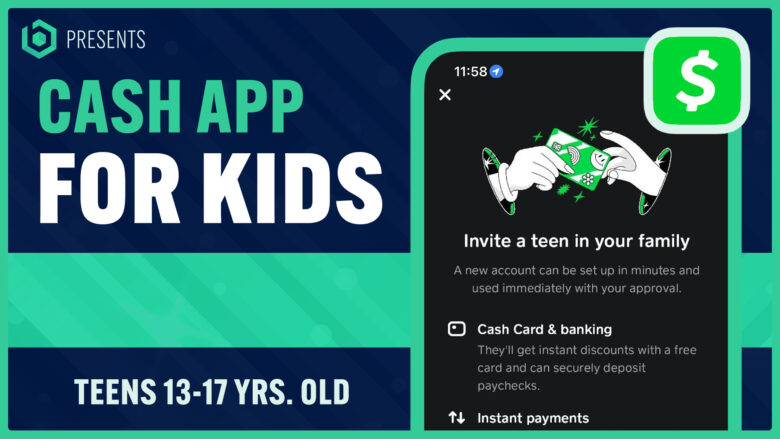

| ✔️ Minimum Age | 13+ Years Old |

| 💳 Cash Card Option | Available |

| 🆓 Free to Use | Yes, Zero Fees |

Looking at options with Cash App for kids?

You’re in the right place!

The Cash App card is a great free option for children ready to learn more about money.

JUMP TO: Better Cash App Alternatives for Minors

We’ll go over the rules & regulations for Cash App accounts for kids and others.

Yes, Cash App has a basic set of features for kids, including a debit card.

The Cash App card can help teach kids & teenagers the value of money and how to manage it responsibly.

But are they allowed to use Cash App?

Let’s find out!

Is Cash App a Good Money Management Option for Kids?

Can a kid have a Cash App account?

Yes, kids 13+ years or older can now have a Cash App account.

Cash App terms of service used to require users to be 18 years or older to sign up. [1]

Children under the age of 18 couldn’t enter into the contract.

The only way to legally have a Cash App is to use their guardian’s card.

And can you have multiple Cash App accounts?

Yes, you can.

The child in this situation would have to use an active account already started by a parent, and you’d have to co-use the account moving forward.

They’ve recently amended their rules to allow minors from ages 13 to 17 access to a Cash App account, so this would work.

But we’d suggest establishing a kids’ account for convenience.

The way they’ve enabled these accounts is pretty neat and convenient for your kiddos.

What About Cash App for a Teenager?

Now, the age range for a Cash App account for a minor is 13-17, and a regular Cash App account is for ages 18+.

If you have kids under that 13-year-old limit, they are not permitted at this time to use the app.

The verification requires an ID from the user, which means minors do not have the means to verify their account.

There are now alternative verification methods for that 13-17 year age range, so we’ll get to that a little further below.

Can Kids Use Their Parents’ Accounts?

Technically, kids could become Cash App users simply by using a parent’s Cash App account.

The parent would have to set it up because you need a legal ID and must be 18 years of age or older according to their terms & conditions.

Once the setup is finished, a parent could provide their login information to their child to use it.

You could even get that glorious referral bonus if you so choose.

However…

…we don’t recommend that.

There are other alternatives where they can learn about money without full access to their bank accounts.

8 Noteworthy Features of Cash App for Kids

Cash App for minors is set up just like it is for regular Cash App users, with a few restrictions.

Approved teen users will not have access to the following features:

- Investing in stocks

- Buying & selling Bitcoin

- Cash App Borrow feature (loan feature)

- Physical check deposits

- Cash deposits

- Cross-border payments

That being said, there are a TON of great features a teen’s account can still access, including a free Cash Card, direct deposit, peer-to-peer payment capability, and much more.

Let’s dive into some of these features that your teens will love!

1. Unique $Cashtag for Their Account

Teens can create their very own unique $cashtag.

This is Cash App’s version of a username.

They can use it to invite friends, pay for each other, and even purchase digital items online.

One great feature of Cash App is the Cash Split.

This allows users to split the bill or send money by splitting the $Cashtag group.

It’s perfect for teens who want to easily divvy up expenses like rent, groceries, gas, etc.

2. Limitations on Certain Features

Safety measures have been thoughtfully added to these teen accounts.

These measures still allow the authorized user (your teen) to have a fulfilling experience with Cash App, but with some level of monitoring by a parent or guardian for safety & security.

It’s the best of both worlds.

They’ve set limitations on features such as how much money can be transferred within a certain amount of time, setting limits on money requests to contacts only, setting up a unique PIN, enabling tracking notifications, and other similar features.

3. Send & Receive Money

Teens can send and receive money similarly to a regular, verified Cash App account.

It is an excellent platform for teens to learn how to manage money by sending & receiving payments from other Cash users.

It’s a quick & easy way to pay back a friend for lunch money, send money to your parents when they forgot to get cash from the ATM before picking you up from school, or keep track of who owes what in regard to chores or favors.

Using Cash App is an excellent way for teens to learn critical financial habits without worrying about overdraft fees, credit card debt, or high ATM withdrawal fees.

Cash App is entirely free when it comes to sending & receiving money within the Cash app platform.

4. Custom Cash Card

Teens also have access to creating and using a custom Cash App card.

This physical debit card is much better than some alternative prepaid debit card options and kids’ debit cards that offer far fewer features.

Plus, they get to design it!

They can create a unique design that fits their personality.

5. ATM Withdrawals

Yes, a minor account does still have access to ATM withdrawals.

They can withdraw cash for a $2 fee at any ATM, although Cash App offers ATM fee reimbursement to users who have direct deposits on their accounts.

It must amount to $300 or more per month, but if your teen meets this requirement, their ATM fees will be reimbursed just like they are with a regular account.

6. Cash Boosts

Just like a regular Cash App account, if your child gets a Cash App card, they will have access to cash boosts.

These are great instant rewards and savings from many familiar retailers.

It’s a great window into major money lessons and an excellent way to teach money management in terms of using coupons and saving money.

What an outstanding personal finance feature your children have access to!

7. Referral Bonuses

When your teen signs up for a Cash App account, they can use your referral code to earn a welcome bonus.

Well, they can do the same by referring their own friends too!

As they refer more friends to use Cash App, they can earn unlimited referral bonuses on their account and use it with their own money (referral bonuses get added to your cash balance).

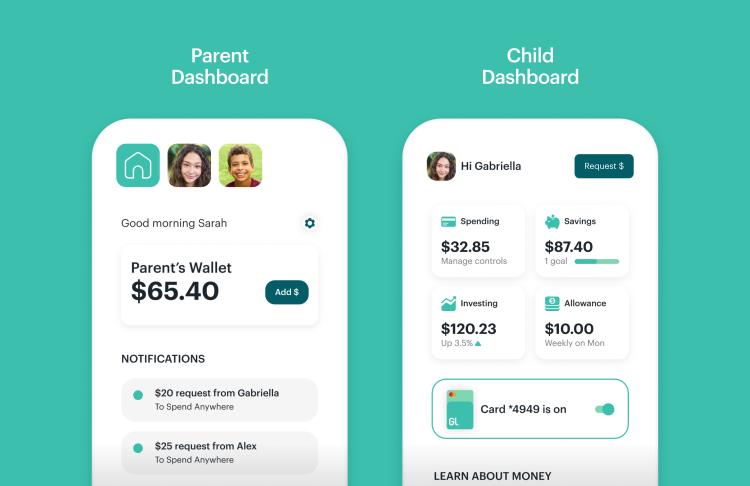

8. Banking Features

Having your teen use Cash App (and a cash card) is such a great way to introduce all of the features of a bank account without the fees and restrictions that come along with that.

Cash App is a free account that a parent or guardian can keep an eye on without exerting full control.

Your kids can have their debit cards (the cash app card is excellent!) and learn more about personal finance with reasonable spending limits and critical features, but primarily free rein over their own ‘checking account.’

Fee-free bank accounts are more common than they used to be, but Cash App has all the features you want in addition to being free.

It’s an excellent banking alternative!

5 Stellar Cash App Alternatives for Kids & Teenagers

Still looking for a financial app for your kids, but Cash App isn’t the right fit?

There are alternatives if you – or they – aren’t interested in a Cash App account.

Here are a few of the best apps like Cash App – specifically for minors – out there at the moment:

- Greenlight

- Current Mobile Bank

- FamZoo

- GoHenry

- Netspend

- Chime Bank

Let’s dig into these a little deeper, shall we?

1. 🥇 Greenlight Debit Card for Kids (Best for All Ages & Multiple Kids)

- Starts at $4.99 per month

- Debit card for kids with 1% cashback

- Parental tools & real-time monitoring

- Kids earn up to 2% on savings

- Investments for kids

- Chores & allowance on autopilot

Another Cash App alternative is Greenlight, which has been around since 2008! [2]

Greenlight works for kids of all ages, and the app excels with families with multiple kids.

The app is still excellent for single-child families, so don’t let that deter you.

They are adding new features all the time, including peer-to-peer payments.

You’ll be able to send money to another Greenlight user without going through PayPal or Venmo first or dealing with Cash App pending payment issues that sometimes occur (not great for youth expense tracking).

They also have excellent features, like sending money through email, messaging, or photos.

2. Current Mobile Bank (Best for Teens 16+)

- No subscription fee or hidden fees

- Best debit card designed specifically for teens

- Excellent parental controls

- Safety and security features

- Automate chores & allowance payments

3. FamZoo

FamZoo is an app designed specifically for kids to use. [3]

You can set allowances and monitor their spending.

This Cash App alternative is great because you can enable an automatic setting that rounds up every transaction (yes, even a $1 purchase) and puts the change in a savings account for your child.

3. GoHenry

Another Cash App alternative is GoHenry, which is available on Android & iOS devices. [4]

It looks like it has all of the same functions as Cash App: send, request, pay bills, reload prepaid cards/gift cards, and more.

The only real downside is that Cash App has a fee of $1 to send payments under $10 while GoHenry charges 2.9%.

Still, it’s a Cash App alternative!

4. Chime Bank

Chime Bank is a fantastic app for teens, as long as they’re 18 or older.

It offers a spending report, a savings goal tracker, and bill payment.

You can also have paycheck deposits automatically sent to Chime if you set it up on your teen’s employer’s website.

Your teen can even get a Visa debit card that they can use right off the bat without any fees.

5. Netspend

Netspend is another great Cash App account alternative.

While Cash App doesn’t have a fee for ATM withdrawals, Netspend has a much higher limit.

They charge $2 for ATM withdrawals and $3 to load cash onto an existing prepaid debit card.

Otherwise, it looks like it’s pretty similar to Cash App: mobile transfers/payments, direct deposit, etc.

Cash App for Minors FAQs

Do You Have to Be 18 to Use Cash App or a Cash Card?

No, you can be 13 years or older to sign up as long as you have a parent or guardians’ permission.

Does Cash App have family accounts for kids?

Yes, you can have your parent or guardian sign up and grant you access to a family account with a debit card for teens.