| 🏧 ATM Compatibility | All ATMs Work for Cash App Card |

| 🌐 In-Network ATMs | 40,000+ MoneyPass ATMs |

| 💸 ATM Fees | $2.50 from Cash App Plus ATM Operator Fee |

| ⚠️ ATM Withdrawal Limits | $1,000 Every 24 hours |

| 🗺️ Cash App ATM Locations | Google Map of Nearby ATMs |

| 💵 Free Cash App ATMs | Unlimited Withdrawal Feature Available |

Are you looking wondering… “is there a free Cash App ATM near me?”

Yeah, so was I, and after trying a few local ATMs and getting very frustrated when I got hit with fees trying to withdraw cash from my Cash App account, I set out to find a free solution.

After some testing and extensive research, I figured out precisely what free Cash App ATMs near me work, so there is no more guessing game and wasted money.

- You can use your Cash App Card at any ATM to withdraw money, but a fee of $2.50 from Cash App plus the ATM operator fee will apply.

- To avoid these fees, set up direct deposit with your Cash App account and receive $300 or more. This activates unlimited ATM withdrawals at over 40,000 in-network ATMs for a 31-day period.

- Cash App has partnered with the MoneyPass ATM network, so look for these ATMs to avoid fees. If you don’t have regular deposits, you’ll pay $2.50 plus ATM operator fees for using ATMs outside the network.

In this short article, I’ll tell you precisely what ATMs are free for Cash App with a map of all locations near you.

We highly recommend getting the Albert App, a money app. It’s similar to Cash App or a bank account, but way better!

Albert has a debit card and savings account (no credit checks) and lets you borrow up to $250 with no interest or fees! It’s also easy & quick to sign-up!

Where Can I Withdraw Money from a Cash App Card?

Can you use a Cash App card at any ATM?

Yes!

If you have money in your Cash App account, you can withdraw cash using your Cash App cash card at any ATM in the United States with only a fee of $2.50 charged by Cash App.

You will also be charged a fee from the ATM operator, which typically ranges from $1.50 to $7.00.

There is a way to avoid these upfront fees when you use an in-network ATM; more about that is below.

Read this article and learn how to withdraw cash from Cash App into a physical cash card you can shop with. And for information about all of Cash App’s fees, check out our Cash App fees calculator.

You’ll receive insider tips on making money online, side hustle ideas, and more. Subscribe now and take control of your financial future.

I promise not to spam, sell, or share your information.

What ATMs Can I Use for the Cash App Card?

The Cash App cards work at any ATM in the U.S. that dispenses money. Cash App partners with Sutton Bank to give customers complete access to cash at any other bank’s ATM, regardless of whether or not they have a bank account there.

Cash App charges will include only a fee of up to $2.50, regardless of the ATM operator fees or financial institution as a network usage fee.

If no ATM operator fees apply, you’ll only be charged the Cash App’s flat fee for withdrawals.

Can I Use My Cash App Card in ATMs outside the U.S.?

Cash App doesn’t work internationally.

The Cash App debit card functionality is restricted to the United States, where you can use it for any purchase in the United States only.

Map of Cash App ATM Locations Near Me

Do you specifically want to make a Cash App ATM withdrawal?

Here is a map of the MoneyPass in-network Cash App ATM locations near you:

Alternatively, you can search Google or Google Maps with “MoneyPass ATM near me” to see a list of the closest ATMs.

How Do I Find the Closest Cash App ATM Near Me?

You can complete a Cash App ATM withdrawal with any ATM nearby.

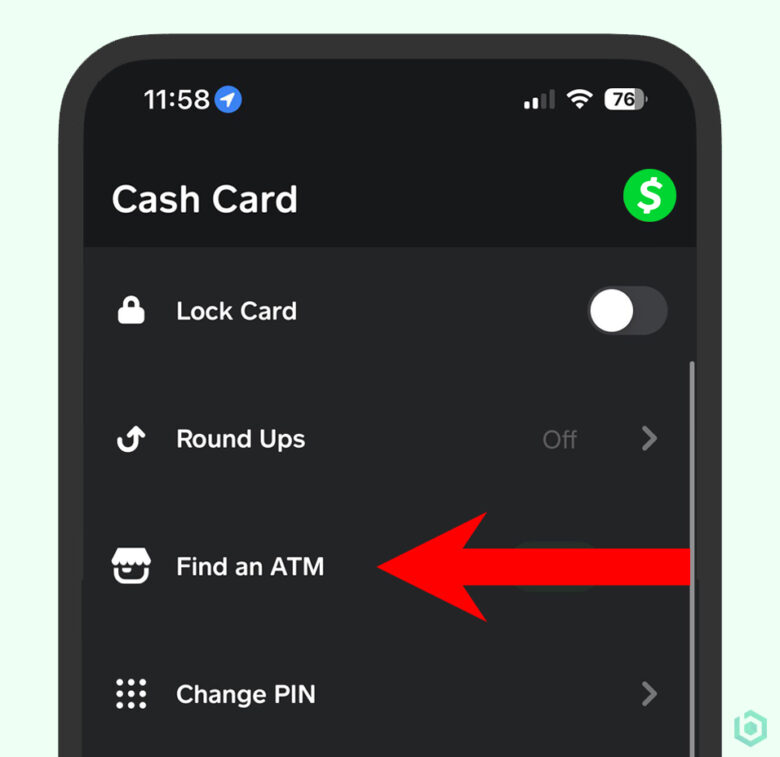

How to Use “Find an ATM” In-App Feature

You can also use the Cash App Find ATM feature in your Cash App account to locate in-network ATMs by doing this:

- Select the Cash Card tab

- Select ‘”Find an ATM” in the menu below

- Select an ATM location near you using the map or search by address

Now that you know which ATMs are nearby, you can learn how to withdraw without fees below.

Bank List of Cash App ATMs near me

You can withdraw from your Cash App account using any bank’s ATM.

Here is the list:

- Ally Financial

- American Express

- Ameriprise

- Ameris Bancorp

- Bank of America

- Bank of Hawaii

- BMO Harris Bank

- BNP Paribas / Bank of the West

- Cathay Bank

- CIT Group

- City National Bank

- Comerica

- Commerce Bancshares

- Credit Suisse

- Discover Financial

- East-West Bank

- E.B. Acquisition Company II LLC

- First-Citizens BancShares

- First Hawaiian Bank

- First Horizon National Corporation

- First Midwest Bank

- First National Bank of Nebraska

- FNB Corporation

- Fulton Financial Corporation

- Glacier Bancorp, Inc

- Goldman Sachs

- Hancock Whitney

- HSBC Bank USA

- John Deere Capital Corporation

- JPMorgan Chase Bank

- KeyCorp

- M&T Bank

- MUFG Union Bank

- New York Community Bank

- Northern Trust

- Old National Bank

- Pacific Premier Bancorp Inc.

- PacWest Bancorp

- PNC Financial Services (PNC Bank)

- Popular, Inc.

- Prosperity Bancshares

- Raymond James Financial

- RBC Bank

- Regions Financial Corporation

- Santander Bank

- State Farm

- State Street Corporation

- Sterling Bancorp

- Stifel

- SVB Financial Group

- Synovus

- The Bank of New York Mellon

- TIAA

- Truist Financial

- U.S. Bancorp

- UBS

- Valley National Bank

- Washington Federal

- And many more…

This list comes from federalreserve.gov. See the complete list here.

My Personal Experience with Cash App ATMs

Let me tell you about this one time on a road trip.

I cruised through the Midwest, using my Cash App cash card to pay for almost everything. One evening, I rolled into this quaint little town and stumbled upon a charming farmers market.

The catch? They only accepted cash.

I knew I could use my Cash App cash card at any ATM, but the thought of those pesky fees was a real downer.

Then it hit me – why not use the Cash App’s ‘Find an ATM’ feature?

I gave it a shot, and lo and behold; there was a Kwik Trip gas station just a few blocks away with a MoneyPass ATM. Thanks to my direct deposit set up with Cash App, I managed to withdraw the cash I needed without any extra charges.

It was an absolute lifesaver! Since that day, I’ve made it a point to always check for in-network ATMs on the Cash App whenever I need cash.

It’s a small step, but trust me, it can save you a good chunk of change and a lot of hassle.

What ATMs are Free for Cash App?

UPDATE: Cash App recently changed its ATM policy. They now offer unlimited withdrawals fee-free via the MoneyPass ATM network (‘in-network’ for Cash App) if you have a monthly direct deposit of $300 or more. Plus, a single non-network ATM reimbursement every 31 days.

So, what ATMs are free for the Cash App Card?

| Cash App User Type | ATM Operator Fee | Cash App ATM Fee |

|---|---|---|

| Has Direct Deposit* | Unlimited withdrawals at in-network ATMs and a single non-network every 31 days. | None |

| No Direct Deposit | Yes, at all non-network ATMs | Yes, All ATMs |

Cash App only offers free ATM withdrawals if you have a direct deposit setup with your account.

To qualify for unlimited free withdrawals at the ATM, you must receive $300 (or more) in monthly direct paycheck deposits.

To do so:

- Tap the Money tab

- Tap the routing and account number below your balance

- Copy and provide the routing and account numbers to your employer

Once you have received qualifying deposits totaling $300 (or more), Cash App will grant unlimited free in-network ATM withdrawals and a single non-network reimbursement of ATM fees every 31 days.

Customers who do not receive qualifying deposits will be charged a $2.50 withdrawal fee from Cash App plus additional ATM operator fees.

Use our find Apply Pay ATMs guide to withdraw using Apple Pay instead of a debit card.

Where Can I Withdraw Money from Cash App for Free

Trying to find out how to get money off Cash App at the ATM without paying ATM fees?

It’s possible.

You should use any ATM in the MoneyPass network to withdraw money from Cash App for free. Kwik Trip has free ATMs, and most 7-Eleven stores have MoneyPass ATMs that you can use to reduce your fees.

Many of these stores also allow you to add money to your Cash App account inside their stores.

Cash App Free ATM at Kwik Trip Gas Stations

Kwik Trip has unlimited withdrawals fee-free for Cash App through their ATMs across the midwest. If you have a Kwik Trip near you, you can withdraw money from your Cash App account without ATM operator fees.

Since Kwik Trip ATMs are part of the MoneyPass network, they also qualify for unlimited free withdrawals from Cash App if you have direct deposit.

You can use the Kwik Trip store locator to find a nearby gas station.

Cash App Free ATM at 7-Eleven Convienence Stores

You may find a MoneyPass ATM at one of the 9,446 7-Eleven locations in the United States. Make sure to verify that the ATM is MoneyPass, so you don’t get any fees.

Most 7-Eleven stores have MoneyPass ATMs, considered in-network ATMs for Cash App.

Is the Walgreens ATM Free for Cash App?

While in-network options such as Kwik Trip and 7-Eleven do not incur fees, Walgreens’ ATMs are considered out-of-network. This means you’ll be subject to the same fees as all other out-of-network ATMs.

If you have direct deposit set up with Cash App, you can use these ATMs once per month with a reimbursement.

What are In-network ATMs for Cash App?

Cash App has partnered with the MoneyPass ATM network, which has over 40,000 ATMs in-network.

You can now withdraw your Cash App balance from MoneyPass ATMs and get free unlimited withdrawals if you have received $300 in direct deposits. Plus, a single non-network ATM reimbursement every 31 days.

If you use Cash App and don’t have regular deposits, you will pay $2.50 to take out cash from your Cash App funds at ATMs in the network and $2.50 plus ATM operator fees for using ATMs outside the network.

So, if you’re asking yourself, ‘Where can I withdraw money from Cash App for free,’ then ATM fees are likely a big deal to you. Look up and find a MoneyPass ATM to save yourself a little stress and worry.

Tips & Tricks to Avoid ATM Fees

Not a fan of paying fees?

Here are a few ideas to avoid paying unnecessary fees to access your Cash App funds.

- You can use the Cash Card at any merchant that accepts debit cards in the U.S. instead of taking out cash.

- Use an in-network ATM (described above).

- Plan ahead. Transfer money from your Cash App account to your bank account, then pull the cash from your bank account without paying ATM fees.

- Consider setting up a direct debit of $300 monthly to your account. This will automatically activate free in-network ATM withdrawals, including ATM operator fees. You’ll also gain access to one non-network ATM fee reimbursement per month. One-time transfers (like reward payouts or cashback) won’t cut it; it must be a recurring direct deposit.

- Use your Cash Card to make a purchase. Request cash back after entering your pin during the payment transaction.

For me, the easiest option is to instantly transfer money from Cash App to my bank account and then use my bank debit card at my bank ATM to withdraw the cash I need. Although it is an additional step, it is still free and can save you some money.

Cash App ATM Withdrawal Limits

For your protection, your Cash Card ATM withdrawal limits are in place. While you can get free unlimited withdrawals using the methods above, Cash App limits how much you can withdraw from an ATM daily.

The ATM withdrawal limits are $1000 across the board:

- Daily limit: $1,000

- Per ATM transaction limit: $1,000

- Weekly limit: $1,000

Transactions that involve receiving cashback will also count toward your Cash App ATM withdrawal limit.

When Does the Cash App ATM Withdrawal Limit Reset?

The limit resets after every seven days.

For example, if you withdraw on the 10th of the month, your one-week limit will be complete on the 17th. Therefore, the Cash App limit will reset on the 18th of the month (this is an example; yours will vary).

Our Takeaway: Utilizing Free ATMs for Cash App

The options are a whole lot better than they used to be when it comes to finding a free ATM for Cash App these days.

Not only can you use the app to send and receive money, but now you can also easily withdraw your money without going through a lot of trouble (or paying fees).

If you’re a high-activity Cash App user and want to be able to access your money without the fuss and fees of traditional ATM transactions, it’s absolutely worth it to set up a direct deposit and find a MoneyPass ATM near you to keep all Cash App ATM fees away.

Free Cash App ATM Near Me – FAQs

Can I withdraw more than $1000 daily with a Cash App cash card?

No, Cash App will limit your daily withdrawal amount to $1000. Transferring the money in the Cash App to another bank for free so you can use a debit card at your bank ATM for free withdrawals is recommended.

Can I use the Cash App cash card for shopping online outside the U.S.?

No, You cannot use the Cash App withdrawals outside the U.S. You can only spend money inside the U.S. by using your Cash Card anywhere that takes Visa cards.

Are there any official ATMs for Cash App?

Cash App does not own any ATMs but partners with Sutton Bank to give customers complete access to their cash at any other bank’s ATM. You can complete Cash Card ATM withdrawals to pull money from any other bank’s ATM with a $2.50 fee per transaction.

Can I see my Cash App ATM transaction history?

Yes! You can view your Cash App transaction history in the Cash App application, including your Cash App reloads, card purchases, ATM withdrawals, fees, online payments, payments to contacts, etc.

Is the ATM at Walgreens free with Cash App?

No, making Cash Card ATM withdrawals at most Walgreens ATMs is not free with Cash App because it’s not part of the in-network ATMs (MoneyPass). You’ll get one non-network ATM fee reimbursed if you receive at least $300 in direct deposits per month.

Is 7-Eleven ATM free for Cash App?

Yes, making Cash Card ATM withdrawals at most 7-Eleven ATMs with the MoneyPass logo is free for Cash App users because it’s part of the in-network ATMs. You’ll get unlimited free withdrawals from in-network ATMs if you receive at least $300 in direct deposits monthly.

What ATMs are free for Cash App?

MoneyPass ATMs are free for Cash App. They’re considered ‘in-network.’ You can easily use your cash card and withdraw cash via free ATM withdrawals. This benefit is only activated if you receive a qualified monthly direct deposit. ATM withdrawal limits still exist for these transactions, but you won’t pay Cash App ATM fees.

Thanks for update ATM cash out ATM cash app.

Honestly I try many ATM seven eleven and BANK OF AMERICA DOESN’T WORK.. IN CITY ORANGE COUNTY CALIFORNIA

WHEN I go this website helping me listings banks could cash out I went to ( East-West Bank )

It’s work fee only 3$ anyway thanks for posting this article

I’m very thankful..

DUNG TRAN

Hi Dung, you can go to any ATM with your Cash Card and withdraw money. There will be a $2.50 fee from Cash App and an ATM operator fee at EVERY ATM you go to. However, if you want to get reimbursed for these fees, you can set up direct deposit with your employer to deposit your paycheck into your Cash App. Once you receive $300 you’ll automatically get ATM fee reimbursements three times per month up to $7 per transaction.

It is not unlimited I think it is like the first two or three withdrawals that are free

Hi Alexis, the unlimited ATMs are an upcoming change with in-network ATMs. Currently, the first three ATM withdrawals are free up to $7 per transaction.

They just changed the policy:

– Unlimited free ATM withdrawals in-network (MoneyPass)

– A single non-network ATM reimbursement every 31 days.

7 dollars a transaction is a joke! All the atm in thomasville Georgia only gives 20’s. What’s 7 dollars going to buy? I want to withdraw 1,500.00 how many transactions will I be charged for? The closest 7-11 is in Jacksonville (4 hour drive)

How do I cash my money out of my cash app account without getting charged

Each ATM operator has their own withdrawal limit and Cash App allows you to withdraw $1,000 per 24 hours. So you would need to do this in 2 transactions over 2 days. If the ATM charges $7.00 then you’ll pay $14 for the 2 withdrawals. Good luck.

Hi Tina,

If you have direct deposits of 300 or more within the last 31 days, you can withdraw for free from an in-network ATM (MoneyPass). We have a map you can find these ATMs easily. Secondly, you can transfer your Cash App balance to an external account like a bank and withdraw the money from them. Good luck!

Is there a tutorial on moving my roundups to my savings account. TO spend