Why Can’t I Borrow Money From Cash App, was the same question I asked myself not too long ago.

I tried to unlock the borrow feature and got frustrated when it didn’t work, so I set out to find a solution.

After some testing and extensive research, I figured out how to unlock borrow on Cash App, so there are no more guessing games and wasted time.

In this short article, I’ll tell you precisely how to borrow money from Cash App and which states have access right now.

To get started, here is a quick overview of the Cash App loan:

If you need quick cash in an emergency, the Cash App mobile application is an excellent option for getting access to funds without jumping through hoops or resorting to high-interest loans.

Are you running low on funds, or wish you could delete that transaction you made the night before?

- A Cash App Borrow loan is only available to select people from specific states who meet the requirements to borrow.

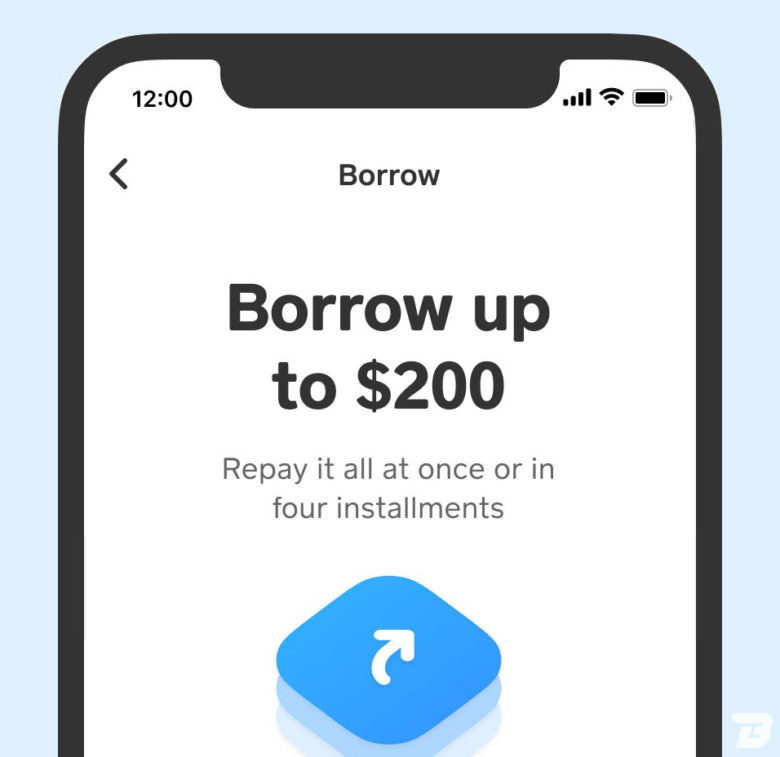

- At first, you can only borrow up to $200 until you build up your borrowing payment history to increase your limit. The highest limit reported available is $600, but very few have this high limit.

- If you don’t use your Cash App frequently and have good credit, you’ll likely not qualify for the borrow feature.

- If you don’t have the borrow option, I suggest moving on to this highly-rated Cash App borrow alternative with no credit checks!

It’s never been easier to borrow money from Cash App!

Either way, this article will walk you through how to borrow money from Cash App and why so many people use it.

So, let’s get started!

Why Can’t I Borrow Money from Cash App?

To be eligible, a user must use the app and their Cash Card frequently, have a good credit history, deposit $1,000 or more monthly, and reside in a state where this feature is available.

Over 1 million active users are using Cash App borrow, but it is not available to everyone.

Cash App allows users to borrow money over a 4-week loan.

You will receive a notification when the borrow feature becomes available for your account.

You must first meet this set of requirements to unlock this loan feature, which is similar to a payday loan but better.

Don’t worry!

Some users have reported that the feature appeared on their app without warning, while others have been offered personal loans without direct deposit.

Once you have access to the feature, you can borrow money and pay it back within a certain time frame.

This is an excellent place to start if you are trying to figure out why you don’t have the borrow feature.

If you see the message “you’re not able to borrow at the moment,” there might be an issue with your account.

Here is a list of the reasons you might not be able to borrow money from Cash App:

- You are under the age of 18

- You don’t have at least $1,000 in deposits each month

- Your account is not in good standing with Cash App

- You were involved in a scam

- Live outside the United States

- You don’t have a fully verified account with your identity and SSN

- Your Cash App is not updated to the latest version

- You might have a negative Cash App balance

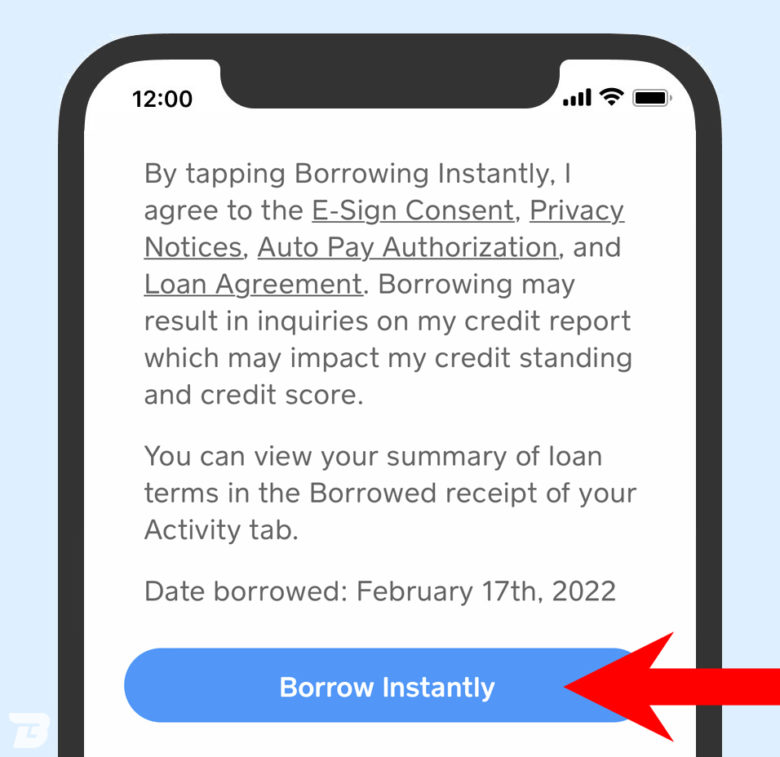

Before you borrow money from Cash App, we suggest reading the legal loan agreement first.

You can quickly meet all the requirements by following the six steps below to borrow money from Cash App.

We highly recommend getting the Albert App, a money app. It’s similar to Cash App or a bank account, but way better!

Albert has a debit card and savings account (no credit checks) and lets you borrow up to $250 with no interest or fees! It’s also easy & quick to sign-up!

Cash App Loan Requirements

Due to the testing phase, these requirements may change frequently.

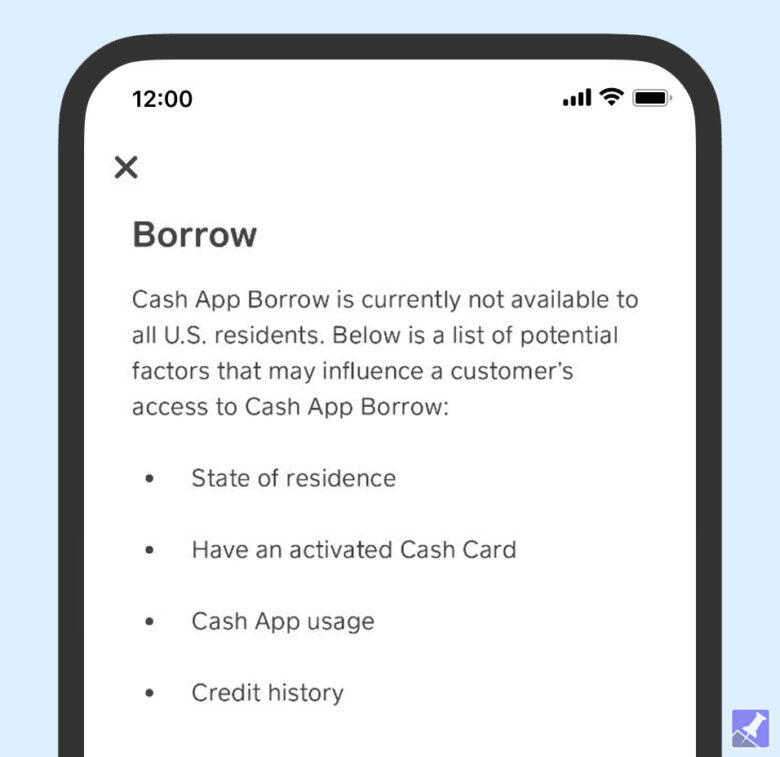

Here is a screenshot from my Cash App showing the current factors they look at when selecting people to try the Cash App Borrow loan feature.

Here are the factors to qualify for the Cash App loan:

- 18+ years old and live in the United States

- Good credit history

- Activated Cash Card

- Frequent Cash App usage

- Live in an eligible state

NOTE: Some users are reporting a credit check is not required (however, the terms of service say a credit check may be required). Also, we’ve seen reports that regular automatic deposits of at least $1,000 per month is needed, but we haven’t seen any hard evidence to support this yet. You must repay the loan on time to continue using the Borrow feature.

What to do if you don’t meet the requirements? If you don’t meet the requirements, we suggest looking at an alternative loan app below.

If you meet these requirements, read on to find out how to unlock the Cash App loan feature for iPhone or Android.

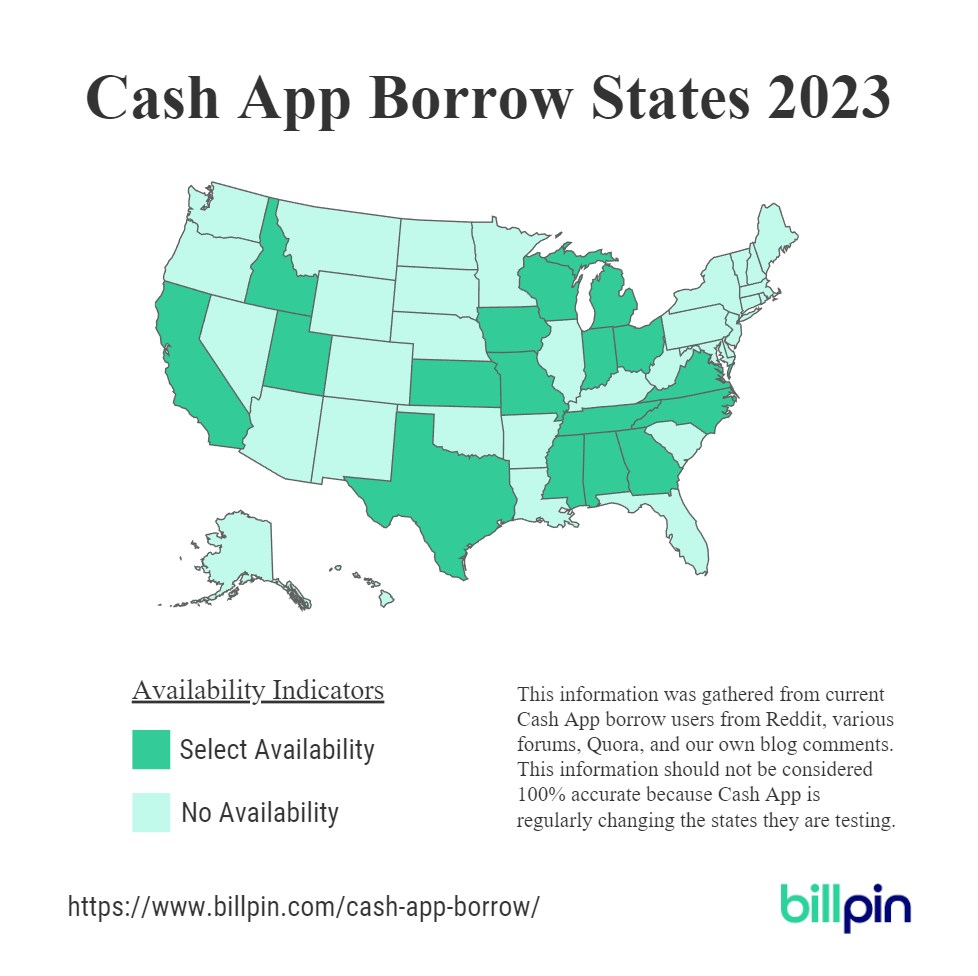

Cash App Borrow States

According to the Cash App help section, your state of residence is a factor for Cash App Borrow loan eligibility.

Cash App Borrow is available to select residents of specific states across the United States.

Here is a list of Cash App borrow states:

- Alabama

- California

- Georgia

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Louisiana

- Michigan

- Mississippi

- Missouri

- North Carolina

- Ohio

- Tennessee

- Texas

- Utah

- Virginia

- Wisconsin

Please note that just because you are living in a participating state does not mean you automatically have access. You’ll need to wait until Cash App invites you to try the borrow feature, even if you meet all the requirements. This list is subject to change at Cash App’s discretion without notice.

To check whether the Borrow feature is available, you can open the Cash App on your device and see if the option to borrow is present.

Alternatively, you may want to check out our complete list of money borrowing apps that loan you money instantly without credit checks.

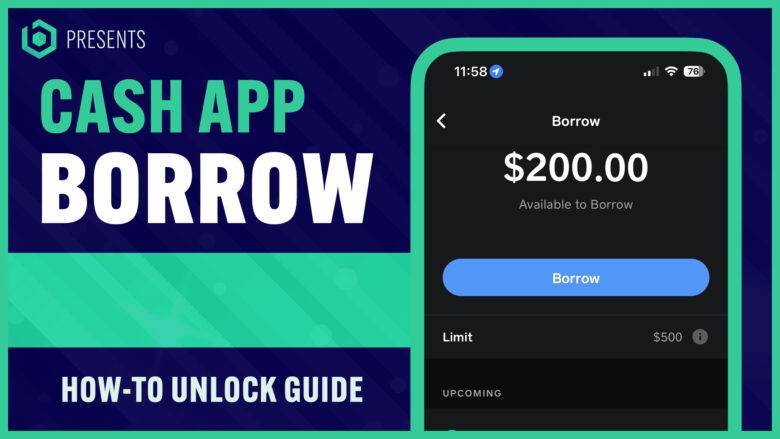

How to Unlock Borrow on Cash App

Here is an overview of how to unlock Cash App borrow:

- Open Cash App & Log In

- Go to the “Money” tab at the bottom left.

- Tap on the “Unlock” button to open the unlock borrow screen

- Tap “Continue” to unlock the borrow feature

- Access the new “Borrow” option in the “Money” tab screen

Now that the feature is unlocked, you can borrow money from Cash App with the steps below.

How to Borrow Money from Cash App

Follow the six-step process below to borrow money from Cash App for iPhone or Android.

You’ll be able to borrow $20, $100, or even up to $600+ once you complete the Cash App loan application.

The loan application takes only 5 minutes to complete. (Note: It’s quick & easy)

Step 1. Sign Up or Open Cash App & Log In

First, you’ll need to open Cash App.

If you don’t have an account yet, you can sign-up with Cash App and get a free money bonus with referral code: K2VP13D.

Note: During the sign-up process, verify your identity with Cash App.

So, can you have 2 Cash App accounts? That would be a yes.

According to an official representative, Cash App users can have two accounts if they use a different email & phone number.

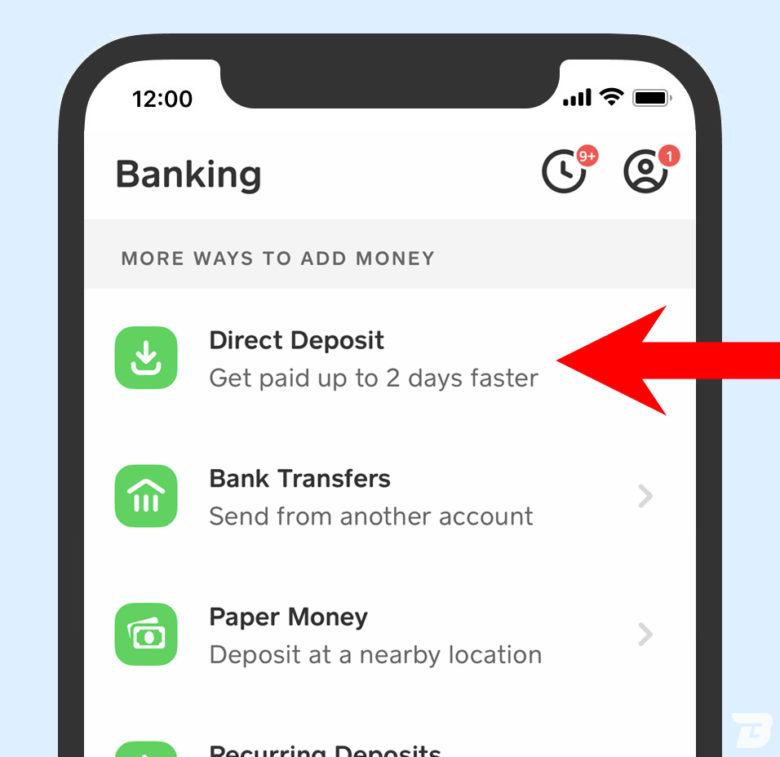

Step 2. Set Up Direct Deposit and Activate the Cash Card

Next, you’ll need to set up your deposits with your Cash App account and activate the Cash Card, which may increase your usage requirement to make you eligible.

- Go to the “Money” tab (at the bottom left) in the Cash App menu.

- Tap on “Direct Deposit.”

- Now select “Get Started” and follow the on-screen prompts.

- Now go to the “Cash Card” tab (at the bottom left) in the Cash App menu.

- Follow the on-screen prompts to order your card or activate it.

NOTE: Borrow customers are reporting that having a direct deposit is not required to borrow from Cash App, but it can help your chances of unlocking the feature.

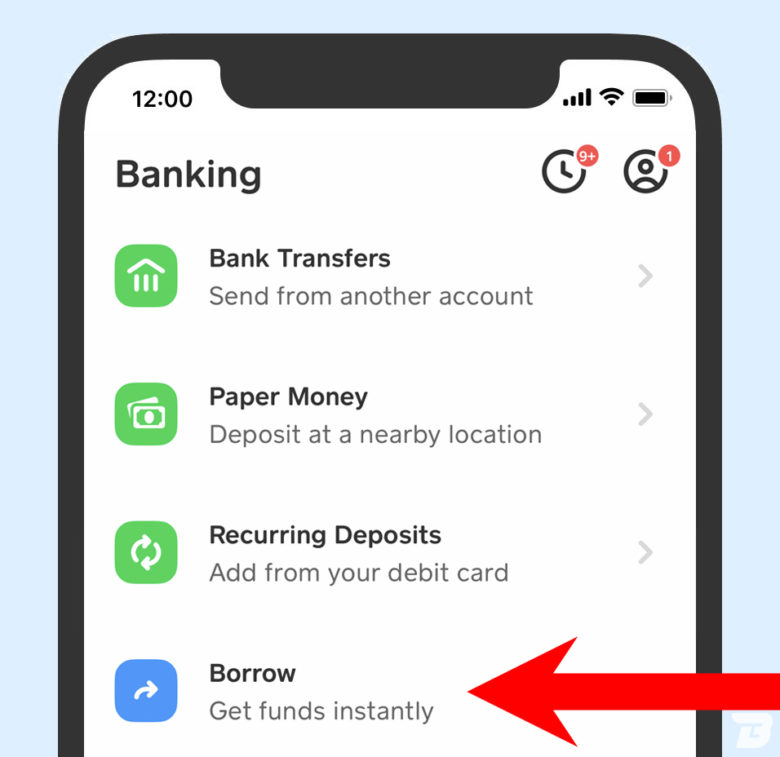

Step 3. Start the Cash App Borrow Loan Process

Now you should be able to access the Borrow feature by going to the “Money” tab on the Cash App menu and scrolling down until you see “Borrow.”

If you don’t see the borrow option here, this means you are not eligable.

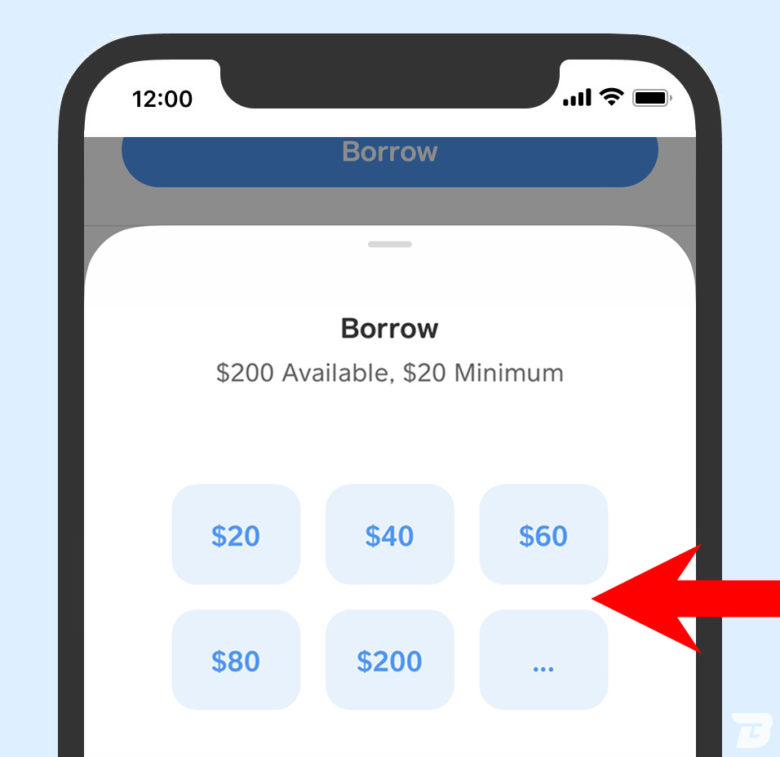

Step 4. Select Your Desired Borrow Amount

Tap the amount of money you need (up to $600+), tap “Request,” then “Confirm.”

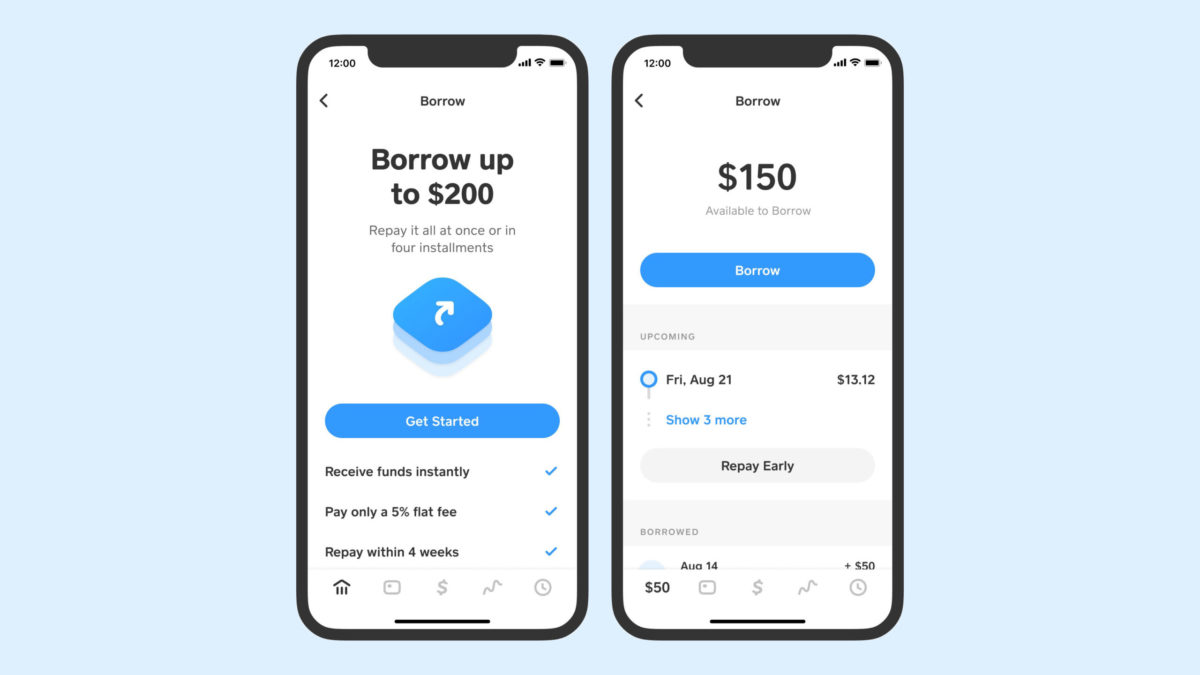

The initial borrow amount will not exceed $200 but can go as high as $600 once you have borrowed and repaid a few loans to increase your borrowing amount.

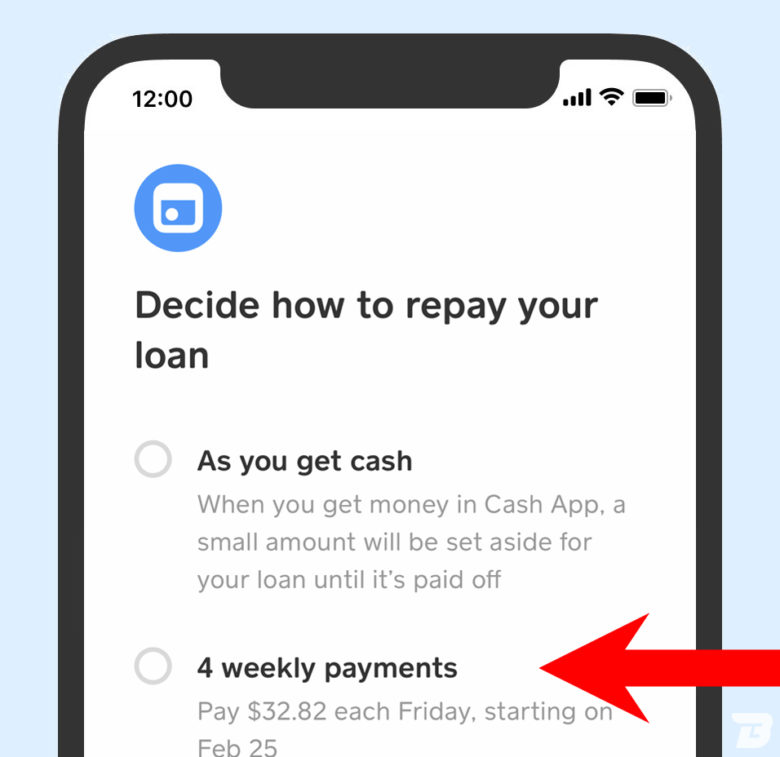

Step 5. Decide How To Repay Your Cash App Loan

The options to repay are: as you get cash, four weekly payments, or all at once.

These are better options than other, more strict payday loan alternatives that force repayment with your next paycheck and without a loan grace period.

Cash App loans are NOT the same as payday loans, though (they’re much better).

The option of 4 weekly payments is the most common, but the all-at-once option is also nice because you make one payment to pay off the loan at the end of the four weeks.

TIP: The app accepts loan payments ahead of schedule. You can pay off the loan early and reduce the 5% loan fee!

Step 6. Accept Loan Terms & Borrow Instantly

Once approved, the money will be available instantly in your Cash App wallet (Note: Cash App will send an email/notification with a link to make the first payment).

Wondering how long it will take to be approved?

Usually, the decision comes back instantly. More about this is below.

TIP: If you get the Cash App card and set up direct deposits, Cash App users could be eligible for a $50-$100 cash card boost when they receive at least $300 in deposits. More about that here.

Best Cash App Borrow Loan Alternative with No Credit Check

Cash App Borrow didn’t work for you?

There are still options available to you to get a cash advance online, similar to Cash App borrow.

Cash advance apps are plentiful these days, all with various pros and cons. Take a look at some of the best cash advance apps to find the one that might fit your needs best.

9 Cash Advance Apps Tested – Here are the results!

In my quest to find the best money-borrowing app, I tested Albert, Cash App, Dave, Earnin, Brigit, Truebill, MoneyLion, Current, and Chime.

After testing these nine different apps, I can only recommend one app, the Albert app.

Why did I pick Albert over the competition?

Albert had the following advantages over the other borrow-money apps:

- Fastest sign-up process

- The lowest requirements for approval

- Highest borrowing amount at $250

- Most flexible repayment options

- Zero interest fees and no credit checks.

These alternative options will also work great if your Cash App Borrow loan has ended or the feature is gone.

Here is how to tell what loan apps work with Cash App or money apps that work with Chime.

1. 🥇 Albert – Fast Sign-Up & Instant Funds up to $250!

The Albert app is one of the best cash advance options and is a highly-rated & trustworthy financial app.

If you sign up for Albert you can borrow $250 now!

- Zero late fees, credit checks, or interest

- Instant, short-term loans up to $250

- Free cash account (no ChexSystems or credit check required)

- Automatic Savings

- Bill negotiation and subscription monitoring

How Cash App Borrow Works?

Cash App’s new feature is a quick and easy way to get up to $600 in immediate funds without the hassle of visiting your bank or credit union.

The best part?

Cash App Borrow works without requiring any collateral, so you don’t have to worry about losing anything if you can’t repay it as promised!

This feature is similar to taking out a loan but is not a good solution for long-term loans.

You should expect to pay this back within four weeks to avoid extra interest charges.

The initial borrow amount will not exceed $200 but can go as high as $600 once you have borrowed and repaid a few loans to increase your borrowing amount.

Now let’s look at the loan terms, but before that, you may want to check out our review of Cash App borrow.

What Are the Terms of the Loan?

Here are the terms you need to know before accepting a loan with Cash App.

- Receive funds instantly

- Pay only a 5% flat fee (no hidden charges)

- Repay in 4 loan payments within four weeks (repay early with no extra charges)

- Must have direct deposit set up (not required)

According to Cash App, overdue interest accrues only if you do not pay your loan by the due date.

Interest will begin accruing on any unpaid Borrowed Amount after the Due Date and will continue to accrue every week until the Payoff Amount has been paid in full.

Check Eligibility for Cash App Borrow

- Open your account by tapping the Cash App balance tab on the bottom-left screen. The amount will vary depending on your current account balances.

- Now click the Cash App “Borrow” button once it opens up for more detail and information about how much money you can borrow from Cash App.

Don’t see this borrow money feature available in your account?

Make sure you follow the five steps listed above for ways to unlock this feature to borrow money.

How Long Does It Take to Get Approved?

Approval time depends on your bank account, but they aim for approval in less than a minute!

Remember that Borrow is best used as an emergency fund and is not intended as a long-term financial solution.

Contact your bank for a more standard loan if you need more cash than the maximum amount you can borrow.

More information about the Borrow feature can be found here.

How Do I Repay Cash App Borrow?

There are three flexible options to make payments to Cash App Borrow.

Here are the repayment options for the loan:

- As you get cash – When you get money in Cash App, a small amount will be set aside for your loan until it’s paid off

- Four weekly payments – Pay one-fourth of the total loan each Friday, starting the following Friday.

- All at once – Pay the full Cash App balance off by the due date at the end of 4 weeks.

You can pay in full early with no penalties or fees.

The only fee you’ll incur is 5% for the entire term of the loan or 1.25% per week as long as you repay it on time.

You can check your balance using your account’s Cash App balance tab.

Here are the official repayment plan terms of service.

When Does Cash App Increase Borrow Limit?

Cash App users with access to the borrow feature are reporting that you can borrow up to $500, but we now know it’s as high as $600.

Depending on various factors, you won’t typically start at $600 but at a lower amount, around $20 or $40.

You can increase your borrowing limit each time you successfully repay the loan.

A Borrow user on Reddit said the following:

“I have borrowed consistently over the time it’s been available but it was mostly to increase the borrow limit and not because it was needed. I did notice in my own experience that my limit never increased if I paid early. It only increased when I let it automatically take the payment when it was due. That is just my own experience though.”

Other users have also reported that after they repay the loan on the scheduled due dates, they have seen a limit increase on the following loan.

If you need more cash than the maximum amount you can borrow, contact your financial institution (bank or credit union) for more options for personal loans.

Alternatively, you could use another borrowing app or have a friend or family member willing to help you.

Go here if you want to see how to send money to someone.

What is the Interest Rate to Borrow from Cash App?

The interest rate on Cash App is a flat fee of 5% on the amount you borrow.

However, over 12 months, this adds up to 60%, but that’s still less than you’d pay with payday loans.

We recommend only using Cash App for short-term personal loans.

TIP: If you’re a new user, check out our Cash App referral code to earn an extra referral bonus.

How Long Will It Take to Receive My Cash?

Depending on where you live in the US, you can expect your money within minutes of requesting it.

Decisions are typically instant, and the money is released to you upon approval.

Does the Cash App Borrow Affect My Credit Score?

Once you fully submit your loan application, it will result in an inquiry on your credit report that might affect your credit score slightly.

Like any credit inquiry, you may have a slight impact that will typically fall off your credit report within a few months.

You may want to consult your financial advisor to understand how this will affect your credit score.

Late payments, missed payments, or other defaults on your Cash App loan may be reflected in your credit history (and therefore affect your credit score).

Does Cash App Borrow Build Credit?

No, the borrow feature does not help build credit.

According to the Cash App terms of the service loan agreement, they do not report on-time payments to any credit agencies but report late payments.

How Often Can You Borrow from Cash App?

You can borrow as often as you need to from Cash App.

You must pay off your first loan before taking another one.

If your first loan was not the maximum amount you could borrow, you could take another loan for the remaining amount.

What Happens with Missed or Skipped Payments?

If you chose an optional weekly schedule, there’s no fee for missed or skipped payments as long as you’ve paid off your total payments by the final due date.

If you have not paid off your total payments by the final due date, then Cash App will charge you a non-compounding 1.25% interest each week until it is paid in full.

Cash App Borrow One-Week Grace Period

Does the borrow feature have a one-week grace period?

Yes, you will be charged 5% of the loan balance for the first four weeks, followed by one-week grace periods that begin to accrue an additional 1.25% interest until the loan is paid in full.

FAQs – Borrow Feature Help

Can I Use Cash App Borrow If I Have Bad Credit?

Yes, you can still apply for and use this loan feature even if you have bad credit (low credit score). Cash App has stated within their Terms & Conditions that they may check your credit history before extending a loan agreement, but users have reported this is no longer their practice. Your Cash App usage is more of a factor, such as using your Cash App card, not having a negative balance in your Cash App account, utilizing the account features regularly, etc.

I Don’t Have the Borrow Feature on Cash App Yet

“How to get borrow on Cash App” has been a popular question for many users. Because Cash App is testing this feature with a select group of people, the feature may not be available to everyone. To increase your chances of unlocking this feature, you need to be a frequent user of the app, and we recommend setting up a direct payroll deposit with your employer. These steps should help with the I don’t have the borrow feature on Cash App issue.

How to Unlock Borrow on Cash App for Existing Users

How can I borrow money from Cash App if I see the unlock button in my account? You can use Cash App to borrow money for a short-term loan. Tap on the unlock feature and follow the on-screen prompts, which will show you how to unlock borrow on Cash App.

Why Won’t Cash App Borrow Money to Me?

How to get Cash App borrow is a hot topic right now. However, they have not fully revealed the criteria for selecting people to join the Cash App borrow testing phase. You’ll need to wait to borrow money if you don’t see the option in your Cash App account.

How to Borrow Money from Cash App on iPhone

Do you have an iPhone and are wondering why don’t I have Cash App borrow? How to borrow money from Cash App 2024 is in a testing phase with iPhone and Android users. You’ll need to meet the requirements as stated throughout this article.

Has Your Cash App Borrow Ended?

If you had previous access to Cash App borrow, but the testing flight has ended, you’ll need to find an alternative to borrow money. We suggest using Albert, an excellent alternative to Cashapp borrow.

Cash App Borrow States Availability

Currently, Cash App is testing Alabama, California, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Michigan, Mississippi, Missouri, Ohio, Tennessee, Texas, Utah, Virginia, and Wisconsin. If you have Cash App borrow, please comment below what state you are located in.

Need a Cash App Borrow Limit Increase?

If you already have Cash App borrow, but you need a limit increase for a higher amount, you’ll need to complete smaller personal loans to increase your limit. For example, if you started with a limit of $20, then borrow that amount and immediately pay it back. When you borrow again, you’ll see a higher limit increase for your next loan.

What Cash App Borrow Credit Score Is Required?

We don’t know the exact number, but it’s safe to say if you have a 680 or above, you have a better chance of getting approved for a loan with Cash App.

Cash App Declined Loan, What to Do

Your only option is to ask for feedback from Cash App and try to improve that aspect of the loan. Most likely, it’s due to your credit score or account standing with Cash App.

Cash App Borrow Gone, Disappeared, or Not Available?

Because the borrow feature is in beta testing status right now, you might not always have access to the option. This means you may see the feature is not available to you. There is no way to know a clear answer as to why the Cash App borrow feature is gone or disappeared from your app. I would suggest using a more dependable alternative like the Albert App.

Cash App Borrow Eligibility Notification

Is Cash App borrow for everyone? No, if you get a Cash App borrow email or a notification on your phone stating you are eligible to try the new Cash App borrow feature, you are one of the lucky few to test the new service. How to borrow from Cash App? Now you can open the app and enable Cash App borrow.

What’s the Highest Cash App Borrow Limit?

The highest amount you can borrow from Cash App is $500. Most users who do not get the maximum limit initially must establish a repayment history with a smaller sum to get a higher $500 limit increase.

Does Cash App let you borrow money?

If you have the borrow feature available on your account, then you will be to borrow money from Cash App.

How do I borrow $200 from Cash App?

To borrow the maximum amount from Cash App, you’ll need to have a borrowing history with the app to build up your borrowing power.

Cash app borrow definitely supports THE STATE OF IOWA!!

Michigan has Cash App borrow

Both my sister and I use cash app here in Tennessee- crazy part is I have the borrow option and she does not even though she is the one with direct deposits from a steady job.

Why is it that I don’t have the borrow sign on my cash app

Does California have borrow in cash app

Cashapp Borrow works for Indiana residents as well.

I’m in Minnesota I barely use my cash app for anything and I have the borrow feature

See

S like a. Easy way to borrow. Money!

Hey !! I need borrow 100 dollar so I can pay my cell phone bill

The Albert App lets you borrow up to $250 you can use the links in the article to sign up.

Louisiana has cash app borrow and today my LIMIT INCREASED TO 225$. I have used cash app borrow since it came out and have always borrowed the maximum amount allowed and have never missed a payment.

I also have always borrowed the max amount allowed and change the repayment schedule from every week , to “all at once” and always pay the full amount of 200$ back early atleast 1-2 days before due. But I am proof that it now will allow you to borrow over 200$ ( mine is now $225 as of 2-15-22

Hi Chris,

Thanks for commenting with all that great information. We’ve recently confirmed with Cash App that the highest limit is $600. Congrats on the limit increase and excellent work!

I’m in North Carolina and I’ve been using the borrow feature since August 2022. This feature was a blessing I pray it continues and eventually begins reporting to the credit bureaus. This would be an awesome credit builder.

For over a year have had it, get direct deposit, do everything they say, maintain a balance all that, repaid every one on time or early and BAM they just quit offering it (Texas from Feb to March )

My max borrow limit at the moment from Cashapp is $1,050. Not sure what the cap is but I have been steadily increasing mine over the past 6 months.

I have a $900 CashApp Borrow limit

LET’S GET THE BORROW FEATURE FOR NEVADA PLEASE THANK YOU