In today’s fast-paced world, finding ways to access funds quickly and efficiently is crucial for those unexpected expenses or urgent financial situations. This has led many to explore the compatibility of popular financial tools like Earnin and Cash App.

But does Earnin work with Cash App, and can it provide you with that much-needed instant cash advance? We have thoroughly researched this topic and are here to answer your questions! In this informative blog post, we will delve into the relationship between Earnin and Cash App, discuss other cash advance apps compatible with Cash App, provide insights into their benefits, and help you make informed decisions about managing your finances effectively.

- Yes, Earnin works with Cash App, allowing users to receive a cash advance instantly and transfer funds between the two apps.

- To link your Earnin account to Cash App, download and install the Earnin app on your smartphone, and sign up for an account using your personal information and bank account details. Once you’re logged in to Earnin, navigate to the Account settings section and select “Link another bank or payment platform,” then choose Cash App from the available options.

- Other cash advance apps that work with Cash App include Albert, Dave, and MoneyLion; all offer their unique features and loan options.

How to use Earnin with Cash App

No, Earnin is confirmed not to work with Cash App. However, you could use a bridge account like Chime to connect the two accounts.

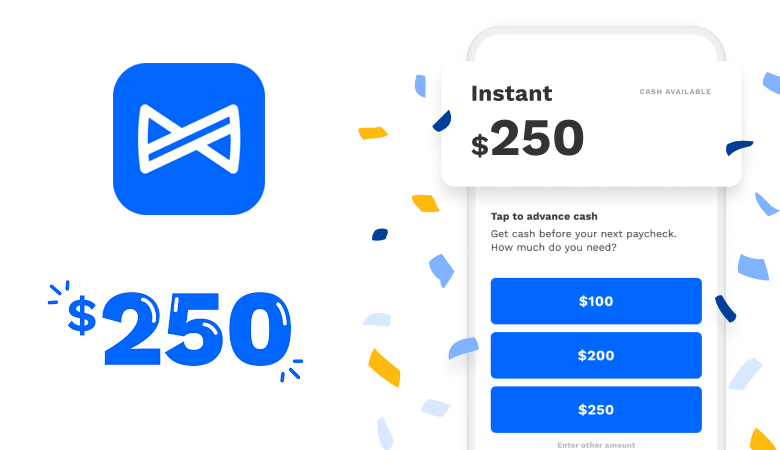

We highly recommend getting the Albert App, a money app. It’s similar to Cash App or a bank account, but way better!

Albert has a debit card and savings account (no credit checks) and lets you borrow up to $250 with no interest or fees! It’s also easy & quick to sign-up!

How To Link Earnin To Cash App (with Bridge Account)

To successfully link your Earnin account to Cash App, follow these simple steps:

- Get the EarnIn App, complete the signup process, and request the Earnin debit card.

- Add a bank account to EarnIn (not your Cash App account)

- If you do not have a real bank account, get a Chime online account (they accept everyone with zero credit checks or ChexSystems checks.) You must have a real bank account (credit unions work, too) to access EarnIn pay advance. Chime will act as your bridge account.

- Once you have the EarnIn debit card, you can add this to Cash App and transfer the advance money into your Cash App account.

Now that your EarnIn account is linked to Cash App with a bridge account, you should be able to receive instant cash advances through the app and have them deposited directly into your Cash App balance. Remember that eligibility requirements still apply, so make sure you meet those before requesting a cash advance through Earnin.

Transferring Funds Between Earnin And Cash App

Transferring funds between Earnin and Cash App is a fairly simple process, allowing users to access their earnings and manage their finances more effectively. Here’s how:

- Once you’ve linked your Earnin account with your existing bank account (or bridge account), you can initiate a transfer from Earnin to your bank account and then to Cash App.

- Go to the “Add Cash” feature in your Cash App.

- Select the amount you wish to transfer from your available Earnin balance.

- Choose the bank account connected to your Earnin app as the source of funds.

- Confirm the transfer details and tap on “Add.”

- Keep in mind that transfers between Earnin and Cash App may take up to a few days to complete, depending on your bank’s processing time.

Additionally, be aware that your balance on Earnin will not sync with your balance on Cash App – it is vital to keep track of both balances separately for accurate financial management.

What Banks Does Earnin Accept?

Find out which traditional banks Earnin accepts to link your account and receive instant access to cash advances.

Does Earnin Use Plaid To Connect?

Yes, Earnin uses Plaid, a secure and widely-used platform that allows various financial apps to connect with financial institutions and banks. By using Plaid, Earnin can access your bank account information safely without storing your banking credentials.

For example, if you have an account at Bank of America or Wells Fargo, connecting it through Plaid enables Earnin to track whether you regularly receive paychecks into your account.

This way, they can determine your eligibility for cash advances based on the income information provided by your bank.

3 Other Cash Advance Apps Compatible With Cash App

Looking for other cash advance apps that work with Cash App? Check out Albert, Dave, and MoneyLion – all offering their own unique features and loan options.

1. Albert – Best for Instant Cash Advances Up to $250!

Albert is a cash advance app that works seamlessly with Cash App for loan app users. It offers up to $250 with no fees or interest, making it an attractive option among other cash advance apps available in the market today.

To use Albert Instant, users must link their debit card to a bank account where they receive their income. This way, users can access their money instantly and transfer funds directly to their Cash App balance or any linked debit cards and accounts.

2. Dave

Another cash advance app that works with Cash App is Dave. This app offers borrowers up to $250 in a cash advance that can be transferred to their Cash App account. Unlike other apps, Dave does charge interest fees but instead relies on subscription fees and tips for revenue.

Dave also offers an overdraft protection feature called Balance Shield Alerts, which notifies users when their bank account balance is low and can automatically transfer funds from an optional savings account to avoid overdraft fees.

The app has 24/7 support through its Live Chat team and requires users to provide information such as their work email and location permissions for eligibility.

3. MoneyLion

MoneyLion is a financial technology company that offers a suite of products to help users improve their financial health. One of these products is Cash Advance, allowing users to borrow up to $250 without interest or fees.

To qualify for MoneyLion’s cash advance service, users must have an active checking account and receive regular direct deposits. Once approved, they can request a cash advance through the MoneyLion app and get their money within minutes.

In addition to its cash advance product, MoneyLion also provides services like bill negotiation and subscription monitoring to help users save money. Its high-interest savings accounts also offer competitive rates compared to traditional banks.

Benefits Of Using Earnin With Cash App

By linking your Earnin account to Cash App, you can enjoy instant access to funds, improved financial management, and flexibility in transferring money between the two platforms.

Instant Access To Funds

As a loan app user, having instant access to funds is crucial in managing financial situations efficiently. With Earnin and Cash App’s integration, accessing your money has never been easier.

This feature is handy when you need money urgently or want to avoid overdraft fees on your account. Additionally, with lightning-speed transfers offered by Cash App, you can have the money in your bank account within seconds of withdrawal.

Improved Financial Management

Using Earnin with Cash App can greatly improve your financial management. You can avoid costly overdraft fees and effectively manage your cash flow by providing quick and easy access to earned wages.

With features like Balance Shield Alerts, users are notified when their balance drops below a certain level, triggering an automatic Cash Out to prevent overdraft fees. The Max Boost feature also allows users to access an additional $50 by having friends “vouch” for them within the app.

Overall, using Earnin in conjunction with Cash App provides flexibility and control over your finances while avoiding the pitfalls of traditional banking systems and payday loans.

Flexibility In Transferring Funds

When using Earnin with Cash App, users can seamlessly transfer funds between their accounts. Whether it’s cashing out a portion of their paycheck or transferring money for bills or other expenses, they can do so quickly and easily.

For example, if a user needs to cover unexpected car repairs but doesn’t have enough money in their checking account, they can use Earnin to request a Cash Out and receive the transferred funds within minutes.

Additionally, the Balance Shield Alerts feature can automatically send Cash Outs to prevent overdraft fees from occurring.

Understanding Earnin And Cash App

Earnin and Cash App are both financial technology companies that offer cash advance services to their users through the use of mobile applications.

What Is Earnin?

As a loan app user, you may have heard of Earnin. It is a popular cash advance app that allows users to access their paychecks before payday without paying any fees or interest.

With Earnin, you can get up to $100 instantly and up to $500 per pay period. The app links to your existing bank account and automatically deducts the amount borrowed from your next paycheck so that you don’t have to worry about making payments or late fees.

To qualify for an advance, you need to be at least 18 years old, a U.S. resident with a checking account, and a verified source of income. Plus, no monthly fees are associated with using the service – just leave an optional tip after receiving funds.

What Is Cash App?

Cash App is a mobile payment and financial management app that allows users to send and receive money within seconds. It also offers personal loans, cash advances, direct deposit options, and investment opportunities in stocks and bitcoin.

Cash App works on both Apple and Android devices and has gained popularity for its user-friendly interface, lightning speed transfers, Balance Shield Alerts, 24/7 support with the Live Chat team, debit card integration with bank accounts, and location permissions for enhanced security.

Cash App is not affiliated with traditional banks but partners with Evolve Bank & Trust to offer FDIC-insured deposits.

Does Earnin Work With Other Payment Platforms Like PayPal?

Earnin is not compatible with other payment platforms like PayPal. However, Earnin links to users’ existing bank accounts for cash advances and supports debit card purchases, ATM withdrawals, and bill payments.

This means that when you link your bank account to Earnin, you can easily access funds without waiting for payday or going through traditional banks.

While Earnin does not work with digital banking apps like Albert, Current, Dave, Go2Bank, or Varo, it offers features such as Balance Shield Alerts, which automatically sends Cash Outs to your account when the balance drops below a certain level helping users avoid overdraft fees.

Additionally, borrowers can receive up to $100 per day and up to $500 per pay period at no cost after registering their Paycheck tip within the app (the company suggests an optional tip of between zero dollars and up to fourteen dollars).

Overall,

Using Earnin provides a flexible way for individuals looking for emergency borrowing solutions without going through high-interest-rate personal loans or other credit checks that require credit history information based on APR calculations.

How Much Can You Borrow From Earnin When Connected To Cash App?

Earnin allows users to borrow up to $500 per pay period when connected to Cash App. However, the amount users can borrow is based on their financial health, bank balance, and typical spending level.

This means that some users may only be eligible for smaller loan amounts if they have low balances or spend most of their paychecks before payday. Additionally, Earnin Express allows users to access up to $1,000 per pay period if their paycheck is routed directly through Earnin.

What Are The Requirements To Link Earnin And Cash App?

To link Earnin and Cash App, here are the requirements:

- You must have a verified Earnin account and a valid Cash App account.

- You must be at least 18 years old and a U.S. resident.

- You must have a verified source of income that can be connected to both Earnin and Cash App.

- You must grant Earnin permission to access your device’s location, contacts, notifications, and other necessary information.

- You must connect your bank account or debit card associated with your Earnin account to Cash App for direct deposit and fund transfers.

- You must ensure that you meet all eligibility requirements for both Earnin and Cash App.

Our Takeaway

In conclusion, connecting Earnin with Cash App can provide users with instant access to cash advances and improved financial management. However, it may not work for prepaid or cash card accounts.

Other cash advance apps compatible with Cash App include Albert, Chime, Dave, and MoneyLion. Understanding the requirements for linking these apps and borrowing money through them is important.

While they offer flexibility in transferring funds without interest charges or finance fees, it’s essential to be aware of subscription fees and tips required to keep the service running smoothly.

FAQs

Does Earnin work with Cash App?

You can use Cash App with Earnin to borrow money before your paycheck arrives. To connect Cash App with Earnin, link your Cash App account as a payment method in the Earnin app.

Can I link Cash App to Earnin?

You can link Cash App to Earnin as a payment method to unlock the feature of borrowing money before your paycheck arrives.

Can I use my prepaid card with Earnin through Cash App?

It depends on the type of prepaid card you have. If your prepaid card has a routing and account number, you can link it to your Cash App and use it with Earnin. However, if your prepaid card does not have these details, you cannot use it with Earnin through Cash App.

Can I get money from Cash App through Earnin?

No, Earnin does not allow you to directly access money from your Cash App. To borrow money through Earnin, you would need to link a traditional bank account or a debit card with Earnin as a payment method.

Can I link a prepaid card to my Cash App account to use with Earnin?

It depends on the type of prepaid card you have. If your prepaid card has a routing and account number, you may be able to link it to your Cash App account and use it with Earnin. However, if your prepaid card does not have these details, you cannot use it with Earnin through your Cash App account.

Can I use Cash App to prepay my Earnin?

No, Earnin does not offer a prepay option for its users. You can only use Earnin to get money before your paycheck arrives.

How does Cash App work with Earnin?

Cash App works with Earnin by allowing you to link your Cash App account as a payment method in the Earnin app. You can then use your Cash App account to borrow money before your paycheck arrives.

How can I borrow money through Earnin using Cash App?

To borrow money through Earnin using Cash App, you need to link your Cash App account as a payment method in the Earnin app. Once you have done this, you can select Cash App as your payment method when requesting advance funds.

Are there any other payday advance apps like Earnin that work with Cash App?

Yes, there are other payday advance apps similar to Earnin that work with Cash App. Some of these apps include Brigit, Dave, and MoneyLion.

How do I link a traditional bank account with Earnin through Cash App?

To link a traditional bank account with Earnin through Cash App, you need to select Bank Account as your payment method in the Earnin app. You will then be prompted to enter your bank account details, including your account and routing numbers. Once you have done this, you can use Earnin to access your hard-earned money before your paycheck arrives.