Are you trying to find cash advance apps that work with Cash App?

After trying this myself and getting very frustrated when nothing worked, I set out to find a solution.

After some testing and extensive research, I figured out the best same-day loans that accept Cash App, so there are no more guessing games and wasted time when you need to borrow money.

In this short article, I’ll tell you precisely about cash advance apps that work with Cash App.

- The Albert app is a cash advance app that works with Cash App, it offers instant funds up to $250 with no interest1 or fees.

- The Chime® app can also be used with Cash App by adding your Chime®2 Debit Card or Chime® Bank account as a payment method. Chime® SpotMe® allows you to borrow money and get an advance of up to $200.

- Some apps don’t directly connect to Cash App, but a workaround is to use a bridge account like Chime® to transfer the money between the accounts.

Note: Some apps might not directly connect to Cash App, but there is a workaround by using a bridge account like Chime® to transfer the money between the accounts.

We have provided detailed instructions below on setting up these bridge accounts to transfer money between cash advance apps and Cash App. We update this article frequently to ensure the most up-to-date information.

We highly recommend getting the Albert App, a money app. It’s similar to Cash App or a bank account, but way better!

Albert has a debit card and savings account (no credit checks) and lets you borrow up to $250 with no interest or fees! It’s also easy & quick to sign-up!

What Cash Advance Apps Work with Cash App?

Cash advance apps can provide instant loans when needed but sometimes don’t directly work with Cash App. However, you can use a traditional bank or credit union account to bridge Cash App and cash advance apps to move funds between them.

Some popular cash advance apps that can be used with Cash App include Albert, MoneyLion, Dave, Brigit, and Cleo.

To use these cash advance apps with Cash App, you need to link a traditional bank account or debit card in both apps and use it as a bridge to move funds back and forth. Remember that cash advance apps primarily support traditional banks, which they can verify with Plaid and check your record of consistent income.

As a result, Cash App may not work directly with these apps.

If you are a Chime® user, check out our guide on cash advance apps that work with Chime® for a complete breakdown of all compatible loan apps.

5 Same-Day Loans That Accept Cash App

Here is a list of the best loan apps that work with Cash App for same-day approval to borrow money.

Keep scrolling for a deep dive into our five favorites.

To read what others say about Cash App, check out some testimonials, many of which mention the app’s capability of being the perfect spending account alongside other popular cash advance apps.

| App | Timeframe | Limit | Fee | Interest | Credit Check |

|---|---|---|---|---|---|

| Albert | Instant | Up To $250 | $8 per month | No Interest | None |

| Chime® (Spotme®) | Instant | Up To $100 | No Fee | No Interest * | None |

| Brigit | 1 Business Day | Up To $250 | $9.99 per month | No Interest | None |

| Cash App Borrow | 1-3 Business Days | Up To $200 | flat 5% fee | No Interest | None |

| Cleo | 1 Business Day | Up To $100 | $5.99 per month | No Interest | None |

| Earnin | 1-3 Business Days | Up To $750 | No Fee | No Interest | None |

| Moneylion | 1 Business Day, Instantfunding Available For A Fee | Up To $250 | $0.25 | No Interest | None |

| Current | Instant | Up To $200 | No Fee | No Interest | None |

| Empower | 1 Business Day, Instantfunding Available For A Fee | Up To $250 | $8 per month | No Interest | None |

| Kora | 1 Business Day | Up To $500 | No Fee | No Interest | None |

| Dave | Instant(Up To $200), 1-2 Business Days (Up To $500 ) | Up To $500 With Extracash Feature | $1 | No Interest | None |

| Pockbox | Under 1 Hour (Additional Fees May Apply) | Up To $500 | No Fee | No Interest | None |

| GreenDollar Loans | 1-2 Business Days | Up To $100 – $5,000 | No Fee | APR 5.99% to 35.99% | None |

| Viva Payday Loans | 1-2 Business Days | Up To $100 – $5000 | No Fee | APR 5.99% to 35.99%. | None |

| Big Buck Loans | 1 Business Day | Up To $100 – $5000 | No Fee | APR 5.99% to 35.99%. | None |

| Heart Paydays | The Exact Time Depends On The Broker Or Lender Chosen | Up To $100 – $5000 | No Fee | APR 5.99% To 35.99%. | None |

| Possible | 1-2 Business Days | Up To $500 | No Fee | $15 to $20 For Every $100 You Borrow | None |

| Gerald | Instant | Up To $215 | $9.99 per month | No Interest | None |

| B9 | The 5Th Of The Following Month | Up To $500 | $9.99 per month | No Interest | None |

| Line | 1 Business Day | Up To $100 | No Fee | No Interest | None |

| Grid Pay Boost | 1 Business Day | Up To $200 | $10 per month | No Interest | None |

| Loan Hunter | Instant | Up To $2500 | No Fee | No Interest | None |

| Hundy | Instant | Up To $25 – $250 | No Fee | No Interest | None |

| Vola | Instant | Up To $300 | $9.99 per month | No Interest | None |

| Solo Funds | 3 Business Days | Up To 575 | No Fee | No Interest | None |

| Varo | 1-2 Business Days | Up To $250 | No Fee | APR 3.00% To 5.00% | None |

| Flexwage | Instant | Unknown | No Fee | Unknown | None |

| Payactv | 1-3 Business Days | Up To $500 – $1000 | No Fee | No Interest | None |

| Dailypay | Instant | No, This Is Not A Loan | No Fee | No Interest | None |

| Even | 1 Business Day | 50% Of The Net Pay You’Ve Already Earned | $6 per month | No Interest | None |

| Branch | 1 Business Day | Up To $150 | No Fee | No Interest | None |

| Zirtue | 2-5 Business Days | Up To $1000 | No Fee | No Interest | None |

| Floatme | 1 Business Day | Up To $50 Per Day | $1.99 per month | No Interest | None |

| Honeybee | 1 Business Day | Up To $500 | No Fee | No Interest | None |

| Zayzoon | 1 Business Day | Up To $200 Per Day | No Fee | No Interest | None |

| Oportun | 1 Business Day | Up To $300 To $10,000 | No Fee | APR 0.3599% | None |

| Lendup | 1-7 Business Days | Up To $1,000 | $5 per month | APR 214.13% to 913.71% | None |

| Speedy Cash | Instant | Up To $2600 | No Fee | APR 132% to 680.7% | None |

| Avant | 1-4 Business Days | Up To $2,000 To $35,000 | No Fee | APR 9.95% to 35.99% | None |

| Opploans | 1 Business Day | Up To$500 To $4,000 | No Fee | APR 59% to 160% | None |

| Netcredit | 1 Business Day | Up To $500 To $10,000 | No Fee | APR 34% to 155% | None |

| Rise Credit | 1 Business Day | Up To $5,000 | No Fee | APR 58.90% to 299.00% | None |

| Fig Loans | 1-3 Business Days | Up To $750 | No Fee | APR 59% to 199% | None |

| Blue Trust Loans | 1 Business Day | Up To $3,000 | No Fee | APR 471.78% to 841.45% | None |

| Check Into Cash | 1 Business Day | Up To $50 To $5,000 | $9.99 | No Interest | None |

| Cashnetusa | Instant | Up To $50,000 Usd | No Fee | APR 0.6274% to 0.8904%. | None |

| Cash App | 1-3 Business Days | Up To $200 | No Fee | No Interest | None |

| Klover | 1 Business Day | Up To $150 | $3.99 per month | No Interest | None |

1. 🥇 Albert – Fast Sign-Up & Instant Funds up to $250

The Albert app is one of the best ways to borrow money online and is a highly rated & trustworthy financial app (as of article publication, the app had a 4.6 rating out of nearly 160,000 reviews!).

When it comes to payday loans, it really doesn’t get more simple and straightforward than this one.

And if you’re specifically looking for cash advance apps that work with Cash App, you’re in luck because Albert can easily connect to use the apps together.

If you sign up for Albert, you can borrow $250 immediately!

Pros & Cons of Albert

Albert’s most positive attributes include:

- No late fees or interest

- No credit check

- Ability to automate savings to reach a goal

- Personalized financial advice

- Access to fee-free ATMs

- User-friendly investing feature

Some of the app’s shortcomings include:

- Monthly subscription fee to access most of the best features

- Loans only up to $250

- Limited customer service options (no phone support)

For a deeper dive into the pros and cons of this app, check out our full Albert review.

How to Set Up Albert with Cash App

During the setup process, you can request a free Albert debit card.

Then, you’ll need to link that Albert debit card to Cash App and transfer the cash advance funds from Albert to Cash App as needed.

You can also use the instant deposit to transfer your Cash App funds to this card.

However, it will not work if you want to link a Cash App Card to the Albert App.

Looking to set up cash advances?

According to the Albert website, to gain access to Albert Instant (cash advance), you must link a debit card to a bank account where you receive your income.

Here is how to set up Albert Instant Cash Avance with Cash App:

- Get the Albert App, complete the signup process, and request the Albert debit card.

- Add a bank account to Albert (not your Cash App account)

- If you do not have a real bank account, get a Chime® online account (they accept everyone with zero credit checks or ChexSystems checks.) You must have a real bank account (credit unions work, too) to access Albert’s instant advance.

- Once you have the Albert debit card, you can add this to Cash App and transfer the advance money into your Cash App account.

Albert Instant does not support prepaid or cash cards because they lack the functionality to receive and repay cash advances.

It also provides the following list of prepaid cards that Albert Instant does not support:

- Netspend

- Walmart Money

- BankMobile Vibe

- Card.com

- Go2Bank

- AccountNow Prepaid Visa

- American Express Reserve

- Money Network Pay Card

Although Albert does not explicitly call out Cash App Card in the above list, it may or may not work.

You’ll receive insider tips on making money online, side hustle ideas, and more. Subscribe now and take control of your financial future.

I promise not to spam, sell, or share your information.

2. MoneyLion Instacash – Get $250 Advance!

You can link your MoneyLion debit card to Cash App to transfer money from your Cash App account to your Money Lion account.

You can get the Money Lion debit card if you sign up for RoarMoney.

You can use the’ instant transfer’ option if you add your Roar Money Card details to Cash App. Cash App supports instant transfer to such linked debit cards. However, there may be delays when transferring funds to fintech debit cards.

Alternatively, you can manually add your Cash App account to Roar Money by entering your routing and account number. This standard ACH transfer may take 1-3 business days to complete.

MoneyLion is more of an online bank, and it operates on a membership model with the product “InstaCash” (no interest), offering advances of up to $250 before payday.

It also offers short-term loans.

You can also use an external bank account to validate your direct deposit and balance history with MoneyLion. There are a few things to remember when connecting an external bank account to MoneyLion to be eligible under their terms and withdraw money.

- The bank account has been open for at least two months and receives regular income/paycheck deposits.

- It has a favorable balance.

Pros & Cons of MoneyLion

MoneyLion’s most noteworthy features include:

- Cash advances of up to $500

- No credit reporting

- High user ratings

- Ability to extend repayment dates without penalty

- No overdraft fees

- No interest

Some possible cons for MoneyLion’s Instacash feature include:

- A monthly fee of $19.99 for budgeting and credit-building features

- Fast-funding fee to get your money quicker

- Previous legal issues affect its trustworthiness

To dig further into this cash advance option, peek at our MoneyLion Instacash review.

3. Chime® – SpotMe® Loan Feature (up to $200)

While Chime® isn’t technically a cash advance app, it’s an app that offers cash advances that do work with Cash App. Chime® can be used with Cash App by adding your Chime debit card or Chime account as a payment method.

If you have a Chime® account, you can use Chime® SpotMe® to get an advance of up to $200 (depending on your direct deposit).

If you choose, you can then transfer funds to your Cash App account (or deposit money into another account or bank debit card).

Pros & Cons of Chime® SpotMe®23

Chime® SpotMe®’s best features include:

- Quick funding speed

- The maximum funding amount can increase over time.

- No fees

- No interest charges

- Fast approval time

- Option to receive your paycheck up to two days early

Some common cons mentioned about it include:

- Merely an overdraft alternative, not a true loan

- Only up to $200

- It doesn’t cover ACH transfers.

You can learn more about Chime® SpotMe® and its various features by reading our Chime® SpotMe® review.

4. Dave – Get $500 Instant Cash!

If you use Dave and have a Dave Spending account, it will work with Cash App when you add your Dave debit card as a payment method.

You can transfer money from Cash App to your Dave account and withdraw funds from your cash advance with Dave to make payments through Cash App.

Please remember that Dave does not support instant transfers from Cash App to Dave Spending Card (which usually works for other debit cards). A standard deposit transfer, according to Dave, can take up to 5 business days.

Dave provides cash advances against your paycheck in exchange for a $1 monthly subscription fee and links an eligible external bank account (traditional banks or credit unions) or Dave’s checking account with eligible direct deposits.

A cash advance of up to $250 is available. You must connect an eligible bank account in Dave to withdraw money.

When you open a checking account with Dave, you will receive a Dave debit card. After that, you can add this card to Cash App. Now, essentially, you have a cash advance app card for convenience.

Pros & Cons of Dave

Common pros discussed about the Dave app include:

- Low-cost membership (only $1)

- Up to $500 loan amount

- Early direct deposit (access your paycheck up to two days early)

- Budgeting tools to help manage expenses

- Access to side hustle opportunities to earn extra money

- Banking features – including earning 3% APY on savings

Some cons to the Dave app include:

- More strict qualification requirements than some competitors

- Limited customer support options

- Possible fees for instant funding or late repayment

Add a Dave Debit Card in Cash App:

- Open Cash App and Log in.

- Then, tap on the Bank icon at the bottom of the cash app home page.

- Then, select ‘Link Bank.’

- Please enter your Dave card number.

- Complete the Verification process by following the on-screen instructions.

- Cash App will be linked to your Dave account.

- Return to the Cash App’s homepage.

- Select the bank or dollar icon.

- Select ‘Add Cash.’

- Enter the amount you’d like to add.

- Click the ‘Add $’ button.

- Check your identity.

- Dave’s money will be transferred to Cash App.

5. Brigit – Instant $500 Loan Now!

There are conflicting answers regarding whether Brigit works with Cash App. According to some sources, Brigit can work with Cash App, and you can link your Cash App account to Brigit to receive cash advances and manage your finances.

However, other sources state that Brigit is confirmed not to work with Cash App. It is important to note that Brigit only allows you to link full-fledged checking accounts using the Plaid service and does not support prepaid card accounts like Cash App.

Brigit works with Plaid to offer customers over 6,000 banks and credit unions to select from.

If you are having trouble linking your Cash App account to Brigit, you may want to consider using a bridge account like Chime® to connect the two apps.

Pros & Cons of Brigit

Some of the best aspects of the Brigit app include the following:

- Less stringent eligibility requirements than some competitors

- No overdraft fees

- Access to both credit-builder loans and paycheck advances

- Limit of up to $600 for credit-builder loans

- Low monthly payment options (as little as $1)

- Budgeting assistance tools

Some of the sore points of the app include the following:

- Cash advances only up to $250

- A monthly subscription fee of $9.99 to access advanced features (including the credit-builder loans)

- Funds aren’t available immediately (can take 1-2 days)

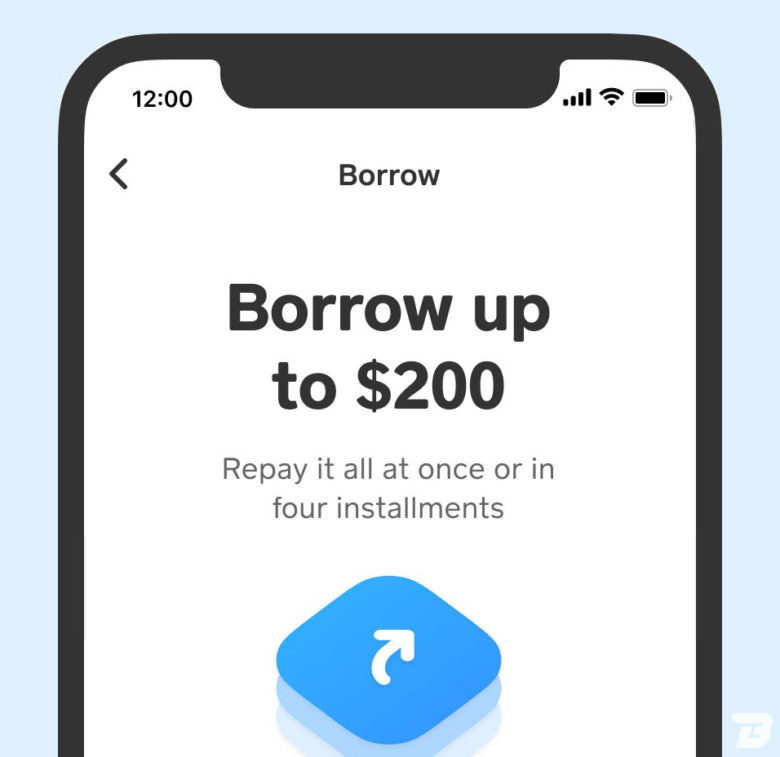

Is it Possible to Borrow Money Using Cash App?

Yes, Cash App does allow you to borrow money.

However, it’s still in a testing phase and unavailable to everyone, with limited, small personal loans of $20 to $200.

According to TechCrunch, loans are funded quickly and must be repaid in four weeks or less.

However, carrying a balance for an extended period can add up – Cash App charges a 5% flat fee to borrow, plus an additional 1.25 percent per week after the grace period.

As long as you understand that a Cash App Borrow loan is best for quick repayment, the new tool may be helpful when you’re short on cash.

Borrowing Money From Cash App Borrow

As previously stated, Cash App Borrow is not yet available to everyone. The only way to find out is to check your app.

Follow these ten easy steps to borrow money from Cash App before your next payday:

- Launch the Cash App.

- Tap on the Cash App balance in the lower-left corner.

- Navigate to the “Banking” section.

- Look for the word “borrow” in the dictionary.

- If you see the word “Borrow,” you can apply for a Cash App loan.

- Select “Borrow.”

- Select “Unlock.”

- Cash App will tell you how much you can borrow.

- Please read the user agreement.

- Accept a Cash App Borrow loan.

If you don’t see the borrow option, you should read our guide on how to unlock borrow on Cash App.

How to Connect Cash Advance Apps to Cash App?

If you want to link cash advance apps that work with Cash App, you should open a traditional bank account or credit union account for direct deposit.

Then, use this bank account or debit card as a bridge between the Cash App and cash advance apps to move the funds between them by individually linking such traditional bank accounts in both apps.

You can then use the bank account as a bridge to move funds back and forth.

You can also use online-only financial technology companies such as Chime®, which work with cash advance apps and are linked to Cash App. Chime® also has its cash advance service, Chime® SpotMe®.

Another possibility is that if you want to access funds from these payday advance apps, you can do so by linking the debit card or bank account you have set up with these cash advance apps, such as Dave and MoneyLion, in Cash App.

You can transfer the borrowed funds to your Cash App account or cash out your Cash App balance to such advance accounts.

However, this establishes a direct fintech-to-fintech connection, which is not ideal but serves the purpose.

What are Cash Advance Apps?

A cash advance app (also sometimes called a payday advance app or loan apps) is an app that allows you to get a short-term loan, usually for a small amount of money to get you by until your next payday.

They are a much cheaper alternative to traditional banks‘ overdraft facilities if you steer clear of fees.

Dave, Brigit, Cleo, Albert, Earnin, MoneyLion, Klover, and other popular cash advance apps include Dave, Brigit, Cleo, Albert, Earnin, MoneyLion, Klover, and others.

On the other hand, Cash App does not support all cash advance apps.

Cash advance apps typically provide advances without interest or finance charges but rely on subscription fees and tips to generate revenue.

These advances are made against your next paycheck, so you effectively borrow before your payday.

First and foremost, let us address whether cash advance apps allow you to link your Cash App account if you receive a direct deposit into your Cash App account and want to use it to access the advance.

Unfortunately, the answer is no.

Cash advance apps require access to your payday and paycheck amounts.

If you have set up direct deposit with Cash App and want to use the cash advance apps by adding your Cash App account to these apps, it will most likely NOT work.

If you’re looking for alternatives to traditional banks, you might want to explore cash advance apps with no direct deposit instead. However, remember that because these payday loan apps primarily support traditional banks, which they can verify with Plaid and check your record of consistent income, Cash App may not work.

Our Takeaway – What Loan Apps Work with Cash App?

If you want to fulfill personal loans, payday loans, or cash needs, then cash advance apps can help you.

The best part is it works smoothly, and with other peer-to-peer lending services, it also allows users to link a bank account and pay bills using its debit card.

We hope this article will help you use Cash App alongside your favorite loan apps for personal loans or cash needs.

Article Sources & Helpful Resources

Here is a list of links that were resources for this article:

- Albert Official Website: The official website of Albert, a financial app offering budgeting, saving, and investing tools.

- Chime® Official Website: The official website of Chime®, a digital banking platform offering fee-free financial services.

- Dave Official Website: The official website of Dave, an app that provides cash advances and budgeting assistance.

- Earnin Official Website: The official website of Earnin, an app that allows users to access their paychecks early.

- Brigit Official Website: The official website of Brigit, a financial app that provides budgeting tools and cash advances.

- MoneyLion Official Website: The official website of MoneyLion, a financial platform offering banking, investing, and loan services.

- Consumer Financial Protection Bureau: The official website of the U.S. government agency dedicated to consumer financial protection.

- Cash App Official Website: The official website of Cash App, a digital banking platform offering feature-rich financial services.

- Payday Loan Wikipedia Page: The wiki page about payday loans and cash advances.

- Cash App – Wikipedia: Wikipedia page about Cash App, a mobile payment service developed by Square, Inc.

- Cash Advance Apps Compatible with Cash App for Quick & Convenient Funding

Can I Use Cash App with Earnin to Get Instant Cash Advances?

Yes, Cash App can be used in conjunction with apps like Earnin to obtain immediate cash advances. By linking your Earnin account to Cash App, you can receive instant cash advances from your upcoming paycheck. This seamless integration allows users to leverage the benefits of both platforms for their immediate financial needs.

Cash Advance Apps that Work with Cash App (FAQs)

Does Albert work with Cash App?

Yes, Albert is confirmed to work with Cash App. However, you might need to use a bridge account like Chime® to connect the two accounts.

Does Brigit work with Cash App?

No, Brigit is confirmed not to work with Cash App. However, you could use a bridge account like Chime® to connect the two accounts. This is an excellent workaround to enable Brigit to work with Cash App.

Does Dave work with Cash App?

No, Dave is confirmed not to work with Cash App. However, you could use a bridge account like Chime® to connect the two accounts.

Does Earnin work with Cash App?

No, Earnin is confirmed not to work with Cash App. However, you could use a bridge account like Chime® to connect the two accounts.

Does FloatMe work with Cash App?

No, FloatMe is confirmed not to work with Cash App. However, you could use a bridge account like Chime® to connect the two accounts.

Are there cash advance apps with no direct deposit required?

Cash advance apps all require some sort of direct deposit, which is a safeguard to ensure they get paid back. Some are less strict than others, though. For instance, the Albert app doesn’t require you to set up your direct deposit directly through their app; you just have to connect to it. This allows you to set up the required automatic payments, but you can adjust the date at any time.

- *Out of network ATM withdrawal fees may apply. See here for details. ↩︎

- Chime® is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC. ↩︎

- Chime® SpotMe® is an optional, no fee service that requires a single deposit of $200 or more in qualifying direct deposits to the Chime® Checking Account each at least once every 34 days. All qualifying members will be allowed to overdraw their account up to $20 on debit card purchases and cash withdrawals initially, but may be later eligible for a higher limit of up to $200 or more based on member’s Chime® Account history, direct deposit frequency and amount, spending activity and other risk-based factors. Your limit will be displayed to you within the Chime® mobile app. You will receive notice of any changes to your limit. Your limit may change at any time, at Chime®’s discretion. Although there are no overdraft fees, there may be out-of-network or third party fees associated with ATM transactions. SpotMe® won’t cover non-debit card transactions, including ACH transfers, Pay Anyone transfers, or Chime® Checkbook transactions. See Terms and Conditions. ↩︎