In today’s fast-paced world, unexpected financial needs can arise at any moment. That’s where quick cash advance apps come to the rescue, providing an easy and affordable way to access funds when you need them most.

With lower fees than traditional payday loans and flexible repayment options, cash advance apps like Earnin, Chime SpotMe, Brigit, MoneyLion, and Dave have become increasingly popular among people in need of emergency funds or small loans.

- Quick cash advance apps like Albert, MoneyLion, Dave, Earnin, Brigit, and Empower offer an easy and affordable way to access funds in times of need.

- When choosing a quick cash advance app, consider factors such as how quickly you will receive funds, interest rates and fees, limits on cash advances, repayment terms, and eligibility requirements.

- While these apps provide quick access to funds at lower costs than traditional payday loans or bank overdrafts – always use caution when borrowing money.

Top 7 Quick Cash Advance Apps With Fast Funding

Here are six of the top cash advance apps that offer fast funding to help you get money quickly in times of need: Albert, MoneyLion, Dave, Earnin, Brigit, and Empower.

We highly recommend getting the Albert App, a money app. It’s similar to Cash App or a bank account, but way better!

Albert has a debit card and savings account (no credit checks) and lets you borrow up to $250 with no interest or fees! It’s also easy & quick to sign-up!

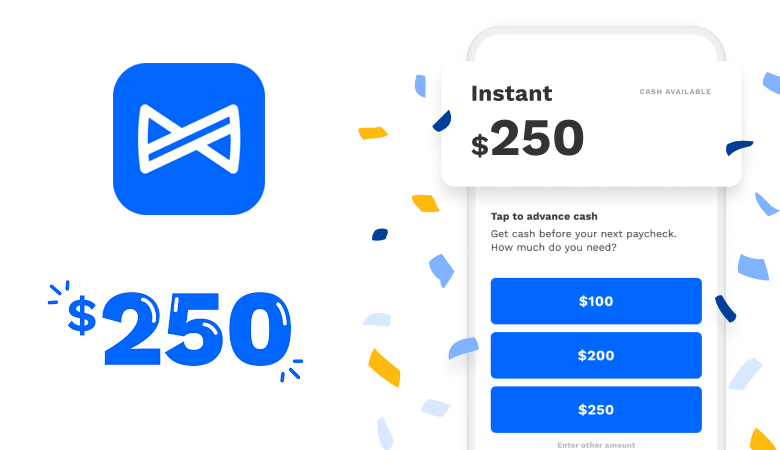

1. Albert: Fastest Cash Advances Up To $250

Experiencing a financial hiccup and need quick cash? Look no further than Albert, an app that offers fee-free cash advances up to $250 without the hassle of a credit check.

By analyzing your bank account history and activity, this user-friendly app will determine your personal cash advance limit.

Imagine needing money for an emergency expense, and within 20 minutes – funds are deposited into your bank account. That’s the speed at which Albert operates when you select their express option for just $6.99 to get instant access to a $100 advance.

With no fees or interest charges beyond that small express cost, Albert proves itself as one of the fastest and most affordable cash advance apps available today.

2. MoneyLion: Low-Cost Cash Advances Up To $250

MoneyLion stands out as a top choice for low-cost cash advances up to $250, with no credit check needed. This user-friendly app allows you to access funds within 48 hours, making it an excellent option for those in need of quick financial assistance.

Starting with an initial borrowing limit of $25, your maximum limit is determined by factors such as income and recurring deposits.

One thing that sets MoneyLion apart from other cash advance apps is its comprehensive suite of AI-powered features aimed at improving your financial health. In addition to providing fast cash advances, the app also offers services like credit-building tools, savings accounts with competitive APYs, and overdraft protection for added peace of mind against unexpected expenses or emergencies.

While fees associated with cash advance apps are generally under $10 – which can be more affordable than bank overdraft fees reaching up to $35 – remember that using these apps too often may lead to a cycle of debt if relied upon for regular expenditures.

3. Dave: Borrow Up To $500 With Flexible Repayment Options

For those in need of a quick cash advance, Dave is an exceptional choice, offering users the ability to borrow up to $500 without any credit check. What sets Dave apart from other cash advance apps is its flexible repayment options – you get a seven-day grace period and the option to extend your repayment date for a fee if needed.

Using Dave comes with added benefits such as free credit monitoring that keeps you informed about your credit score and alerts you on changes. There’s also a monthly subscription fee of just $1 which gives access to budgeting tools and overdraft alerts, helping keep your financial life organized.

If you’re ever in need of some extra money, the Side Hustle feature can help you find gig work opportunities tailored to your skills. With over 10 million satisfied users and coverage by major media outlets like Forbes and The Wall Street Journal, it’s evident that Dave truly aims at empowering people financially while keeping them safe from bank overdraft fees or payday loan debt traps.

4. Earnin: No-Fee Cash Advances Up To $500

As a cash advance user, you might be looking for an app that gives you access to quick cash without charging fees or interest. Look no further than the Earnin app! With Earnin, you can borrow up to $500 and pay it back once your paycheck arrives.

Earnin stands out from other cash advance apps because it allows users to access their earned wages in advance based on the number of hours worked. And if you need the money even faster, they also offer a fast funding option with a fee of just $3.99.

Keep in mind that while Earnin doesn’t charge traditional interest rates, there may still be costs associated with borrowing through the app, such as tipping or optional subscription fees.

5. Brigit: Fee-Free Overdrafts Up To $250

One cash advance app that stands out from the rest is Brigit. This innovative app offers fee-free overdrafts up to $250, helping users avoid costly bank fees. With a simple sign-up process and no hidden fees or credit checks, Brigit’s cash advance app is a reliable option for those who need quick access to funds without worrying about high-interest rates.

In addition to overdraft protection, the app also provides budgeting tools and real-time alerts when your account balance is low, making it easy to manage your finances and avoid unexpected expenses.

6. Empower: High Initial Limit Cash Advances Up To $250

Empower is a great option for those in need of high initial limit cash advances up to $250. They offer fast funding and an easy-to-use interface that makes getting the money you need quick and painless.

However, it’s essential to keep in mind that Empower charges a subscription fee of $8 for their cash advance feature, and they offer instant delivery of their cash advances with a fee of $6.

Additionally, the APR example for Empower’s cash advance app is 283.9%, so make sure you’re aware of all costs associated with borrowing before taking out a loan from them.

7. FloatMe

How To Choose A Quick Cash Advance App

To make the best choice when selecting a cash advance app, consider factors such as how quickly you will receive funds, interest rates, and fees, limits on cash advances, repayment terms, eligibility requirements, and user reviews; keep reading to learn more about comparing these apps.

How Quickly You Get Funds

Getting access to funds quickly is a top priority for anyone in need of a cash advance. Fortunately, many quick cash advance apps offer same-day or even instant funding options.

For example, the Albert app provides the fastest cash advances of up to $250 that can be deposited into your bank account within minutes. Similarly, Empower offers high initial limit cash advances up to $250 with instant funding available for eligible members.

Other apps like MoneyLion and Earnin also provide no-fee cash advances of up to $500 that can be accessed instantly or within 24 hours.

Interest Rates And Fees

Understanding the interest rates and fees associated with cash advance apps is essential for any user. While these apps provide quick access to funds, they come at a cost that varies from app to app.

It’s important to review the terms carefully before taking out a cash advance. Some apps may charge subscription fees between $8-$19.99 per month in addition to fast-funding and other transaction fees.

It’s crucial always to read the fine print so there are no surprises when it comes time to repay your advance or assess additional charges levied against usage or eligibility criteria changes over time due to unforeseeable circumstances like pandemics or regulatory updates implemented by third-party banks supporting such platforms underpinning their operations built upon financial technology infrastructure advancements enabling instant lending without collateral but providing short-term fiscal support rather than long term investments recommended by investment advisors within an AI-powered marketplace accessible through mobile banking applications available today!

Cash Advance Limits

One important factor to consider when choosing a quick cash advance app is the borrowing limit. Most apps have varying limits depending on your income, credit score, and repayment history.

For example, Earnin offers no-fee advances up to $500 per pay period for existing customers with a good track record of timely repayments.

It’s essential to be mindful of your borrowing limit and avoid overborrowing beyond what you can comfortably repay within the specified time frame.

Repayment Terms

It’s essential to consider repayment terms when choosing a cash advance app. Some apps offer credit-builder loans with longer repayment periods of up to 48 months and lower APRs ranging from 11.59% to 29.99%.

Other apps allow flexible repayment options, such as Dave, which allows users to choose their payment date and offers extended due dates.

However, it’s crucial to remember that cash advance apps are not a long-term solution for financial difficulties and should only be used in emergencies. It’s best practice always to read the fine print before agreeing to any loan terms or subscription fees associated with using these apps.

Eligibility Requirements

To use a cash advance app, you’ll need to meet certain eligibility requirements. These can vary depending on the app, but common factors include having a bank account and a regular source of income such as direct deposits from an employer.

For example, Empower’s cash advance app requires users to have at least three recurring monthly direct deposits totaling $500 or more into their linked checking account. MoneyLion’s cash advance app is available only to exist customers who have had an active RoarMoney account for at least two months with consistent direct deposits and no recent overdrafts.

User Reviews And Reputation

As a cash advance user, one crucial factor to consider when choosing a quick cash advance app is user reviews and reputation.

Online review sites like Trustpilot can provide an excellent source of unbiased feedback from real users. Take the time to read through both positive and negative reviews to get a balanced view of how the app works in practice.

Additionally, check out each app’s rating on Google Play or the App Store, paying attention to comments about customer service, ease of use, reliability, and overall satisfaction.

By doing your homework up front on user reviews and reputation, you’ll be able to choose a reputable cash advance app that meets your needs while avoiding scams or predatory lenders that could put you further into debt.

Comparing Cash Advance Apps

Compare cash advance apps based on the speed of disbursement, eligibility criteria, fees and interest rates to choose the best app for your needs.

Speed Of Cash Disbursement

As a cash advance user, one of the most important considerations when choosing an app is how quickly you can access your funds. Some apps offer instant funding within minutes of approval, while others may take up to 24 hours or longer.

For example, Earnin and Brigit both offer no-fee cash advances up to $500 with fast disbursement times of as little as a few minutes after submitting your request. Meanwhile, MoneyLion and Dave also provide quick access to cash in as little as one business day through bank transfers or debit card deposits.

Eligibility Criteria

To use cash advance apps, you typically need to have a checking account and a steady income. Some apps require users to have direct deposit set up from their employer, while others accept other forms of income like gig work or unemployment benefits.

However, eligibility criteria varies among different cash advance apps. For instance, MoneyLion requires users to maintain certain level of financial stability before applying for their low-cost advances.

Meanwhile, Brigit provides overdraft protection services with no-interest loans up to $250 only for users who are eligible members and can afford the monthly subscription fee.

Checking out each app’s requirements will help ensure that you meet the qualifications before submitting an application.

Fees And Interest Rates

As a cash advance user, one of the crucial aspects to consider when choosing an app is the fees and interest rates charged. While some apps offer low or no fees, others may have subscription fees, fast-funding fees, or tips that can significantly increase the cost of borrowing.

For instance, Brigit’s cash advance app has an APR example of 520.9%, while Earnin’s is at 312.3%. Empower offers an APR example of 283.9%, and Dave provides an example with a rate of 468.8%.

MoneyLion also has a high APR of 520.9%.

Pros & Cons Of Using Cash Advance Apps

Using cash advance apps can be a convenient solution for quick access to funds. However, it’s important to understand the pros and cons before using them. Here are some of the key factors to consider:

Pros:

- Fast and easy money: Cash advance apps offer a quick and easy way to access cash when strapped for funds.

- No credit check: Most cash advance apps don’t require a credit check, making them more accessible to those with poor credit scores.

- Instant funding: Some apps offer instant funding for qualified users, allowing users to receive funds instantly.

- AI-powered savings tools: Some cash advance apps use artificial intelligence-powered technology to help users improve their financial outcomes, including budgeting tools and savings goals.

- Cashback rewards: Some apps offer cashback rewards for certain purchases made with connected debit cards.

Cons:

- High-interest rates: The APR on cash advance loans can range from 146% to 520.9%, making them one of the most expensive borrowing options available.

- Fees: Cash advance apps may charge various fees such as subscriptions, fast-funding fees, or voluntary tipping, which can add up quickly if not managed properly.

- Borrowing limit: Many cash advance apps have relatively low borrowing limits compared to other types of loans or credit sources.

- Overuse and debt cycle risk: Using cash advance apps regularly can lead to constant borrowing and a cycle of debt if not used responsibly.

- Predatory lending practices: Some lenders may use predatory lending practices that trap borrowers into frequent borrowing cycles.

In conclusion, while there are benefits to using cash advance apps for emergency expenses or unexpected bills, it’s important for users to understand the potential costs and risks involved before deciding whether it’s the right option for their financial situation.

Alternatives To Cash Advance Apps

If you’re looking for alternatives to cash advance apps, here are some options to consider:

- Personal loans from online lenders: Many online lenders offer small personal loans that can be used for emergency expenses with lower interest rates than cash advance apps.

- Credit union loans: Credit unions may offer payday alternative loans with low-interest rates and longer repayment terms than traditional payday loans.

- Buy now, pay later” apps: Splitting large purchases into smaller payments with apps like Affirm or Afterpay can help avoid the need for a cash advance.

- Side gig work: Becoming a rideshare driver on platforms like Uber or Lyft, taking online surveys, or babysitting can provide additional income in a pinch.

- Borrowing from family or friends: While not always ideal, borrowing money from loved ones can sometimes be a better option than using a high-interest cash advance app.

- Paycheck advance programs: Some employers offer paycheck advances as an employee benefit, allowing workers to access earned wages before payday without the need for a loan.

- Credit-builder loans: SeedFi’s Borrow & Grow Plan offers credit-builder loans with longer repayment periods and lower interest rates than many cash advance apps.

- Savings accounts: Building up an emergency fund in a savings account can provide a safety net for unexpected expenses without the need for borrowing.

- Overdraft protection: Adding overdraft protection to your checking account can help cover short-term expenses without incurring high fees associated with cash advance apps.

- Financial assistance programs: Local organizations and government agencies may offer financial assistance programs for those facing hardship.

- Cutting expenses: Reducing unnecessary expenses and creating a budget can free up money to cover emergency expenses without resorting to borrowing.

Understanding Cash Advance Apps With Quick Turn Arounds

Learn how cash advance apps with quick turnarounds work, including their safety and whether or not you can use multiple apps at once.

How Do Cash Advance Apps Work?

Cash advance apps function as a bridge between the user’s paycheck and their financial needs. These apps allow users to borrow money quickly without having to wait for days or weeks to get approved.

To use a cash advance app, you typically need to connect your bank account or provide details about your income source and pay schedule.

Once approved, the funds are usually deposited directly into your bank account, which enables you to access them immediately. More importantly, cash advance apps offer flexible repayment options that often align with your next paycheck date or allow you to set up automatic deductions from your bank account.

Overall using a cash advance app will solve an urgent financial problem immediately, but it is critical for borrowers not to rely on them repeatedly and fall into a cycle of debt over time.

Are Cash Advance Apps Safe To Use?

As a cash advance user, safety should be among your top concerns. The good news is that most cash advance apps are safe to use as long as you choose reputable and well-established providers.

Make sure to research and scrutinize the app’s history, security protocols, data privacy policy, and customer reviews before signing up.

However, it’s worth noting that not all cash advance apps operate under the same regulations or scrutiny levels. You should also be aware that some less scrupulous lenders may use predatory lending tactics or fail to disclose hidden fees and charges.

To avoid falling into such traps, always read the fine print carefully before accepting any terms or conditions offered by an app provider.

Can I Use Multiple Cash Advance Apps At Once?

Yes, it is possible to use multiple cash advance apps at once. However, it’s important to be aware of the terms and conditions of each app before doing so. Different apps may have varying borrowing limits, repayment terms, eligibility requirements, and fees.

In addition, consistently using multiple cash advance apps can lead to a cycle of debt if not managed carefully. Therefore, it’s crucial to have a plan for managing debt and exploring other alternatives for borrowing money when needed.

Our Takeaway

In conclusion, quick cash advance apps can be a useful solution for those in need of immediate funds. However, it is important to choose a reputable app with low fees and interest rates, as well as flexible repayment options.

Take the time to compare different apps based on your unique needs and eligibility requirements. Remember to always use caution when borrowing money, and consider alternatives such as personal loans or credit union loans if possible.

Article Sources & Helpful Links

Here are some helpful links that may help you learn more:

- Albert Official Website: The official website of Albert, one of the cash advance apps mentioned in the article.

- MoneyLion Official Website: The official website of MoneyLion, another cash advance app discussed in the article.

- Dave Ramsey’s Guide to Emergency Fund: A guide on how to build an emergency fund as an alternative to relying on cash advance apps.

- Consumer Financial Protection Bureau’s Guide on Payday Loans: An official government resource providing information on payday loans, a related topic to cash advance apps.

- Federal Trade Commission’s Advice on Payday and Car Title Loans: An official government resource offering advice on payday loans and car title loans, related topics to cash advance apps.

- MoneyLion on App Store: The App Store link for MoneyLion, provides direct access for readers interested in downloading the app.

Quick Cash Advance Apps (FAQs)

What are cash advance apps?

Cash advance apps are mobile applications that allow users to borrow money and receive the funds quickly.

What is the purpose of using cash advance apps?

The purpose of using cash advance apps is to get access to money quickly and easily, typically to cover unexpected expenses or to bridge the gap until the next payday.

What are the pros and cons of cash advance apps?

The pros of cash advance apps include easy access to funds, fast approvals, and flexibility in repayment options. The cons include high-interest rates and fees, potential impacts on credit scores, and the risk of getting caught in a cycle of debt.

What are the best cash advance apps?

Some of the best cash advance apps currently available include MoneyLion, Dave, and the Chime account’s “Get Paid Early” feature. These apps offer instant cash advances, high borrowing limits, and flexible repayment options.

Do cash advance apps require a credit check?

It depends on the app. Some apps require a credit check as part of the application process, while others do not. Having a good credit score can also increase your chances of being approved for a higher borrowing limit and lower fees.

Is there a late fee for using cash advance apps?

Yes, many cash advance apps charge late fees if you do not repay the loan on time. Some apps may also charge additional fees for using certain features or services.

What is the highest cash advance amount I can get from an app?

The highest cash advance amount varies depending on the app, but some apps offer loans of up to $2,023 or more. However, the exact amount you can borrow will depend on a variety of factors, including your credit score and income.

Can cash advance apps help improve my credit score?

While using cash advance apps may not directly improve your credit score, making timely payments and avoiding default can help you build a positive credit history over time.

How fast and easy is it to get a cash advance through an app?

Getting a cash advance through an app can be very fast and easy, with many apps offering instant approval and deposits. However, the exact timing will depend on the app and your individual circumstances.

What are some small cash advances I can get through an app?

Many apps offer small cash advances ranging from $100 to a few hundred dollars. These can be useful for covering unexpected expenses or getting extra cash before your next payday.