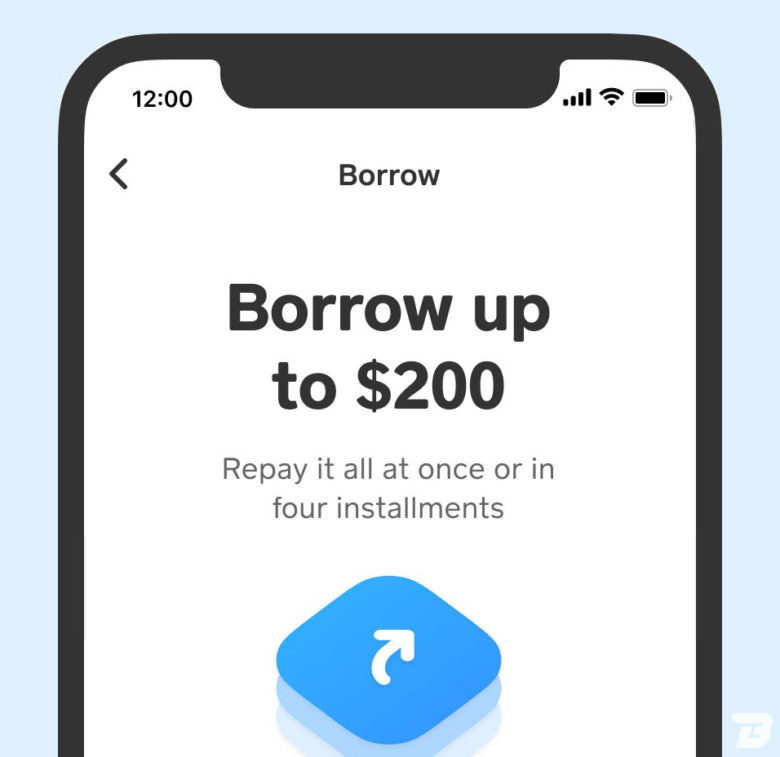

In today’s fast-paced world, having quick access to cash for emergencies or unexpected expenses is crucial. Enter Cash App Borrow – the innovative feature from Cash App that provides short-term loans of up to $200 right from your mobile device.

- Cash App Borrow is a mobile app feature that allows users to borrow between $20 and $200 for short – term personal or household expenses.

- Eligibility criteria for borrowing include deposit history, activated cash card, state of residence, credit score, and user history.

- Repayment options include autopay or manual repayment using the linked debit card; late payments incur additional fees.

- While Cash App Borrow can be useful for quick access to small amounts of money without a credit check, it comes with high-interest rates and short repayment terms. Alternative loan options like Viva Payday Loans may offer more flexibility.

What Is Cash App Borrow?

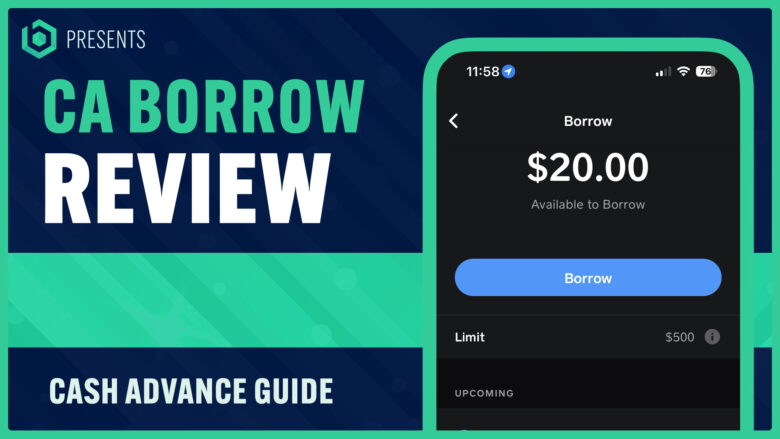

Cash App Borrow is a loan feature that allows Cash App users to take out small, short-term loans for personal or household purposes, emergency expenses, or investing in stocks and bitcoin.

Overview Of Cash App Borrow Features

Cash App Borrow is a feature designed to provide its users with a hassle-free, short-term borrowing experience. With this service, you can access loans between $20 and $200 quickly and easily for personal or household purposes.

The user-friendly interface of the Cash App makes the borrowing process simple and straightforward. Once you’re eligible to use Cash App Borrow, there’s no need to worry about jumping through endless hoops like traditional lending processes.

One standout feature of Cash App Borrow is its integration within the existing ecosystem provided by Square Inc., allowing seamless interaction with other financial services offered on the platform such as investing in stocks and Bitcoin trading or using their debit card – The Cash Card – for ATM withdrawals along with attractive money-saving features like ‘Cash Boost’ discounts at select merchants.

As someone who relies on cash advances frequently for emergencies or unexpected expenses should always evaluate different options before making any decisions thoroughly; I find this feature helpful considering how quick it offers access to funds when needed without hindering my daily routine!

Cash App Borrow: How It Works

To activate the Borrow feature on Cash App, simply click on the “Borrow” button and select the amount you wish to borrow; eligibility for borrowing is based on a user’s deposit history, activated cash card, state of residence, credit score, and user history.

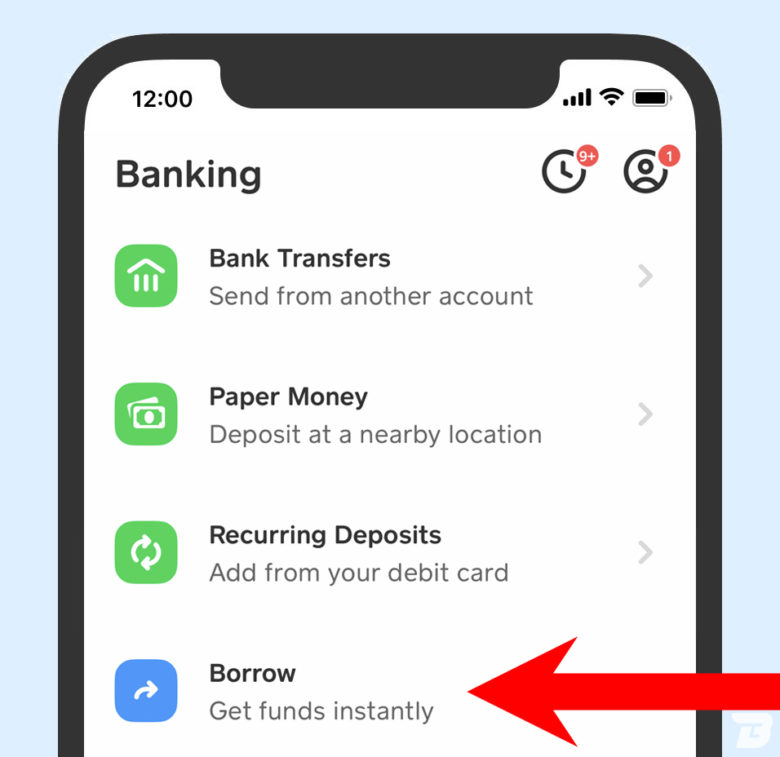

How To Activate Borrow On Cash App

To activate the Borrow feature on Cash App, follow these simple steps tailored to cash advance users:

- Open the Cash App on your mobile device.

- Tap on the Banking tab on the bottom left corner of the app’s main screen.

- Search for and select the “Borrow” option within the Banking tab.

- Review and accept the terms and conditions presented in the loan agreement.

- Submit any required documentation, such as proof of income or employment status.

- Wait for Cash App to review your eligibility based on criteria like credit history, location, app usage frequency, and active Cash Card status.

- Once approved, activate Borrow by confirming your choices for the loan amount and repayment options.

Remember that eligibility for Cash App Borrow is subject to various factors mentioned above. Stay up-to-date with your account information, maintain regular transactions with your Cash Card, and monitor credit factors to increase your chances of qualifying for this convenient borrowing feature from Cash App.

Eligibility Criteria

Navigating the eligibility criteria for Cash App Borrow may seem a bit tricky, but I’m here to break it down for you in simple terms. To qualify, you’ll need to meet several requirements such as an active Cash Card, consistent deposit history into the app, and be located in an eligible state of residence.

Let me share my experience with you – When I wanted to use Cash App Borrow for some emergency car repairs, I used the app frequently and maintained a robust deposit record.

My credit score was also reasonably good, which boosted my chances of unlocking this feature.

Borrowing Limits

As a cash advance user, it is important to understand the borrowing limits of Cash App Borrow. The feature allows eligible users to borrow between $20 and $200 for personal or household purposes, such as emergency expenses.

Your eligibility for borrowing on Cash App will depend on several factors like deposit history, activated cash card, user history, state of residence, and credit history.

It’s worth noting that compared with other loan options like personal loans or payday loans from direct lenders like Viva Payday Loans (which offer up to $5000), the amount you can borrow from Cash App is relatively small and may not be suitable for larger expenses or investments in stocks and Bitcoin.

How To Use Cash App Borrow

To borrow money using Cash App Borrow, simply select the amount you need and confirm your loan terms before submitting your request; if approved, the funds will be deposited directly into your account.

Step-by-Step Guide To Borrowing Money

Here’s a quick and easy guide on how to borrow money through Cash App:

- Ensure that you are eligible for Cash App Borrow by checking whether the feature is available to you based on various factors, such as regular deposit history, your state of residence, and credit history.

- Activate the Borrow feature by tapping on it within the app and following the prompts to set it up.

- Choose the amount that you want to borrow, between $20 and $200.

- Review the interest rate and repayment date before confirming your loan request.

- Provide any additional information needed for verification purposes, such as a valid debit card or linked bank account.

- Wait for approval of your loan application, which typically takes a few seconds.

- Once approved, instantly receive the borrowed funds into your Cash App balance or linked account.

- Use the funds for personal or household expenses within four weeks from the date of borrowing.

- Repay your loan by either enabling autopay or manually paying back from your Cash App balance or linked account before the due date.

- Ensure you have enough funds in your Cash App balance or linked account to avoid late payment fees or automatic deductions from future deposits.

It’s important to consider all aspects of borrowing before making any decisions, including reviewing eligibility criteria and fees associated with borrowing through Cash App Borrow or other alternative options.

My Experience with Cash App Borrow

You know, there was this one time when my son was about to start college. We thought we had everything covered until we realized we forgot about his textbooks. They were pricier than we expected, and we needed a quick solution.

That’s when I thought about Cash App Borrow. I’ve been using Cash App for a while, so I decided to give it a shot. I borrowed $200, just enough for the books. The process was a breeze – a few taps on my phone and the money was there.

I chose to pay it back manually. Set a reminder on my phone for the due date, and when the day came, I paid it back. Easy peasy.

This experience showed me how handy Cash App Borrow can be in a pinch. But it’s a tool to use wisely, given the high interest rates and short repayment terms. It’s definitely a good option to have up your sleeve for those unexpected life moments.

How To Repay Money Borrowed From Cash App

To repay a loan borrowed from Cash App, users can either enable autopay which automatically deducts the repayment amount on the due date or manually make payments before the due date using their linked debit card.

Repayment Options And Due Dates

When it comes to paying back your Cash App Borrow advance, you have a few options to choose from:

- Automatic Repayment: You can set up automatic repayment through the app, which will deduct the money owed directly from your Cash App balance or linked bank account on the due date.

- Manual Repayment: If you prefer to repay your advance manually, you can do so by navigating to the “Borrow” tab in the app and selecting “Repay Now.” From there, you can choose to repay either the full amount or a portion of it.

- Due Dates: The due date for your repayment will be displayed in the “Borrow” tab of the app, and Cash App will send push notifications and email reminders leading up to that date. It’s important to note that additional fees and interest may apply if you don’t repay your advance by the due date.

Remember, repaying your Cash App Borrow advance is crucial for avoiding additional fees and maintaining good credit standing. Delinquent accounts may be reported to credit bureaus, which can negatively impact your credit score.

So stay on top of your repayment schedule by choosing an option that works best for you and never miss a payment!

Pros And Cons Of Cash App Borrow

Pros of Cash App Borrow include quick and easy access to small loans, low borrowing fees compared to traditional lenders, and the ability to borrow without a credit check.

Advantages Of Using Cash App Borrow

As a cash advance user, you may wonder if Cash App Borrow is a good option for your borrowing needs. Here are some advantages to consider:

- Quick access to funds: Cash App Borrow allows eligible users to borrow money instantly and receive the funds directly in their Cash App account. This can be extremely helpful for unexpected expenses.

- Low borrowing limit: The $200 borrowing limit on Cash App Borrow can be an advantage for those who only need a small number of funds. It can also help prevent users from overborrowing and accruing too much debt.

- No credit check required: Unlike many traditional loan options, Cash App Borrow does not require a credit check to authorize the loan. This can be helpful for those with poor credit or no credit history.

- Easy repayment options: Cash App Borrow offers both autopay and manual payment options, making it convenient for users to repay their loans on time.

- Affordable interest rates: At 5%, the interest rate charged by Cash App Borrow is lower than many other short-term loan options available.

- Secure and easy-to-use platform: With PIN entry, Touch ID, or Face ID verification and all user data encrypted, Cash App Borrow provides a secure way to borrow money online.

- Boosts credit score (if repaid on time): Successfully repaying the loan on time could help improve your credit score over time as it demonstrates responsible borrowing behavior.

Overall, if you’re looking for a quick and affordable way to borrow small amounts of money without needing good credit or jumping through hoops, Cash App Borrow could be an excellent option for you!

Disadvantages Of Using Cash App Borrow

While Cash App Borrow can be a useful tool for quick cash advances, it also has some disadvantages that users should consider before borrowing:

- High-Interest Rates: Cash App Borrow incurs a 5% interest rate per week, which can add up quickly for longer repayment periods.

- Late Fees: If you fail to repay your loan on time, you will be charged a 1.25% late fee each week until it is paid off in full.

- Short Repayment Terms: Cash App Borrow’s maximum repayment term is only four weeks, which may not be enough time for some users to repay the loan in full without incurring additional fees and interest.

- Limited Borrowing Amounts: The maximum amount you can borrow with Cash App Borrow is $200, which may not be enough to cover larger expenses or emergencies.

- Potential Credit Score Impact: If you fail to repay your loan on time or default on your loan, it could negatively impact your credit score.

- No FDIC Insurance: Unlike traditional banks, Cash App does not offer FDIC insurance on balances, so users may not have the same level of protection for their funds.

- Not Cost-Effective for Some Users: Depending on the amount borrowed and repayment terms, other borrowing options, such as personal loans or credit cards, may offer lower interest rates and longer repayment periods, making them a more cost-effective choice for some users.

It’s important to weigh these disadvantages against the benefits of using Cash App Borrow before deciding if it’s the right option for your financial needs.

Is Cash App Borrow Safe And Secure?

Cash App Borrow is safe and secure, with PIN entry, Touch ID, or Face ID verification for payments and encryption of user data.

Security Measures In Place

I take security seriously, and I’m sure you do too. So let me tell you about the measures in place to keep your information secure when using Cash App Borrow. First, user data on Cash App is encrypted to protect against unauthorized access.

Additionally, Cash App uses PIN entry, Touch ID, or Face ID to verify payments for added security. This ensures that only authorized users are able to make transactions on your account.

Lastly, if your cash card is lost or stolen, you can disable it immediately from within the app to stop any further use of the card until a replacement arrives.

Cash App Borrow Fees And Charges

Cash App Borrow charges a 5% immediate fee on the borrowed amount, with an additional 1.25% per week after four weeks, making it a viable option for small expenses that can be repaid quickly.

Interest Rates And Late Fees

When using Cash App Borrow, it’s essential to be aware of the interest rates and late fees associated with this service. Let’s break down the costs you can expect when borrowing money through Cash App:

| Fee Type | Amount | Details |

|---|---|---|

| Interest Rate | 5% | This 5% interest fee is charged immediately upon borrowing and is not an annual percentage rate (APR). It is a one-time flat fee. |

| Late Fee | 1.25% per week | If you fail to repay your loan within the four-week repayment period, a late fee of 1.25% per week will be added until the borrowed amount is fully repaid. |

Keep in mind that these fees can add up quickly, especially if you do not repay the borrowed amount on time. It’s crucial to borrow responsibly and have a plan to pay back the funds within the allotted four-week timeframe.

How Does Cash App Borrow Affect Your Credit Score?

As a borrower, you may be wondering how using Cash App Borrow will impact your credit score. The good news is that using this feature won’t affect your credit score directly.

It’s essential to understand that Cash App Borrow is an unsecured short-term loan that doesn’t require collateral or a traditional credit check. Therefore, it won’t positively impact your credit history either.

One crucial factor in determining the effect of borrowing from Cash App on your credit score is whether they report missed payments to the relevant authorities.

Ultimately, while using Cash App Borrow may not initially affect your overall credit rating, it’s still essential to prioritize making timely payments and avoiding defaults for long-term financial health.

Cash App Borrow Alternatives

Other borrowing options are available, such as Viva Payday Loans, which offers larger loan amounts and more flexible repayment periods than Cash App.

Comparison With Other Borrowing Options

It’s important to compare Cash App Borrow with other borrowing options to determine which one is the best fit for your financial needs. The table below highlights some key differences between Cash App Borrow and other popular alternatives.

| Borrowing Option | Loan Amount | Interest Rate | Repayment Period | Eligibility Requirements | Pros | Cons |

|---|---|---|---|---|---|---|

| Cash App Borrow | Up to $200 | 5% | 4 weeks | Select customers based on various factors, including credit history and deposit activity | Easy application process and quick access to funds for eligible users | Low borrowing limit and not available to all Cash App users |

| Personal Loans | Varies based on lender and borrower qualifications | Varies based on lender and borrower credit | Varies based on lender and borrower agreement | Generally require a good credit score and verifiable income | Higher loan amounts and flexible repayment options | Longer application process and may require a good credit score |

| Viva Payday Loans | $100 – $5,000 | Varies based on lender and borrower credit | Flexible repayment periods | Varies based on lender requirements | Access to larger loan amounts and flexible repayment schedules | Higher interest rates and potential for additional fees |

| Instant Loan Apps (e.g., Varo Money, PockBox, MoneyLion, Chime’s SpotMe) | Varies based on app and user qualifications | Low-cost borrowing options | Varies based on app and user agreement | Varies based on app requirements | Quick access to funds and potential for low-interest rates | Loan amounts and availability may be limited |

Consider factors like loan amount, interest rate, repayment period, and eligibility requirements when evaluating which borrowing option is most suitable for your individual financial situation.

Understanding Cash App Borrow

To fully understand Cash App Borrow, knowing the borrowing limits, eligibility criteria, repayment options and due dates, and potential fees and charges associated with using the service is important.

How Much Can You Borrow From Cash App?

As a cash advance user, you may be wondering how much you can borrow from Cash App. This loan feature allows users to borrow between $20 to $200 for personal or household purposes.

It’s important to note that the borrowed amount must be paid back within four weeks with a 5% interest rate added. However, an extra week extension is available at an added cost if you need more time to repay the loan.

Failure to repay the loan may result in late fees and reporting of missed or late payments to credit bureaus.

How Do I Qualify To Use Cash App Borrow?

To qualify for Cash App Borrow, you’ll need to have a regular deposit history and an activated cash card. You’ll also need a good credit history, so it’s important to ensure that your credit score is in good standing before applying.

It’s important to note that Cash App Borrow is best suited for small expenses that can be paid back within a month. If you’re not eligible or looking for other options, several instant loan apps are available where users can compare lenders from the comfort of their home.

These apps may be perfect for those with low or bad credit who may not qualify for traditional loans.

What Happens If You Don’t Pay Cash App Borrow Back?

There can be serious consequences if you don’t pay back your Cash App Borrow loan on time. The first thing to note is that if the loan isn’t repaid within four weeks, a 1.25% late fee may be incurred.

Additionally, if you fail to repay your loan, Cash App may deduct funds from your balance or debit card through autopay until the debt is repaid.

If your account balance becomes negative due to unpaid debts on a Cash App Borrow, you won’t be able to use certain features until the debt is cleared up. Furthermore, Cash App may report unpaid debts to credit bureaus which could negatively affect your credit score and future borrowing opportunities.

Can Cash App Borrow Funds Be Accessed Instantly?

Yes, eligible and approved users of Cash App Borrow can access their funds instantly. The money is available for use as soon as the loan is authorized. This feature allows users to get quick access to emergency cash for personal or household purposes.

Unlike traditional banks that may take days or weeks to process loan applications, Cash App offers a convenient and instant borrowing option for those who need it most.

Our Takeaway: Is Cash App Borrow Worth It?

In conclusion, Cash App Borrow can be a useful option for users who need quick access to small amounts of money for short periods. However, it is important to carefully consider the eligibility criteria and repayment terms before applying.

The immediate fee and weekly interest charges may add up if the loan isn’t repaid promptly. Alternatives like Viva Payday Loans may offer larger loan amounts and more flexible repayment options.

Cash App Borrow

In today’s fast-paced world, having quick access to cash for emergencies or unexpected expenses is crucial. Enter Cash App Borrow – the innovative feature from Cash App that provides short-term loans of up to $200 right from your mobile device.

Product Brand: Cash App

Product In-Stock: InStock

4

Article Sources & Helpful Links

Here are some helpful links that may help you learn more:

- Cash App Official Website

- Cash App Help Page

- How Do I Access an Old Account on Cash App

- Where is my Cash Out on Cash App

- Payday Loans Information on Consumer Financial Protection Bureau

- Cash App Profile on Better Business Bureau

- Bank Accounts & Services Information on Consumer Financial Protection Bureau

Cash App Borrow Review (FAQs)

Can I borrow money from Cash App?

Yes, Cash App offers a cash advance service called Cash App Borrow that allows eligible users to get a loan agreement for up to $200 from Cash App.

How do I know if I am eligible to get a loan from Cash App?

To be eligible for Cash App Borrow, you need to have a Cash App account with direct deposit and regular activity. Cash App will notify you if you are eligible to borrow money from Cash App.

How do I unlock access to Cash App Borrow?

To unlock access to Cash App Borrow, you need to have a Cash App account with at least one direct deposit. Once you have met this requirement, Cash App will notify you if you can borrow money from Cash App.

What is a cash advance?

A cash advance is a short-term loan that you can get from a lender or an app that allows you to access money before your next paycheck.

Does Cash App offer payday loans?

No, Cash App only offers cash advances. Payday loans are different types of loans that can be much more expensive and have different terms and conditions.

How much money can I get from Cash App Borrow?

You can get a loan agreement for up to $200 from Cash App Borrow.

How long does it take to get a loan from Cash App?

If you are eligible to borrow money from Cash App, the loan will be deposited into your account as soon as possible, usually within one business day.

Does Cash App charge any fees or interest for its cash advance service?

Cash App charges a flat 1.25% fee for its cash advance service. This means that if you borrow $100 from Cash App, you will need to pay back $101.25 within one week.

Will Cash App report my loan activity to the credit bureaus?

Yes, Cash App may report your loan activity to the credit bureaus. This means that your loan activity may appear on your credit report and affect your credit history and score.

Can I use Cash App Borrow to transfer money to other users?

No, Cash App Borrow only allows you to get a cash advance for yourself. You cannot use it to transfer money to other users.

Is Cash App Borrow a credit builder?

Yes, Cash App Borrow can help you build credit if you make regular deposits and repay your loans on time. However, it is not designed to be a credit builder service.