Are you in need of a quick financial boost but don’t know where to turn? The Albert app could be your saving grace, offering cash advances up to $250 with no interest or fees attached.

This article will guide you through the straightforward process of securing a cash advance on this user-friendly platform. Keep reading, and let’s unlock financial flexibility together!

- The Albert app offers a user-friendly platform for obtaining cash advances up to $250 with no interest or fees.

- Users can access the Instant Cash feature by setting up direct deposit into their Albert Cash bank account.

- To qualify for an advance, users need to have a linked bank account, receive regular direct deposits, and maintain good standing with their employer.

- Subscribing to Albert Genius provides additional benefits such as personalized financial advice, cash bonuses, fee-free ATM withdrawals, and easy investing opportunities.

Understanding Albert Instant Cash

Albert Instant Cash is a feature within the Albert app that allows users to instantly access cash advances of up to $250 without any interest or fees.

How Does Instant Cash Feature Work?

The instant cash feature of the Albert app provides a lifeline for those in need of quick funds. Once registered, users can access cash advances up to $250 instantly without having to pass a credit check.

Albert’s unique algorithm evaluates your income and spending habits to determine the advance amount you’re eligible for. It’s designed with convenience in mind – when it’s time for repayment, Albert automatically recovers its advance from your next paycheck deposited into your linked bank account, ensuring a smooth transaction without any hassle or fees.

This is more than just an emergency fund; it’s like having a dependable friend ready to help anytime you face unexpected financial hiccups.

We highly recommend getting the Albert App, a money app. It’s similar to Cash App or a bank account, but way better!

Albert has a debit card and savings account (no credit checks) and lets you borrow up to $250 with no interest or fees! It’s also easy & quick to sign-up!

How to Set Up Direct Deposit with Albert

Getting your paycheck deposited directly into your Albert Cash bank account is a fairly straightforward process. Here’s how you can go about setting it up:

- First and foremost, download the Albert app from either the Google Play Store or Apple App Store.

- Next, sign up for an account using relevant personal and financial information.

- Once your account is set up, navigate to the “Albert Cash” section of the app.

- You’ll find an option there to set up direct deposit; click on that.

- The app will prompt you with instructions to share your routing and account number with your employer or payroll provider.

- After providing these details to your employer, they will be able to make direct deposits into your Albert Cash bank account.

- These funds are typically available within two business days after they’re received by Sutton Bank.

How to Get Advance up to $250 with Albert App

To get an advance of up to $250 with the Albert app, simply follow these steps: link your bank account, set up direct deposit with Albert, and meet the conditions for advancing money.

It’s a quick and easy way to access cash when you need it most.

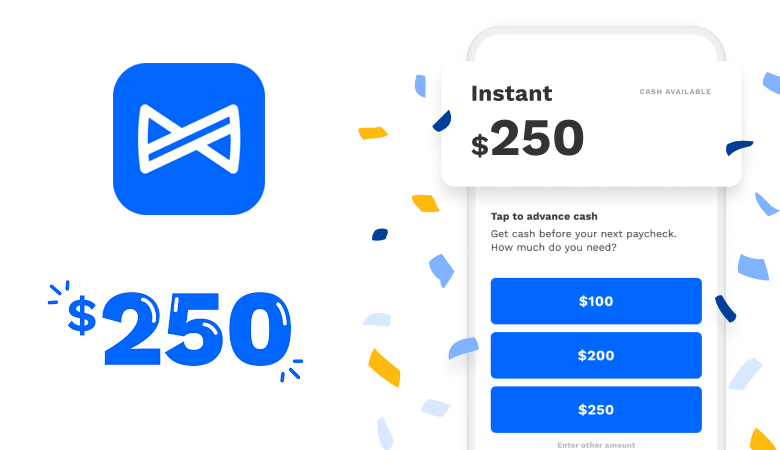

Steps to advance up to $250

Getting a cash advance with Albert App is straightforward. Here are the steps you need to follow to advance up to $250:

- The first step is downloading the Albert app from either the Google Play or Apple App Store.

- Sign up using your personal details.

- You’ll have to link your primary bank account to qualify for an advance.

- Albert uses Plaid, a secure third-party service that helps in connecting your bank with the app.

- You must also set up direct deposit into your Albert Cash bank account.

- Once these are setup and verified, click on the “Albert Instant” button to request a cash advance.

- You will need to confirm how much money you want, with options regarding specific amounts available.

- If you’re approved instantly, funds can be transferred directly into your Albert Cash bank account.

- The advanced amount will automatically be deducted from your next deposited paycheck.

Conditions for advancing money

To qualify for a cash advance of up to $250 with the Albert app, there are a few conditions that need to be met. Firstly, users must have a linked bank account and receive regular direct deposits into their account.

Secondly, users need to have an active Albert Cash bank account where the funds can be deposited. Thirdly, users should maintain good standing with their employer and have steady employment history.

Finally, it’s important to note that each user is limited to three cash advances per pay period. By meeting these conditions, users can easily access the financial support they need through the Albert app without any hassle or delays.

Benefits of Using Albert App

Using the Albert app offers several benefits, including early paycheck access, cash back rewards on spending, and fee-free ATMs for Genius subscribers.

Early paycheck access

With the Albert app, you can enjoy early access to your paycheck, giving you greater control over your finances. This means that you don’t have to wait until payday to receive the money you’ve earned.

Instead, with just a few taps on your smartphone, you can request a cash advance of up to $250 instantly and conveniently. The best part is that there are no credit checks or high-interest rates involved; it’s a hassle-free solution for financial emergencies.

So whether you need some extra cash for unexpected expenses or want to stay ahead of bills, Albert has got you covered with its easy-to-use early paycheck access feature.

Cash back rewards on spending

The Albert app goes beyond just providing cash advances – it also offers an enticing incentive for users to earn money while spending. With its cash back rewards feature, users can receive rewards for their debit card transactions made through the app.

This means that every time you make a purchase, you have the opportunity to earn some extra cash. It’s a win-win situation – you get to spend as usual and earn money at the same time.

So why not make your everyday purchases more rewarding with Albert?.

Fee-free ATMs for Genius subscribers

Genius subscribers of the Albert app enjoy the perk of fee-free ATMs, making it easier and more convenient to access their cash. With this feature, there are no extra charges or fees when using an in-network ATM to withdraw money.

This way, you can save on unnecessary expenses while having quick and easy access to your funds whenever you need them.

Security Measures in Albert App

To ensure the safety of its users’ funds, Albert takes several security measures within its app.

FDIC-insured accounts

Albert app offers FDIC-insured accounts, providing users with the peace of mind that their funds are protected. The Federal Deposit Insurance Corporation (FDIC) ensures that if a bank fails, depositors will be reimbursed for up to $250,000 per account.

With Albert’s partnership with Sutton Bank, users can rest assured knowing that their money is safe and secure. This added layer of security makes Albert app a trustworthy choice for managing your finances and accessing cash advances up to $250 without any worries about the safety of your funds.

Protection against bank failure up to $250,000

Albert App understands the importance of security when it comes to managing your finances. That’s why they provide protection against bank failure up to $250,000. This means that if anything were to happen to Albert or their partner banks, your funds would still be secure and insured.

With this added peace of mind, you can confidently use the Albert App knowing that your money is protected.

Subscription Services in Albert App

The Albert app offers a subscription service called Albert Genius, which provides expert financial guidance and a range of additional benefits to subscribers.

Overview of Albert Genius subscription

The Albert Genius subscription is a valuable plan offered by the Albert app that provides personalized financial advice and services to its users. With a yearly subscription, subscribers have the opportunity to earn a one-time cash bonus.

Additionally, the app has a referral program where both the referrer and the referred friend can earn a cash bonus. As an Albert Genius subscriber, you can enjoy fee-free cash withdrawals at over 55,000 ATMs using your Albert card.

This exclusive feature allows you to access your money conveniently without any extra charges. The Albert Genius subscription truly enhances your financial management experience with its comprehensive benefits and expert guidance.

Benefits of subscribing to Albert Genius

Subscribing to Albert Genius in the Albert app comes with a range of benefits that can greatly enhance your financial wellness. Here’s what you can expect:

- Personalized financial advice: With Albert Genius, you gain access to expert financial guidance tailored to your specific needs and goals. Get personalized advice on budgeting, saving, investing, and more from a team of experienced financial advisors.

- Cash bonuses: As an Albert Genius subscriber, you have the opportunity to earn a one-time cash bonus. This extra income can help boost your financial situation and give you a head start towards achieving your goals.

- Referral rewards: Albert has a referral program where both you and your referred friends can earn cash bonuses. By recommending Albert Genius to others, you not only help them improve their finances but also earn rewards for yourself.

- Cashback on purchases: When using the Albert cash card for your everyday spending, you can earn cashback on eligible purchases made through the app. This allows you to save money while managing your expenses effortlessly.

- Fee-free ATM withdrawals: With the Albert debit card provided to Genius subscribers, you can withdraw cash fee-free at over 55,000 ATMs nationwide. Say goodbye to unnecessary withdrawal fees and enjoy convenient access to your funds whenever needed.

- Easy investing opportunities: The Albert app makes it simple to start investing with as little as $1. Take advantage of its user-friendly investment platform and begin growing your wealth even with small amounts of capital.

- No minimum balance or maintenance fees: Unlike traditional banking institutions, the Albert app has no minimum balance requirements or monthly maintenance fees. This means you can keep more of your hard-earned money and have full control over how you manage it.

- Instant cash advances up to $250: One of the standout benefits of subscribing to Albert Genius is the ability to get instant cash advances when unexpected expenses arise. Access up to $250 with no credit check required and repay it conveniently with your next paycheck.

- Flexibility and convenience: Albert’s cash advance feature offers unparalleled flexibility, giving you the freedom to access funds when you need them most. Whether it’s covering an emergency expense or bridging the gap until your next payday, Albert Genius has got you covered.

Our Takeaway

In conclusion, obtaining $250 from the Albert app is quick and easy. With their Instant Cash feature, users can access cash advances instantly without any interest or fees. Simply set up direct deposit with Albert, follow a few simple steps, and you’ll have the extra funds you need in no time.

Experience the convenience and financial flexibility that Albert has to offer by downloading the app today.

Article Sources & Helpful Links

Here are some helpful links that may help you learn more:

- Albert Official Website: The official website of Albert, the finance app discussed in the article.

- Albert on Apple App Store: The download link for the Albert app on the Apple App Store.

- Albert on Google Play Store: The download link for the Albert app on the Google Play Store.

- Consumer Financial Protection Bureau on Payday Loans: An official government resource explaining payday loans.

- Wikipedia page for Albert App: The Wikipedia page providing information about the Albert app.

- Wikipedia page for Payday Loans: The Wikipedia page providing information about payday loans.

- FDIC on Payday Loans: An official government resource from the Federal Deposit Insurance Corporation discussing payday loans.

- Federal Trade Commission on Payday Loans: An official government resource from the Federal Trade Commission discussing payday loans.

- Federal Reserve on Filing Complaints: An official government resource from the Federal Reserve on how to file a complaint against a bank.

- Trustpilot Reviews for Albert: User reviews for the Albert app on Trustpilot.

- Albert on Crunchbase: Albert’s profile on Crunchbase, providing details about the company’s funding, investors, and team.

- Albert on LinkedIn: Albert’s official LinkedIn page, providing updates and information about the company.

How Do You Get $250 from Albert App (FAQs)

How do I get $250 from Albert App?

To get $250 from Albert App, you can apply for a cash advance through the app. Simply download the Albert App, sign up for an account, and follow the instructions to request an Albert Cash advance.

What is a cash advance?

A cash advance is a short-term loan provided by a financial institution, like Albert App, that allows you to borrow money against your next paycheck.

Can I get an Albert Cash advance?

Yes, if you meet the eligibility requirements, you can get an Albert Cash advance. The process is quick and easy, and you can receive the funds directly into your Albert Cash account.

How does Albert App work?

Albert App is a banking app that offers a range of services, including cash advance options. By linking your checking account and providing your employment and income information, you can access early access to direct deposit funds and receive cash advances when needed.

Can I get a cash advance from other apps like Albert?

Yes, there are other cash advance apps available that offer similar services to Albert App. Some popular options include Cash App, Loan Apps, and other banking apps that provide cash advance options.

Are there any fees associated with getting a cash advance from Albert App?

Yes, there may be fees associated with getting a cash advance from Albert App. These fees may vary and can include cash withdrawal fees, late fees, and overdraft fees. It’s important to review the terms and conditions of the app before applying for a cash advance.

What is the Albert debit card?

The Albert debit card is a feature offered by Albert App that allows you to access your funds and make purchases like a traditional debit card. It is linked to your Albert Cash account, and you can use it anywhere that accepts debit cards.

Is Albert App a safe and secure option for getting cash advances?

Yes, Albert App takes the security of your personal and financial information seriously. They use encryption and security measures to protect your data and are committed to keeping your information safe.

Can I earn cashback with Albert App?

Yes, Albert App offers the opportunity to earn cashback with their savings accounts. By saving money and meeting certain requirements, you can earn a percentage of cashback on your purchases.

What banking services are provided by Albert App?

Albert App provides a range of banking services, including cash advances, savings accounts, access to direct deposit funds, and the Albert debit card. These services are provided by Sutton Bank, member FDIC.