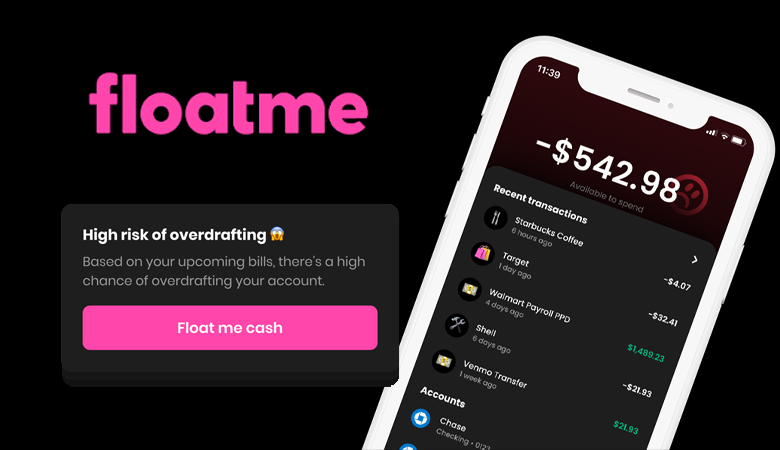

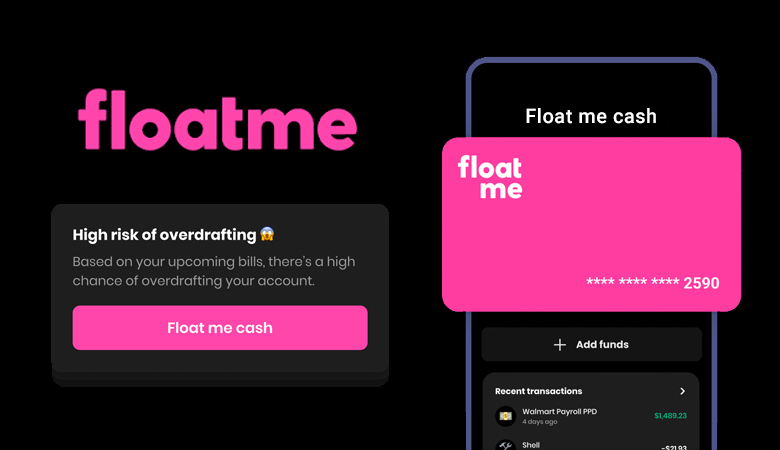

Do you struggle with making ends meet before your next paycheck? Like you, I’ve battled these same cash flow issues and discovered that the FloatMe app could be a useful tool. This detailed review on FloatMe provides insights into how it operates, its features, benefits and drawbacks to help you make an informed decision.

Dive in, let’s explore if FloatMe is the financial lifesaver we’ve been looking for.

- FloatMe is a cash advance app that allows users to access small cash advances of up to $50 before their next paycheck, providing a temporary solution for unexpected expenses or financial gaps.

- The app does not require a credit check and charges a low monthly membership fee of $1.99, making it an affordable option compared to traditional payday lenders.

- With fast funding speed and a streamlined application process, FloatMe ensures that users can receive their funds within 2 hours with an instant transfer or 1 to 3 business days through a normal bank account transfer.

- FloatMe stands out from other cash advance apps with its transparent fees, no interest charges or tips on advances, and coverage for unexpected expenses between paychecks.

How Does FloatMe Work?

FloatMe works by allowing users to access small cash advances of up to $50 before their next paycheck. Users can apply for an advance through the app, and once approved, the funds are deposited into their bank account.

The app does not require a credit check and charges a low monthly membership fee of $1.99. With FloatMe, users have the flexibility to cover unexpected expenses without incurring high fees or interest charges.

Funding Speed

In the world of cash advance apps, getting your funds quickly is often key. FloatMe understands this urgency and offers impressive funding speed to its users. If you opt for an instant transfer using a debit card, you can receive your funds in as little as two hours! However, if you’re not in a rush or don’t want to use a debit card, normal bank account transfers will get you your much-needed cash advance within 1 to 3 business days.

This swiftness gives FloatMe a competitive edge over many other payday lenders that sometimes take more time to process loans. The rapid funding speed makes the app ideal for those times when unexpected bills sneak up on you or when the paycheck just seems too far away – relief from financial stress is only a few taps away with FloatMe.

Application Process

The application process for using FloatMe is straight-to-the-point and user-friendly. Here’s a quick breakdown:

- Download the FloatMe app from App or Google Play Store.

- Open the app and initiate the sign – up process.

- Provide necessary details such as your full name, email address, and create a secure password.

- Connect your bank account to FloatMe using secure financial technology Plaid.

- Confirm that you receive recurring paycheck deposits of at least $200 into this account.

- Verify that your bank account maintains a positive balance most of the time.

- Link an active debit card to your account – this will be used for transactions.

- Next, confirm employment status, ensuring it’s not gig work like Uber driving or Door Dashing; those are not supported currently by FloatMe.

- After completing these steps successfully, get approval to borrow up to $50 before next payday.

Approval Time

Getting approved for a cash advance through FloatMe is lightning fast and hassle-free. In most cases, the approval process takes only a few minutes once your application gets submitted. All it requires is that you meet certain eligibility criteria such as having a steady income, which ensures that FloatMe can trust you with small cash advances.

So there’s no need to fret over cash emergencies anymore! With FloatMe by your side, swift financial help is just an app away – ready to rescue you from unexpected expenses whenever needed.

Borrow Limit

FloatMe offers a borrowing limit of up to $50, allowing users to access small cash advances before their next payday. This transparently capped borrowing limit ensures that you can stay within your financial means and avoid getting into excessive debt.

Whether you need extra funds for unexpected expenses or to cover overdraft fees, FloatMe provides a convenient solution with its low maximum advance. So when you’re in a pinch and need some extra cash, FloatMe has got you covered with its flexible borrowing options.

Fees and Costs

When it comes to fees and costs, FloatMe offers a straightforward and affordable approach. The app charges a low monthly membership fee of just $1.99, making it one of the most cost-effective options in the cash advance space.

Unlike traditional payday lenders, FloatMe does not charge interest or tips on your advances, ensuring you won’t be hit with additional hidden costs. With transparent pricing and no surprise fees, FloatMe provides a reliable and budget-friendly solution for those who need access to small cash advances without breaking the bank.

Is FloatMe Worth It?

Is FloatMe worth it? Let’s find out if this cash advance app is a good choice for your financial needs.

| Criteria | Rating | Explanation |

|---|---|---|

| Funding Speed | 8/10 | The funds were transferred to my account relatively quickly. |

| Approval Speed | 7/10 | The approval process was fairly quick, but there was a slight delay. |

| Borrow Limit | 7/10 | The borrowing limit was sufficient for my needs, but may not suit everyone. |

| Fees & Interest | 8/10 | The fees and interest rates were reasonable compared to other similar services. |

| Application Process | 9/10 | The application process was straightforward and user-friendly. |

| Repayment Terms | 7/10 | The repayment terms were clear, but could offer more flexibility. |

| Trustworthiness | 8/10 | The app seems trustworthy, with clear policies and secure transactions. |

| Transparency | 8/10 | The app is transparent about its fees, terms, and conditions. |

| Customer Support | 7/10 | Customer support was helpful, but at times response was slower than expected. |

| User Ratings | 8/10 | Based on my personal experience, I would rate the app highly. |

| Overall Rating | 8/10 | Overall, FloatMe is a reliable and user-friendly app with room for improvement. |

Please note that these ratings are based on my personal experience and may not reflect the experiences of other users.

Who is FloatMe Good For?

FloatMe is a great option for individuals who find themselves in need of small cash advances on an ongoing basis. If you frequently face unexpected expenses or occasionally struggle to make ends meet before your next payday, FloatMe can provide the financial assistance you need.

With its transparent fees and low monthly membership fee of $1.99, FloatMe offers a straightforward and affordable solution to bridge those gaps between paychecks. Whether you’re facing an emergency or simply want some extra flexibility with your finances, FloatMe is here to help without the hassles of credit checks or high interest rates.

FloatMe Features Overview

FloatMe offers several key features that set it apart from other cash advance apps. With easy access to small cash advances, no credit check requirement, and coverage for unexpected expenses, FloatMe provides a convenient solution for those in need of financial assistance.

Don’t miss out on learning more about the benefits and drawbacks of using FloatMe – read on!

Cash Advances

One of the key features of FloatMe is its cash advances. As a cash advance user, you can borrow up to $50 before your next paycheck, providing a temporary solution to unexpected expenses or financial gaps.

Unlike traditional payday loans, FloatMe offers small cash advances without charging interest or tips. This means that you’ll only need to repay the amount borrowed, without incurring additional fees or charges.

With fast turnaround times and easy application process, FloatMe ensures that you have access to the funds you need when you need them most.

No Credit Check Requirement

One of the standout features of FloatMe’s cash advance app is that it does not require a credit check. This means that individuals with less-than-perfect credit can still access the financial assistance they need without worrying about their creditworthiness.

Whether you have a poor credit score or no credit history at all, FloatMe focuses more on your steady income when considering eligibility for a cash advance. This makes it an inclusive option for those who may have been turned away by traditional lenders due to their credit situation.

With FloatMe, you can get the support you need regardless of your credit background, providing peace of mind and financial relief in times of unexpected expenses or emergencies.

Unexpected Expenses Coverage

One major feature that sets FloatMe apart from other cash advance apps is its unexpected expenses coverage. With this feature, FloatMe aims to help users handle any unexpected expenses that may arise between paychecks.

Whether it’s a medical bill, car repair, or emergency expense, FloatMe provides a safety net for those unforeseen financial burdens. This coverage can provide peace of mind and alleviate the stress of not having enough funds to cover these unexpected costs.

It’s important to note that while FloatMe does offer this coverage, there are limitations in terms of the maximum advance amount available, which is $50. However, even with this limit, the unexpected expenses coverage can still be a valuable resource for covering those urgent financial needs before your next paycheck arrives.

Comparing FloatMe to Other Cash Advance Apps

FloatMe stands out from other cash advance apps due to its low monthly membership fee of $1.99 and its no credit check requirement, making it more accessible for users in need of quick funds.

FloatMe vs Albert

As a cash advance user, it’s important to understand the differences between FloatMe and Albert. Here’s a comprehensive comparison between these two apps.

| FloatMe | Albert | |

|---|---|---|

| Borrow Limit | With FloatMe, you can borrow up to $50 before your next payday. | Albert allows you to borrow up to $100 in advance of your paycheck. |

| Fees and Costs | FloatMe requires a low monthly membership fee of $1.99 and doesn’t charge interest or tips. | Albert requires a monthly subscription fee of $4 but offers flexible tipping. |

| Credit Check | FloatMe does not require a credit check for you to borrow. | Albert also does not conduct a credit check for its cash advances. |

| Funding Speed | Receiving funds from FloatMe can take up to 2 hours via debit card and 1 to 3 business days normally. | Albert typically provides funds within hours, but it can take up to 2 business days in some cases. |

| Eligibility Requirements | For FloatMe, you need direct deposits from your employer, earn at least $200 per paycheck, maintain a positive bank account balance, and have a debit card attached to an active checking account. | On the other hand, Albert requires consistent income, an active checking account, and a positive checking account balance. |

While both FloatMe and Albert share similarities, the differences in borrowing limits, fees, and funding speed may influence which app is the best fit for your needs.

FloatMe vs Earnin

In comparing FloatMe and Earnin, it’s essential to consider key aspects such as borrowing limits, fees, and eligibility requirements.

| FloatMe | Earnin | |

|---|---|---|

| Borrowing Limit | Allows users to borrow up to $50 before their next payday | Similar borrowing limits as FloatMe |

| Fees | Monthly membership fee of $1.99, does not charge interest or tips | Earnin’s membership fee is not mentioned, it may have additional costs |

| Turnaround Time | Within 2 hours using a debit card or 1 to 3 business days generally | Earnin’s turnaround time not explicitly stated |

| Eligibility Requirements | Direct deposits from employer, earn at least $200 per paycheck, maintain a positive bank account balance, and have a debit card attached to an active checking account | Earnin’s specific eligibility requirements are not specified here |

| Credit Check | No credit check required | Not specified whether Earnin requires a credit check |

| Additional Features | Offers a 30-day free trial for new users | Earnin’s additional features are not specified here |

From this comparison, it seems FloatMe may offer clearer conditions and benefits which can be a major advantage for prospective users.

FloatMe vs Dave

FloatMe and Dave are both renowned cash advance apps, but they vary significantly in their offerings, making it essential to comprehend their differences.

| FloatMe | Dave | |

|---|---|---|

| Maximum Advance Amount | With a maximum advance amount of $50, FloatMe caters to individuals looking for small, quick loans. | Dave, on the other hand, allows users to borrow up to $75, offering a little more flexibility for those with larger unexpected expenses. |

| Membership Fee | FloatMe has a nominal membership fee of $1.99 per month. | Dave charges a higher membership fee, reaching up to $1 per week or $52 per year. |

| Receiving Funds | You can receive funds from FloatMe within 2 hours via debit card or 1 to 3 business days normally. | While Dave also offers instant funding, it comes with an additional cost of $4.99. |

| Credit Check | No credit check is required to avail advances from FloatMe, thus providing an accessible solution for individuals with lower credit scores. | Dave operates on the same principle, it doesn’t require a credit check. |

| Contribution to Credit | One downside of FloatMe is that they do not contribute to improving users’ credit. | Dave, however, does report to the major credit bureaus, helping users improve their credit score over time. |

Understanding your needs and assessing these points can guide you in making an informed decision between FloatMe and Dave.

FloatMe vs MoneyLion

Here’s how FloatMe sizes up against MoneyLion in terms of features and benefits.

| FloatMe | MoneyLion | |

|---|---|---|

| Maximum Advance | Up to $50 | Varies by user |

| Membership Fee | $1.99/month | Free and premium options available |

| Credit Check Required | No | Yes, for some services |

| Funding Speed | Within 2 hours with a debit card or 1 to 3 business days normally | Instant with MoneyLion checking account |

| Interest and Fees | No interest or tips | Varies, interest for some services |

| Additional Features | Expense tracking and financial insights | Investment options, credit building loans, and more |

While FloatMe offers a straightforward service with no credit check and small advance amounts, MoneyLion, on the other hand, provides a broader range of services including investment options and credit building loans. However, MoneyLion may require a credit check for some of the services they offer. Both platforms are viable depending on your financial needs and credit situation.

Pros and Cons of Using FloatMe

FloatMe offers quick funding speed and a simple application process for small cash advances. However, the low maximum advance amount and lack of due date extensions may be limiting for some users.

Learn more about the pros and cons of using FloatMe to make an informed decision.

Advantages

FloatMe offers numerous advantages for cash advance users:

- Easy Application Process: FloatMe has a simple and user-friendly application process, allowing users to quickly apply for a cash advance without any hassle.

- No Credit Check Requirement: Unlike traditional lenders, FloatMe doesn’t require a credit check. This means that individuals with poor or no credit history can still qualify for a cash advance.

- Low Fees: FloatMe charges a low monthly membership fee of $1.99, making it an affordable option for those in need of small cash advances.

- Quick Funding Speed: Once approved, users can receive their funds within 2 hours using their debit card or 1 to 3 business days through bank account transfer.

- Overdraft Alerts: FloatMe provides real-time alerts to help users avoid overdraft fees and manage their finances effectively.

- Unexpected Expenses Coverage: With FloatMe, users have the peace of mind knowing they have access to funds when unexpected expenses arise before their next paycheck.

- No Interest or Tips: FloatMe does not charge any interest or tips on the borrowed amount, providing an even more affordable option compared to other cash advance apps.

- Cash Advances Before Payday: FloatMe allows individuals to access up to $50 before their next payday, providing financial flexibility when needed most.

- Financial Security: FloatMe is partnered with Evolve Bank & Trust and is FDIC insured, ensuring that user funds are protected.

- Positive Bank Balance Requirement: To use FloatMe, individuals must maintain a positive bank balance as it works by advancing money based on recurring direct deposits from the employer.

Disadvantages

While FloatMe offers some valuable benefits to cash advance users, there are also a few disadvantages to consider:

- Limited Borrowing Potential: The maximum advance amount from FloatMe is $50, which may not be enough to cover larger unexpected expenses. This could be limiting for users who require more substantial financial assistance.

- Low Initial Advance Amounts: New users typically have access to advances ranging from $10 to $30. While this can help with smaller immediate needs, it may not provide enough support for those facing more significant financial challenges.

- Mixed Customer Reviews: FloatMe has received mixed reviews from customers, with a BBB rating of D and 60 customer complaints. These complaints include issues regarding billing and collection problems, problems with the product or service, and unauthorized charges.

- Subscription Fee: Although the monthly membership fee for FloatMe is relatively low at $1.99, it is still an additional cost that users need to factor into their budget. This fee may not be appealing to individuals looking for completely free cash advance options.

- Lack of Credit Building Opportunities: While FloatMe does not require a credit check and does not charge interest or tips, it also does not contribute to improving users’ credit scores. For those seeking to build or repair their credit history, FloatMe may not offer the desired benefits in this regard.

Understanding FloatMe

Discover how safe and secure FloatMe is, the eligibility requirements for using the app, and the repayment terms. Dive deeper into understanding FloatMe and make an informed decision about whether it’s the right cash advance app for you.

Read more to gain valuable insights!

How Safe and Secure is FloatMe?

As someone who values the security of my personal information, I understand the importance of using a safe and secure cash advance app. With FloatMe, you can rest assured that your information is protected through advanced encryption technology.

They prioritize user privacy and take measures to ensure that all transactions are secure.

FloatMe also transparently discloses their membership fee, allowing you to make informed decisions about your finances. This upfront approach shows their commitment to transparency and building trust with their users.

Additionally, FloatMe’s eligibility requirements typically cater to individuals with a steady income, ensuring responsible lending practices.

Eligibility Requirements for FloatMe

To qualify for an advance through FloatMe, you need to meet certain eligibility requirements. Here’s what you need:

- Direct deposits from your employer: FloatMe requires you to have regular direct deposits from your employer into your bank account.

- Minimum income requirement: You need to earn at least $200 per paycheck to be eligible for advances through FloatMe.

- Positive bank account balance: It’s important to maintain a positive bank account balance to be considered for advances with the app.

- Active checking account with a debit card: You must have an active checking account with a debit card attached in order to use FloatMe.

FloatMe Loan Repayment Terms

Repaying your cash advance through FloatMe is simple and straightforward. Here are the loan repayment terms to keep in mind:

- Payment Due Date: Your repayment is automatically deducted from your bank account on your next payday. This ensures that you don’t have to worry about manually repaying the loan.

- Automatic Deduction: FloatMe uses your linked debit card and positive bank account balance to automatically deduct the loan amount on the due date. This makes it convenient and hassle-free for you.

- Repayment Amount: The repayment amount includes the advanced cash amount plus any applicable fees, such as the monthly membership fee or instant float fee.

- No Due Date Extensions: It’s important to note that FloatMe does not offer due date extensions. Therefore, it’s crucial to ensure that you have sufficient funds available in your bank account on the due date.

- No Impact on Credit Score: FloatMe does not report your repayments or use them to improve your credit score. This means that using their service will not positively or negatively impact your credit history.

- Transparent Fees: The fees associated with FloatMe are transparently disclosed before you agree to take an advance, so there are no surprises when it comes time for repayment.

FloatMe Customer Reviews and Complaints

As a cash advance user, I understand that reading customer reviews and complaints can help me make an informed decision about whether or not to use FloatMe. While researching the app, I found that FloatMe has received mixed reviews from users.

On one hand, the app has a high rating on both the App Store and Google Play, with 4.8 and 4.5 out of 5 stars respectively based on thousands of customer reviews.

However, it’s also important to consider the complaints made by customers. According to the Better Business Bureau (BBB), FloatMe has a D rating and has received 60 customer complaints so far.

Some common issues reported by users include problems with billing or collection, difficulties canceling accounts and obtaining refunds, unauthorized charges, as well as concerns about providing bank account information.

While these complaints are worth considering, it’s important to keep in mind that experiences may vary among different users. It may be helpful to read individual reviews and weigh the positive feedback against potential drawbacks when deciding if FloatMe is right for you as a cash advance user.

FloatMe Compared to Payday Loans

FloatMe and payday loans both come with their pros and cons, and it’s crucial to understand these before making a decision. To help you weigh your options, let’s compare the two in a detailed table.

| FloatMe | Payday Loans | |

|---|---|---|

| Maximum Loan Amount | FloatMe offers a maximum loan amount of $50. | Payday loans, depending on the state and lender, can go up to $1,000. |

| Fees | FloatMe charges a low monthly membership fee of $1.99. | Payday loans can come with hefty fees that range from $10 to $30 for every $100 borrowed. |

| Credit Check | FloatMe does not require a credit check. | Some payday lenders may perform credit checks or require a good credit score. |

| Funding Speed | FloatMe provides funds within 2 hours using a debit card or 1 to 3 business days normally. | Payday loans usually provide instant funds or within 24 hours. |

| Repayment Terms | FloatMe’s loan term varies. | Payday loans typically require repayment by your next payday, generally within two weeks. |

| Impact on Credit | FloatMe does not contribute to improving users’ credit. | Some payday loans can negatively impact your credit if you fail to repay on time. |

It’s clear that while FloatMe might offer lower amounts and a slower funding speed, it stands out with its minimal fees, lack of credit checks, and flexible repayment terms. On the other hand, payday loans offer larger loan amounts and faster funding but can come with high fees and stringent repayment terms.

Our Takeaway: Is FloatMe Good?

In conclusion, FloatMe is a reliable pay advance app that provides small cash advances to users before their next paycheck. With its low monthly membership fee and no credit check requirement, it offers a convenient solution for those in need of quick funds.

However, the limited maximum loan amount may be a drawback for some users. Overall, if you regularly find yourself in need of small cash advances, FloatMe could be a beneficial tool to have at your disposal.

FloatMe

FloatMe is an app that offers small, interest-free cash advances to its members. It’s a low-cost service that can help you avoid overdraft fees. However, some users have reported issues with the app, such as not receiving their money. It’s important to research and consider these reviews before deciding to use the service.

Product Brand: FloatMe

Product In-Stock: InStock

4.2

Article Sources & Helpful Links

Here are some helpful links that may help you learn more:

- Official FloatMe Website: The official website of FloatMe, the company being reviewed in the article.

- FloatMe Evolve Agreement: The official agreement page of FloatMe’s partnership with Evolve.

- FloatMe MVP Rewards Program: The official page detailing FloatMe’s MVP Rewards Program.

- FloatMe Contact Page: The official contact page of FloatMe for any queries or support.

- Consumer Financial Protection Bureau: A U.S. government agency dedicated to ensuring fair treatment by banks, lenders, and other financial institutions.

- Federal Deposit Insurance Corporation: An independent agency created by the U.S. Congress to maintain stability and public confidence in the nation’s financial system.

- Trustpilot – FloatMe: FloatMe has a rating of 4 out of 5 based on 10 reviews.

- Apple App Store – FloatMe: FloatMe has a rating of 4.8 out of 5 based on 59,688 reviews.

- Google Play Store – FloatMe: FloatMe has a rating of 4.4 out of 5 based on 35,118 votes.

- Better Business Bureau – FloatMe: FloatMe has mixed reviews and complaints on BBB.

FloatMe Review (FAQs)

What is FloatMe?

FloatMe is a mobile app that offers instant cash advances to help you avoid overdraft fees and late fees.

Is FloatMe a cash advance app?

Yes, FloatMe is a cash advance app.

How much can you withdraw from FloatMe?

You may be able to use the money from FloatMe to withdraw up to $200 per pay period.

How can FloatMe help you avoid overdraft fees?

FloatMe helps you avoid overdraft fees by providing quick cash advances so that you don’t fall short on your minimum balance and trigger overdraft fees.

Is FloatMe better than payday loans?

Yes, FloatMe is better than payday loans because it typically doesn’t charge late fees, and there’s no credit check required to qualify for FloatMe.

How long does it take to get a cash advance from FloatMe?

It can take up to three business days to get a cash advance from FloatMe.

Does FloatMe charge late fees?

FloatMe typically doesn’t charge late fees, but you’ll have to pay the amount owed plus a $1.99 fee per pay period if you don’t pay back the advance on time.

Does FloatMe report payments to credit bureaus?

No, FloatMe doesn’t report payments to credit bureaus.

What is the monthly fee for using FloatMe?

The monthly fee for using FloatMe is $1.99.

Can FloatMe help you build credit?

No, FloatMe doesn’t report payments to credit bureaus, so it can’t help you build credit.

Are there any apps like FloatMe?

Yes, there are other cash advance apps like FloatMe, such as Cash App and Earnin.