Being self-employed presents unique financial challenges, and cash advance apps are emerging as a convenient solution for many gig workers, freelancers, and independent contractors.

These apps provide quick access to funds when you need them most without the hassle of traditional loans. Our comprehensive guide will dive into the top 5 cash advance apps designed specifically for self-employed individuals, the benefits they offer, essential tips on managing money effectively in this modern economy, and how to choose which app suits your needs best.

- Cash advance apps can be a convenient solution for self-employed individuals seeking quick access to funds without the hassle of traditional loans.

- Earnin, Albert, Klover, Dave, and Solo Funds are the top five cash advance apps for self-employed individuals. Each app offers unique benefits catered to different needs like no credit check requirements, overdraft protection, and instant access to funds with flexible repayment options.

- Using cash advance apps requires responsible use through proper budgeting strategies while having emergency funds in place.

- Cash advance apps offer various benefits, such as flexible repayment options that make managing finances easier by providing quick and easy access to money when needed most.

Do Cash Advance Apps Work With The Self-Employed?

Yes, cash advance apps do work for self-employed individuals, particularly those working in the gig economy. These platforms are designed to provide financial assistance to freelancers, independent contractors, and consultants who may need quick access to funds between payments from clients.

For instance, Argyle offers cash advances up to $1,000 for eligible gig workers, while Ualett provides short-term loans with minimal fees and low-interest rates. On the other hand, there are also more specialized apps like Stoovo that not only grant cash advances but also help users discover flexible work opportunities according to their preferences.

We highly recommend getting the Albert App, a money app. It’s similar to Cash App or a bank account, but way better!

Albert has a debit card and savings account (no credit checks) and lets you borrow up to $250 with no interest or fees! It’s also easy & quick to sign-up!

Moves is another platform offering up to $1,500 in cash advances for 1099 workers without any credit check requirements or employment verifications.

Cash advance apps can be an invaluable resource for self-employed individuals seeking immediate financial assistance without resorting to traditional payday lenders that often charge steep interest rates and fees.

Top 5 Cash Advance Apps That Work For Self Employed

Here are the top five cash advance apps that work for self-employed individuals: Earnin, Albert, Klover, Dave, and Solo Funds. Don’t miss out on learning about their benefits and how to choose the right one for your needs.

Earnin: Best Overall Cash Advance App: Earnin

As a self-employed individual, you’re likely aware of how challenging it can be to access funds quickly for unexpected expenses or cash flow fluctuations. That’s where Earnin comes in as the best overall cash advance app for people like us.

What sets Earnin apart from other cash advance apps is its unique approach to fees: users are not charged any mandatory fees or interest rates. Instead, they only request voluntary tips based on what we think their service is worth.

This means you can get an instant cash advance ranging from $100 up to $500 without worrying about being burdened with high-interest rates like traditional payday loans often entail.

Additionally, Earnin boasts a “Boost” feature that allows fellow users to endorse each other’s profiles and potentially increase borrowing limits – invaluable support if you find yourself regularly strapped for cash due to irregular income cycles common among self-employed professionals.

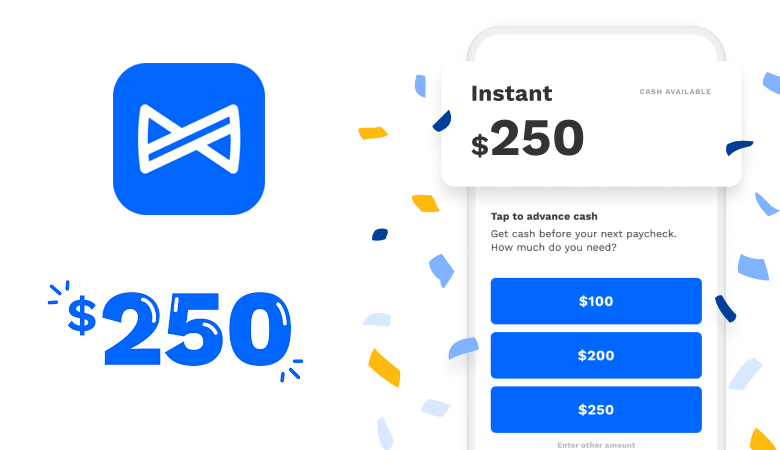

Albert: Best For Gig Economy Workers

As a gig economy worker, you might search for a cash advance app that’s tailor-made for your unique needs – and that’s where Albert steps in. Known as the best cash advance app for those working in the gig market, it offers fantastic features like instant access to up to $250 and annual bonuses on all savings of up to 0.10%.

The key selling point of Albert lies within its comprehensive combination of essential banking services and payday advances. With an exclusive checking account called Albert Cash, users can tap into their entire paycheck up to two days early! Additionally, a subscription service known as Genius offers valuable financial planning options.

These perks make managing finances as an Uber driver or DoorDash courier far more convenient, allowing you complete control over short-term loans and long-term budgeting tools.

Klover: Best For Fast Cash Advances: Klover

Klover is a cash advance app specializing in fast approvals and quick access to funds. As a self-employed individual, this can be incredibly helpful when unexpected expenses arise or income is irregular.

Klover provides advances up to $200 with no credit check and no fee, making it an affordable option for those who need immediate financial assistance. The app also offers flexible repayment terms and allows users to pay back their advances in as little as 24 hours or over several weeks.

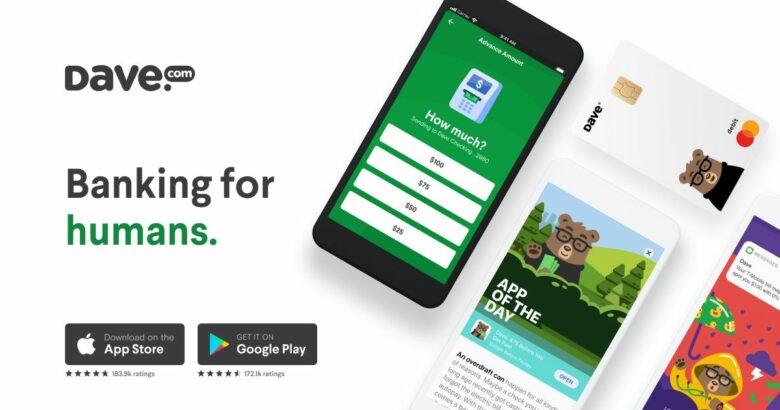

Dave: Best For Overdraft Protection

As a self-employed individual, overdraft fees can be a real concern. That’s where Dave comes in as the best cash advance app for overdraft protection. It offers up to $500 in instant cash advances and uses technology like Argyle to assess your earnings history and give you confidence to loan money with no interest or fees.

Repayment options are flexible, with partial settlements allowed until the full sum is paid off and repayment dates set on your next payday. Additionally, Dave offers other loan options such as car and personal loans for gig workers who need financial assistance beyond an instant cash advance.

Plus, the app has a referral program that rewards users $5 for every successful referral.

Solo Funds: Best For No Credit Check Requirements

As a self-employed gig worker, getting approved for a cash advance can be challenging due to credit check requirements. However, Solo Funds offers the best option for those requiring no credit check.

Unlike other cash advance apps that rely heavily on your credit history and score, Solo Funds understands that many gig workers have irregular incomes and may not meet traditional borrowing criteria.

With this app, you can borrow loans ranging from $20 to $575 without worrying about undergoing a credit check process.

Moreover, the platform is designed explicitly with gig workers in mind who work on a freelance or contract basis. The loan application process on Solo Funds is quick and involves minimal paperwork – just link your bank account and follow the simple instructions within the app.

Gig workers can access short-term loans conveniently and flexibly through this user-friendly app which makes managing finances easier while navigating the unpredictable nature of employment in today’s economy.

Benefits Of Cash Advance Apps For Self-Employed Individuals

Cash advance apps offer several benefits to self-employed individuals, including quick access to funds, flexible repayment options, no credit check requirements, and help managing finances.

Quick Access To Funds

As a self-employed individual, having quick access to funds is crucial when faced with unexpected expenses or emergencies. Fortunately, cash advance apps offer a convenient solution.

These apps allow you to access money quickly and easily without going through the lengthy application process required by traditional lenders. With some cash advance apps like Earnin, you can get your paycheck up to two days early, providing you with a much-needed financial cushion during tough times.

Other options like Klover offer instant advances that reflect in your bank account within minutes, ensuring you don’t have to wait for days on end for approval.

Flexible Repayment Options

As a self-employed individual, managing your finances and budgeting for unexpected expenses can be challenging. Cash advance apps offer flexible repayment options that make managing your finances easier.

With these apps, you can choose a repayment schedule that works best for you based on your income and expenses.

Some of the cash advance apps like Earnin also offer automatic savings features to help you build an emergency fund over time. This way, you can avoid high-interest loans or credit card debt when faced with unexpected expenses.

No Credit Check Requirements

One of the biggest advantages of using cash advance apps as self-employed is that most apps don’t require a credit check. This means that even if you have bad credit or no credit history, you can still qualify for a cash advance.

Instead of relying on traditional loan sources that may reject your application based on your credit score, these apps focus more on your earning potential and repayment ability.

This makes them great options for independent contractors, freelancers, and gig workers who typically have lower incomes or fluctuating earnings.

Helps Manage Finances

Another benefit of using cash advance apps as self-employed is the built-in budgeting and expense tracking tools. Many cash advance apps, such as Cleo and Float Me, offer in-app features that allow you to monitor your spending habits and create budgets based on your income.

These tools can be especially helpful for those who have irregular incomes or expenses that fluctuate from month to month. By keeping track of where your money is going, you can make more informed financial decisions and avoid overspending.

How To Choose The Right Cash Advance App

Consider the loan amount, fees and interest rates, security features, and customer service when choosing the right cash advance app for your self-employed needs.

Loan Amount

As a cash advance user, it’s important to consider the loan amount offered by different apps. While some apps may offer larger loans of up to $500, others may only offer up to $100.

Keep in mind that the loan amount you are approved for will depend on your earnings history and creditworthiness. For example, Earnin is one app that offers advances up to $100 per day or $500 per pay period based on your paycheck schedule.

Borrowing only what you need and can afford to repay within the given timeframe is crucial. Remember that taking out a higher loan amount means paying more interest and fees in return.

Fees And Interest Rates

As a cash advance user, it’s important to be aware of the various fees and interest rates associated with different cash advance apps. Some apps charge transaction or subscription fees, while others offer optional tips for their services.

It’s crucial to compare these fees and rates carefully before selecting an app that suits your budget best. For instance, some cash advance apps may have lower interest rates than payday lenders but still charge upfront or recurring fees, which can add up quickly and make the loan more expensive in the long run.

Security Features

As a cash advance user, it is essential to ensure that the app you choose has reliable security features. Personal information should be protected through encryption methods like AES 256-bit encryption, which ensures that your data is secure.

It’s also important to note that providers are doing due diligence to gather information and learn more about these personal finance apps with cash advance features.

This means you can trust the reputable providers out there who prioritize their users’ safety and privacy.

Customer Service

Good customer service is crucial when it comes to choosing a cash advance app. As a cash advance user, it’s essential to choose an app with reliable and responsive customer support that can address any concerns or issues promptly.

For example, apps like Earnin have dedicated support teams available seven days a week through in-app chat. This allows users to get help quickly and efficiently without having to jump through hoops.

Furthermore, good customer support services provide users with guidance on managing their finances better using budgeting tools found within the app. For instance, some apps such as Dave allow users access to advances and monitor expenses by syncing up their bank accounts directly enabling them to stay on top of their financial obligations effectively.

Understanding Cash Advance Apps For Self Employed

Are you self-employed and wondering if cash advance apps are viable for your financial needs? This section will discuss the benefits of using these apps, how to choose the right one for you and clear up any confusion surrounding cash advances.

Can Self-employed Individuals Get Cash Advances?

Yes, self-employed individuals can get cash advances through various cash advance apps that are available. These apps use technology to assess the earnings history of gig workers and provide them with quick access to funds.

Some of these apps include Earnin, Albert, Klover, Dave, and Solo Funds. These apps offer low-fee or interest-free advances on earnings made by gig economy workers such as Uber or Lyft drivers, DoorDash, and Instacart shoppers who may have trouble qualifying for traditional loans due to their income status or lack of employment verification.

What Are The Alternatives To Cash Advance Apps?

If you’re a self-employed individual in need of funds, there are several alternatives to cash advance apps that you can explore. One option is to open a checking account with overdraft protection.

This ensures that your transactions will be covered even if you don’t have sufficient funds in your account, but make sure to read the terms and fees carefully before signing up.

Another alternative is credit-builder credit cards, which allow you to build your credit score while giving you access to quick cash.

Building up an emergency fund in a savings account is another proactive alternative. This allows you to set aside money for unexpected expenses and emergencies without relying on borrowing options like cash advance apps or payday loans.

Other potential options include invoice factoring, personal loans, and credit cards – just make sure they fit into your financial situation and budget appropriately by paying attention to interest rates and repayment terms.

Are Cash Advances The Same As Payday Loans?

Cash advances are often compared to payday loans, but they are not exactly the same. While both provide short-term funding options for those in need of quick cash, cash advance apps generally offer better terms and lower fees than traditional payday lenders.

Cash advance apps typically have lower interest rates and no extensive paperwork or credit checks.

Furthermore, many cash advance apps cater specifically to self-employed individuals such as rideshare drivers or freelancers. For example, Earnin allows users to access up to $500 per pay period based on their earnings history without any fees or interest charges.

Dave offers overdraft protection by providing a small loan when a user’s bank account balance is low.

Tips For Managing Money As A Self-Employed Individual

To keep track of your finances as a self-employed individual, it’s best to establish a budget, create an emergency fund, and track all expenses.

Budgeting

As a self-employed individual, budgeting is critical to managing your finances effectively. Cash advance apps can be helpful in this regard, as many of them come with budgeting tools to help you track your expenses and create a financial plan.

For example, some apps like Klover offer AI-driven budgeting tools that analyze your spending patterns and suggest ways to save money.

In addition to using cash advance apps’ built-in budgeting tools, it’s important for self-employed individuals to establish a solid budget on their own. This involves tracking income and expenses closely, creating an emergency fund for unexpected expenses, and setting realistic financial goals such as saving for retirement or paying off debt.

Emergency Fund

As a self-employed individual, having an emergency fund is essential. It can provide a cushion for unexpected expenses or help cover bills during slow periods of work. Cash advance apps are great for short-term financial needs but shouldn’t be relied on as a long-term solution.

To start building an emergency fund, set aside a portion of your income each month and put it into a savings account. Ideally, you should aim to save at least three to six months’ worth of living expenses.

An example of how an emergency fund can come in handy is in case of unforeseen medical costs or equipment repairs that are not covered by insurance or warranties. Having money saved up means self-employed individuals won’t need to take out loans from cash advance apps with high interest rates or incur overdraft fees on their bank accounts.

Tracking Expenses

As a self-employed individual, tracking expenses is crucial for managing finances and ensuring that you are keeping up with your earnings. It can be challenging to keep track of all the different expenses when running your own business, but many cash advance apps also come equipped with budgeting tools to help make this process easier.

For example, Cleo offers in-app budgeting tools that categorize expenses automatically and provide insights into spending patterns.

By staying on top of your expenses, you’ll better understand where your money is going each month, making it easier to plan for future purchases or investments.

Our Takeaway

In conclusion, cash advance apps are a helpful tool for self-employed individuals to manage their finances and access funds quickly. With various options available like Earnin, Albert, Klover, Dave, and Solo Funds catering to gig workers’ different needs, from instant cash advances to overdraft protection- it’s important to choose the right one that suits your requirements.

Cash advance apps also come with benefits such as flexible repayment options and no credit check requirements, making them an attractive option compared to payday loans. However, it’s crucial for self-employed individuals to budget effectively and have emergency funds in place while utilizing these apps.

Article Sources & Helpful Links

Here are some helpful links that may help you learn more:

- Earnin Official Website: The official website of Earnin, one of the cash advance apps mentioned in the article.

- Dave Official Website: The official website of Dave, another cash advance app for self-employed individuals.

- IRS Self-Employed Individuals Tax Center: A comprehensive resource from the IRS for self-employed individuals, providing tax information and guidelines.

- SBA Licenses and Permits: A guide from the U.S. Small Business Administration on applying for business licenses and permits.

- Better Business Bureau: A platform to check the credibility of businesses and find trusted BBB ratings.

- Federal Maritime Commission: The federal agency responsible for regulating the U.S. international ocean transportation system.

Cash Advance Apps for Self-Employed (FAQs)

What are cash advance apps for self-employed?

Cash advance apps for self-employed are mobile applications that allow self-employed individuals to get access to cash easily, without going through the complicated loan application process of traditional lenders. These apps offer small cash advances to users that can be repaid quickly, with interest and fees attached to the amount.

What makes cash advance apps for gig workers different from traditional cash advances?

Cash advance apps for gig workers are tailored to the needs of self-employed individuals who work in the gig economy. These apps consider an individual’s gig work history and earnings potential to determine eligibility for a cash advance. This approach is different from traditional lenders who consider an individual’s credit score, income and other traditional factors to determine eligibility for loans.

What are the popular cash advance apps for gig workers?

There are many apps that offer cash advances for gig workers, such as Earnin, Dave, Brigit, and MoneyLion. These apps provide instant cash advance options, typically up to a certain limit, depending on an individual’s gig work history and earnings potential.

How do cash advance apps for gig workers work?

Cash advance apps for gig workers typically require users to sign up for a free account and link their bank account and gig work history. After this, users can apply for a cash advance, which they can receive either via direct deposit or a debit card. The advance amount and fees vary depending on the app and the user’s eligibility.

Are there any eligibility requirements for gig workers to get an advance through a cash advance app?

Yes, most cash advance apps for gig workers require that users have a gig work history and a minimum income level to be eligible for an advance. Some apps also require users to set up direct deposit to receive their cash advance.

How much cash can I receive through a cash advance app for gig workers?

The amount of cash you can receive through a cash advance app for gig workers varies depending on the app and your eligibility. Typically, the limits can be up to a few hundred dollars.

What are the fees associated with getting a cash advance through these apps?

Most cash advance apps for gig workers charge a fee for the instant access to cash, typically between $1 to $5 per advance. Some apps may also charge a late fee if the advance is not repaid on time.

How do these apps differ from predatory payday loans?

Cash advance apps for gig workers differ from predatory payday loans because they assess an individual’s gig work history and earnings potential to determine eligibility and advance amount. These apps also tend to offer lower fees than payday loans, making them a safer and more affordable alternative.

What should I look for when choosing the best cash advance app for gig workers?

When choosing a cash advance app for gig workers, look for an app that is easy to use, has low fees, provides instant cash advances, and has positive user reviews. You should also make sure to read the terms and conditions carefully to understand the fees and repayment terms associated with the app.

How do cash advance apps for gig workers provide an alternative to overdraft and payday loans?

Cash advance apps for gig workers provide a more convenient and affordable alternative to overdraft and payday loans because they offer small cash advances at a lower fee than overdraft fees and predatory payday loans.

Are cash advance apps for gig workers free?

While most cash advance apps for gig workers are free to download and use, they do charge fees for the instant access to cash. Some apps may offer a free cash advance for first-time users, but most apps charge a fee for subsequent transactions.