Are you considering Branch as your go-to cash advance app but want to be sure it’s right for you? You’re not alone. Like you, I’ve personally dove deep into understanding the ins and outs of Branch, uncovering that they have a TrustScore of 3 out of 5 based on 97 reviews.

This article aims to provide a comprehensive review of Branch – from its features and usability to service quality and consumer feedback. Ready for a financial truth bomb? Let’s dive in!

- Branch is a cash advance app that offers financial flexibility and convenience to hourly employees.

- The app has received positive reviews for its user-friendly interface, customer service, and zero-interest cash advance options.

- However, some users have reported issues with payment delays, unresponsive customer support, and security concerns.

- It is important for potential users to weigh the pros and cons of using Branch and consider both positive and negative reviews before making a decision.

What is the Branch App?

The Branch App is an innovative digital platform that has been simplifying financial wellness for hourly employees since 1999. It’s a multi-functional tool known for its top features like performance management, compensation statements, and incentive management – helping businesses choose better software solutions.

Popular among users with an impressive rating of 4.6 out of 5 based on 698 reviews, the Branch app not only offers benefits to businesses but also rewards hourly workers with noteworthy perks.

You’ll appreciate this app, especially if you’re seeking convenience in managing your finances while staying clear of any unnecessary jargon or complexity. Think about getting access to early wages through cash advances or enjoying the liberty to manage your funds via a dedicated debit card feature offered by Branch.

The simplicity doesn’t end there; it extends to improved team collaboration and easy learning experiences, as lauded by most users. However, as no product can be entirely flawless – some have expressed concerns over incorrect charges and shift coverage issues in their reviews.

How Does Branch Work?

Getting started with Branch is a relatively easy process that can be broken down into the following steps:

- Download the Branch App from Google Play Store or Apple App Store.

- For verification purposes, please provide the necessary personal details, including your social security number.

- Connect an active checking account that has been receiving paychecks via direct deposit for at least two months.

- Once your account is verified, you can request a cash advance.

- A cash advance limit will be set based on your spending habits and paycheck amount.

- Upon approval, the funds can be instantly deposited to your Branch Wallet or transferred to a connected bank account within three business days.

- The advanced amount will automatically be deducted from your next direct deposit paycheck, removing the need to repay manually.

- Beyond its cash advance feature, you can also use Branch as a digital wallet for purchases and transactions by using the Branch Debit Card, which comes protected with Mastercard’s Zero Liability policy.

Is Branch Worth It?

Navigating the financial world can feel like a labyrinth sometimes, especially when you’re dealing with paycheck advances. Branch strides ahead in this field, presenting itself as an innovative solution for consumers and hourly employees seeking financial flexibility.

It’s not just another payday loan service – it offers zero-interest cash advance options, providing an edge over traditional banks notorious for their exorbitant overdraft fees.

Branch Bank has garnered both applause and criticism from its users. Take Mikhail Rosenberg, who’s quick to laud the impeccable customer service provided by representatives like Luke at branchapp.com.

Then there’s Carl Singh, expressing his frustration regarding unresponsiveness and poor treatment of customers offering a contrasting view on Branch’s capacity to serve clients effectively.

While Trustpilot reviews paint a diverse picture of user experiences – ranging from seamless transactions to episodes of fraudulent activity – it is clear that while Branch may be worth considering for some individuals, others express caution based on negative experiences.

One thing remains consistent: if you’re looking for straightforward solutions to your everyday banking needs or seeking alternatives to traditional bank-associated fees, Branch claims its spot in the race confidently.

However, no single app will fit every individual user perfectly – reading about other people’s experiences, such as Stephen Schramke, who advises potential users to read through Trustpilot reviews before engaging with them, could help you gauge if it aligns well with what you need out of a banking partner.

Who Is Branch Good For?

As a cash advance user, you may be wondering if Branch is the right app for you. Well, let me tell you who Branch is good for. First of all, if you’re someone who needs quick access to cash before your next paycheck, then Branch can be a great solution for you.

With their cash advance feature, you can get the funds you need without any hassle.

Not only that, but Branch is also ideal for hourly employees who are looking for some financial flexibility. Whether it’s covering unexpected expenses or simply managing your finances between paydays, Branch offers a convenient way to stay on top of your money.

What sets Branch apart from other cash advance apps is its commitment to customer service. Many users have praised their excellent support team and mentioned specific representatives like Luke, who go above and beyond to assist customers.

However, it’s important to note that not everyone has had a positive experience with Branch. Some users have faced difficulties in getting paid or resolving issues with the bank itself. So it’s worth doing your research and reading reviews on platforms like Trustpilot before deciding if Branch is right for you.

In conclusion, if you’re in need of quick access to cash and appreciate good customer service, then give Branch a try. Just make sure to weigh the pros and cons based on your own needs and preferences before making a decision.

Pros and Cons of Using Branch

Using the Branch app offers advantages such as easy cash advances, direct deposit options, and other unique features. However, it also has its disadvantages like fees associated with certain transactions and withdrawal limits that may not meet everyone’s needs.

Advantages of Branch

I love using Branch for my cash advance needs. Here are some of the advantages I’ve found:

- Easy Accessibility: Branch is available as a mobile app, making it convenient for me to access it anytime, anywhere.

- Inclusive Features: The app is designed to promote inclusivity and transparency among employees. I can easily share information, post schedules, and send shift reminders to the entire crew.

- Team Recognition: With Branch, I have the ability to recognize and praise individual team members or the whole team for their hard work. It’s a great way to boost morale and create a positive work environment.

- Activities Board: The activities board allows me to post general messages that everyone can see without cluttering their personal messages. It’s a handy feature for communicating with colleagues in a place where I may not know everyone well.

- User-Friendly Interface: Branch has an intuitive interface that makes navigating the app simple and straightforward. I can easily find what I need without any hassle.

- Security Measures: The app is FDIC-insured and includes features like Mastercard’s Zero Liability policy and EMV chip technology on its debit card, ensuring my financial transactions are secure.

- Financial Flexibility: Branch offers cash advances with zero-interest fees for consumers and employees, providing much-needed financial flexibility when unexpected expenses arise.

- No Hidden Fees: Unlike traditional payday loan options, Branch doesn’t have hidden fees or flat rates that can quickly add up. This transparency gives me peace of mind when using the app.

Disadvantages of Branch

As a cash advance user, it’s important to be aware of the potential disadvantages of using Branch. Here are some key drawbacks to consider:

- Negative customer experiences: Several users have reported negative interactions with Branch Bank, including difficulties in getting paid and a lack of willingness from the bank to find solutions.

- Poor customer service: Customers have expressed frustration about unresponsiveness and poor treatment from Branch Bank representatives.

- Technical issues: Some users have experienced problems with their Branch Bank card not working properly, and customer service has been unable to resolve the issue satisfactorily.

- Limited options for Spark drivers: One user wished that Spark drivers had the option to use a regular bank account instead of relying solely on Branch Bank.

- Security concerns: There have been instances where users’ Branch Wallets were hacked, resulting in financial loss. Additionally, customers have faced difficulties in obtaining support from the bank in resolving these issues.

Is Branch Safe and Legit?

As someone looking for a reliable cash advance app, it’s important to know if Branch is safe and legit. Well, the good news is that Branch has established itself as a trusted name in the industry.

With an average TrustScore of 3 out of 5 based on 97 reviews, Branch has gained credibility among its users.

It’s worth mentioning that Branch takes security seriously. Their website and mobile app have received high ratings on both the Apple App Store and Google Play, indicating that they prioritize user safety.

Additionally, as an FDIC-insured company, you can rest assured knowing that your funds are protected.

Moreover, employees at Branch have the option to take advances against their paychecks instead of resorting to payday lenders. This not only provides financial flexibility but also promotes responsible borrowing habits.

Overall, with positive customer reviews and a focus on security, Branch emerges as a safe and legit option for those seeking cash advances.

How To Open a Branch Account

Opening a Branch account is quick and easy. Here’s how you can get started:

- Visit the official website of Branch Bank at branchapp.com.

- Look for the “Sign Up” or “Get Started” button on the homepage and click on it.

- Fill in your personal information, such as your full name, email address, and phone number.

- Create a strong password that meets the security requirements.

- Read and accept the terms of service and privacy policy.

- Choose whether you want to open an individual or business account.

- Provide additional details, such as your social security number or employer identification number (EIN), depending on the type of account you’re opening.

- Verify your identity by following the provided instructions, which may include uploading a photo of your ID or answering security questions.

- Once your identity is verified, you will receive an email confirmation with further instructions to activate your account.

User Experience: A Deep Dive Into Branch Reviews

User experiences with Branch Bank vary greatly, with some praising the app’s convenience and helpful customer service, while others have encountered issues such as difficulty getting paid and poor support when dealing with problems.

Positive User Experiences

I have come across several positive user experiences while using the Branch app. One of the standout features is its inclusivity and ease of accessibility, which has been praised by many users.

The ability to easily share information with colleagues through the app has been a game-changer for employees, allowing them to post their weekly schedules, shift reminders, and even training tips for the entire team to see.

Additionally, users appreciate the activities board feature that allows them to send general messages without cluttering personal conversations.

Another aspect that received praise is the ability to recognize and praise individual crew members or teams as a whole within the app. It fosters a sense of camaraderie and boosts morale among coworkers.

Overall, users find Branch useful in workplaces with numerous people they may not know well, making it easier to stay connected and engaged with their peers.

There are still some areas for improvement mentioned by users, such as glitches in individual messaging where sending emojis can be problematic at times or needing to restart the app to load new messages.

Users also expressed a desire for more industry-specific GIFs within the app. Some reviewers mentioned receiving notification alerts about conversations but struggled to locate those conversations when opening the app.

Negative User Experiences

I have come across several negative user experiences while researching about Branch Bank. Customers have expressed frustrations with difficulties in getting paid and a lack of willingness from the bank to find a solution.

One customer, Carl Singh, mentioned experiencing unresponsiveness and poor treatment from Branch Bank. Additionally, users have reported issues with card functionality and unhelpful customer service, leading to negative experiences like that of Randy Stephenson.

It seems that some customers are also dissatisfied with the option for Spark drivers to use only a Branch Wallet instead of a regular bank account, as highlighted by Nashira Thomas. Another reviewer named Jerlena Miller Rodreques had her Branch Wallet hacked, resulting in financial loss, and faced challenges in receiving support from the bank.

Breaking Down the Branch App Features

In this section, we will explore the various features offered by the Branch app.

Cash Advances for Consumers and Employees

As a cash advance user, one of the key features that drew me to Branch Bank was their offering of cash advances for both consumers and employees. With Branch, you have the option to receive an advance on your paycheck before payday, providing much-needed financial flexibility.

This can be especially beneficial for hourly workers who may face unexpected expenses or fluctuating income. It’s worth noting that while some customers have praised this feature and found it helpful in managing their finances, others have raised concerns about fees associated with these cash advances.

However, it’s important to carefully evaluate your own financial habits and determine if this service aligns with your needs before making a decision.

Direct Deposit

With Branch, you can easily set up direct deposit for your paychecks. This means that instead of waiting in long lines at the bank or dealing with paper checks, your money will be automatically deposited into your Branch Wallet.

It’s a convenient and hassle-free way to access your funds. Plus, the app offers zero-interest cash advances on your paychecks, so if you need some extra money before payday, you can get it instantly without any fees or interest charges.

And don’t worry about the security of your funds – Branch Bank is FDIC-insured and follows strict security protocols to protect your personal information. So whether you’re looking for financial flexibility as an hourly employee or simply want an easier way to manage your paycheck, direct deposit with Branch is a great option to consider!

Other unique features

As a cash advance user, you’ll be glad to know that Branch offers some other unique features that can enhance your financial experience. One standout feature is the option for direct deposit, which allows you to conveniently receive your paycheck directly into your Branch account.

This eliminates any need for paper checks or waiting in long lines at the bank. Additionally, Branch provides financial flexibility for hourly employees, ensuring that you have access to funds when you need them most.

With these and other innovative features, Branch goes above and beyond to meet the needs of cash advance users like yourself.

Assessing Branch’s Customer Service

When it comes to assessing the customer service provided by Branch Bank, I have experienced both positive and negative interactions. One standout experience was when I reached out for assistance and was pleasantly surprised by the level of support I received.

Luke, a representative of Branch Bank, went above and beyond to address my concerns and provide me with the information I needed.

However, it’s important to note that not all customers have had such positive experiences. Some individuals have expressed frustration with the bank’s unresponsiveness and poor treatment of customers.

For example, one customer reported difficulty in getting paid and felt that Branch Bank showed no willingness to find a solution.

Additionally, there have been complaints about issues unresolved by customer service representatives. Customers like Randy Stephenson encountered problems such as their card not working properly without receiving adequate resolution from Branch Bank’s customer service team.

Although there are mixed reviews about Branch Bank’s customer service, it is essential for potential users to weigh these experiences against their own needs and preferences before making a decision on whether or not this app is right for them.

Fees Associated with Branch

Despite its rich suite of features, Branch does not burden its users with excessive fees. It believes in helping individuals manage their finances more effectively without adding financial strain. It’s important to note that Branch does not charge fees for connecting a checking account or receiving payments on a Branch debit card.

While it’s delightful news, there are still a few considerations that you should be aware of as a user. Here’s a summary of the fees associated with Branch in a table format:

| Services | Fees |

|---|---|

| Checking Account Connection | No Fee |

| Receiving Payments on Branch Debit Card | No Fee |

| Cash Advance | Determined by Branch’s technology-based assessment |

For cash advances, Branch relies on technology to determine the amount of the advance. It’s critical to remember that if you have a history of overdrafts or other similar issues, you may be disqualified from receiving the advance.

Always remember the mission of Branch is to enable businesses and individuals to manage their financial resources better, and that includes minimizing unnecessary charges.

Comparing Branch with Other Similar Apps

When comparing Branch with other similar apps, it’s essential to look at several components, including user ratings and core features. Below is a table that breaks down how Branch stands up against its competitors, Performio, CaptivateIQ, and Commissionly.io.

| Branch | Performio | CaptivateIQ | Commissionly.io | |

|---|---|---|---|---|

| User Rating | 4.6 (based on 698 reviews) | 4.3 (based on 332 reviews) | 4.8 (based on 775 reviews) | 4.9 (based on 44 reviews) |

| Top Features | Performance management, Compensation statements, & Incentive management | Offers similar features with an emphasis on an intuitive interface | Focuses on commission planning and reporting features | Specializes in commission tracking for sales teams |

| Customer Service | Praised by users for its customer service support, with particularly high praise for one representative, Luke | Customer service experience not specified in reviews | Not specifically reviewed for customer service | Customer service quality not widely reviewed |

While Branch holds a strong position with a high user rating and praise for its customer service, it does have room for improvement when compared to its competitors’ ratings. It’s always important to consider individual needs and preferences when choosing a cash advance app.

Our Takeaway

In conclusion, Branch Bank has received a mixed response from customers. While some users have praised the customer service and financial flexibility for hourly employees, others have reported issues with payment delays and unresponsive support.

It is crucial for potential users to consider both positive and negative reviews before making a decision about using Branch.

Branch App

The Branch app is generally well-received. Users find it simple and easy to use, with high adoption rates. It’s seen as better than other HR tools due to its seamless integration. It’s also considered a good alternative to payday loans. However, it has some negative reviews and eligibility requirements.

Product Brand: Branch

Product In-Stock: InStock

4.39

Article Sources & Helpful Links

Here are some helpful links that may help you learn more:

- Branch Official Website: The official website of Branch, a mobile-first technology that helps workers grow financially.

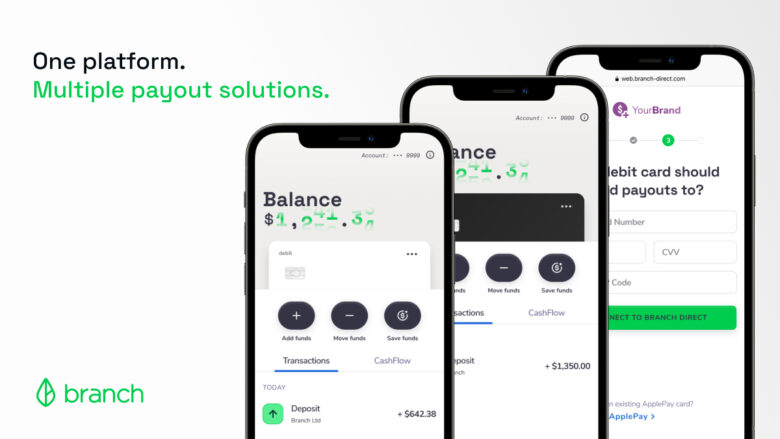

- Branch Payout Choice: Branch offers multiple payout solutions, providing flexibility to launch and manage instant payouts.

- Branch 1099 Contractor Payments: Branch provides a solution to instantly pay independent contractors as soon as the job is done.

- Branch Employee Payments: Branch offers a platform to instantly pay employees wages, tips, and more.

- Branch Gig Economy Payments: Branch provides a free gig economy payment app, sending payouts the moment contractors finish a gig.

- Branch Trucking & Logistics Payments: Branch offers instant settlements for truck drivers, last-mile delivery drivers, logistics workers, and more.

Review of Branch App (FAQs)

What is Branch Review?

Branch Review is a topic about a financial app called Branch that provides paycheck advances, offers direct deposits, and other banking services.

What is a paycheck advance?

A paycheck advance is a service where Branch allows users to request an advance from their upcoming paycheck.

How can I request a paycheck advance from Branch?

To request a paycheck advance from Branch, you need to download the Branch app from the App Store or Google Play, create an account, and link it to your bank account. Once your account is set up, you can request an advance through the app.

Is Branch a direct lender?

No, Branch is not a direct lender. They facilitate paycheck advances and other financial services, but the funds come from a partnering financial institution.

What is direct deposit?

Direct deposit is a feature offered by Branch that allows users to have their paychecks deposited directly into their bank accounts. This eliminates the need for physical checks and allows for faster access to funds.

How long does it take to receive my money from Branch?

Once your paycheck advance is approved, you can receive your money in as little as 24 hours.

Is Branch a reliable service?

Yes, Branch is a reliable service. They are a legitimate financial institution and are backed by the FDIC (Federal Deposit Insurance Corporation).

Can I use Branch if I have bad credit?

Yes, Branch is available for individuals with all types of credit histories. They understand that financial emergencies can happen to anyone.

How does Branch differ from a payday loan?

Branch is an alternative to a payday loan. While payday loans often come with high-interest rates and short-term repayment periods, Branch offers more reasonable rates and flexible repayment options.

What kind of financial products does Branch offer?

Branch offers various financial products, including paycheck advances, direct deposits, and personal finance tools to help you manage your money.

What do I need to know before using Branch?

Before using Branch, it’s important to understand that they are not a direct lender and that requesting a paycheck advance may affect your future paychecks. It’s also crucial to provide accurate information to ensure a smooth transaction.