Struggling to access cash quickly during an unexpected financial pinch? Albert, a comprehensive financial app, comes as a lifesaver providing instant cash advances up to $250.

This article is your guided tour on how to effectively use the Albert App for instant access to cash, step by step. Let’s explore and make money management stress-free!

- Albert App provides instant cash advances up to $250 for users facing unexpected financial emergencies.

- To access instant cash in the Albert App, users need to install and set up the app, link their bank account, and set up direct deposit.

- The Albert App offers several key benefits, such as no interest or credit check requirements for cash advances, flexible repayment options, and no direct deposit requirement.

What Are the Requirements for Albert Instant Feature?

In order to use the Albert Instant feature, there are a few specific requirements you need to meet. Here’s what you will need:

- Install and set up the Albert app: You can easily find the app on App Store.

- Link your bank account: This is necessary for verifying eligibility and facilitating transactions.

- Set up direct deposit: The functionality of receiving cash advancements from Albert requires an active direct deposit established in your account.

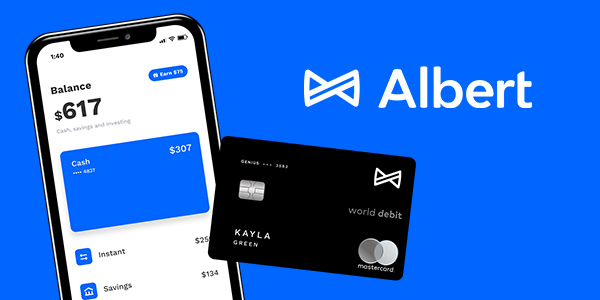

- Use of Albert debit card: The issued Mastercard by Sutton Bank allows seamless transactions and instant access to funds.

- Choose a repayment plan: Depending upon your financial situation, choose a feasible repayment period for the cash advance without any interest charges.

- Age requirement: As per standard norms, users must be at least 18 years old to use the Albert app.

- U.S residency: For now, only U.S residents have access to the services offered by Albert.

How to Access Instant Cash in the Albert App

To access instant cash in the Albert App, you need to set up the app, link your bank account, and set up direct deposit. Once these steps are completed, you can easily request a cash advance and transfer the money to your bank account or Cash App.

Setting up Albert App

To get started with the Albert app, you first need to download it from the App Store. After downloading, there are a few steps you can follow to set up the app:

- Open the Albert app and click on ‘Get Started’

- Provide all necessary personal information like your name, email address and create a password.

- Accept terms & conditions of Albert’s service to proceed.

- Establish security measures for your account such as secure login details and setting up a passcode or biometric authentication.

- Access the range of financial services from banking to investing, savings tactics and budgeting assistance.

- Opt – in for alerts on suspicious activities on your account as part of identity theft protection.

- Set up your direct deposit and start reaping benefits like early access to paycheck before other conventional banks.

- Link your debit card to earn cash back on daily transactions.

We highly recommend getting the Albert App, a money app. It’s similar to Cash App or a bank account, but way better!

Albert has a debit card and savings account (no credit checks) and lets you borrow up to $250 with no interest or fees! It’s also easy & quick to sign-up!

Linking your bank account

The Albert app requires a linked bank account to enjoy its full suite of offerings, particularly the instant cash feature. Here are the simple steps to link your bank account:

- Download and install the Albert app from the App Store or Google Play.

- Launch the app and follow the prompts to set up an account.

- After creating an account, navigate to your profile located at the lower right corner of your screen.

- Select ‘Link another account’ under ‘Accounts & Settings.’

- Search for your bank or credit union by typing in its name in the search bar.

- After selecting your bank, enter your online banking username and password (these details are strictly for authentication purposes).

- Upon successful verification, Albert will import your financial transactions from this linked account – providing a holistic view of your financial situation.

Setup direct deposit

To access instant cash in the Albert app, you need to set up direct deposit. Here’s how you can do it:

- Open the Albert app on your mobile device.

- Go to the “Settings” or “Profile” section of the app.

- Look for the “Direct Deposit” option and select it.

- Follow the prompts to provide your employer’s information, such as their name and address.

- You may need to fill out a direct deposit form provided by your employer or enter their ABA routing number and your account number.

- Once you’ve entered all the required details, review the information for accuracy.

- Submit your direct deposit request.

How to request for a cash advance

To request a cash advance in the Albert App, follow these simple steps:

- Open the Albert App on your smartphone.

- Navigate to the “Cash Advance” section within the app.

- Select the desired amount you wish to borrow, up to $250.

- Review the processing fees associated with the cash advance.

- Confirm your request by providing necessary information such as your employment details and upcoming payday.

- Wait for approval, which is usually instant, but can take up to a few minutes.

- Once approved, the cash advance will be deposited into your Albert Cash account.

- You can then transfer the funds to your linked bank account or use them through the Cash App.

Transferring money to your bank account or Cash App

To transfer money to your bank account or Cash App using the Albert app, follow these simple steps:

- Link your bank account: Start by setting up the Albert app on your device and linking your bank account. This will allow you to easily transfer funds between your Albert account and your bank.

- Setup direct deposit: If you haven’t already, set up direct deposit with Albert. This will enable you to receive your paycheck directly into your Albert account, making it easy to access funds instantly.

- Request a cash advance: Once you have funds available in your Albert account, you can request a cash advance. Simply open the app and navigate to the instant cash section. Enter the desired amount and follow the prompts to complete the request.

- Transfer money to your bank account or Cash App: After receiving approval for your cash advance, you can choose to transfer the funds directly to either your linked bank account or Cash App. Select the desired destination, enter the necessary details, and initiate the transfer.

- With Albert, you have the flexibility to transfer funds from your Albert account to different financial platforms seamlessly.

- You can link bridging accounts like Chime to facilitate transfers between Cash App and other apps.

- Be sure to review any associated fees or processing times for transfers in each app’s terms and conditions.

Key Benefits of Using Albert App for Cash Advances

The Albert app offers several key benefits for users accessing cash advances, including instant access to funds, flexible repayment options, and no direct deposit requirement.

Instant access to funds

With the Albert app, you can enjoy instant access to funds whenever you need them. Whether it’s for an unexpected expense or just a little extra cash in your pocket, Albert has got you covered.

With their cash advance feature, users can request up to $250 without any interest or credit check required. And the best part? You have the flexibility to repay the cash advance when it works for you.

No more worrying about high-interest rates or rigid repayment terms. Just quick and easy access to the funds you need, exactly when you need them.

No direct deposit requirement

With Albert’s instant cash feature, there is no direct deposit requirement to access your funds. Unlike other cash advance apps that rely on direct deposits, Albert offers a more flexible option for those who do not have regular or direct deposit income.

This means that even if you don’t receive your paycheck through direct deposit, you can still qualify for an instant cash advance from the app. This makes it easier and more convenient for users to get the financial assistance they need without any additional requirements or complications.

Flexible repayment options

When it comes to accessing instant cash in the Albert App, one of the key benefits is the flexibility it offers in terms of repayment options. Unlike traditional loans or payday advances with rigid payment schedules, Albert allows users to repay their cash advances when they can afford it.

This means you don’t have to stress about meeting strict deadlines or worrying about late fees if your financial situation changes unexpectedly. With Albert, you have control over your repayment timeline and can choose what works best for you.

It’s important to note that while Albert doesn’t charge interest on their cash advances, there may be processing fees involved depending on the method of advance and debit card type.

Understanding Albert Instant Feature

In this section, we will delve deeper into how to qualify for Albert Instant Cash, the speed at which it works, its unique features compared to other cash advance apps, and whether you can transfer money from Albert to Cash app.

Read on to learn more about maximizing the benefits of this convenient financial tool.

How do you qualify for Albert Instant Cash?

To qualify for Albert Instant Cash, you need to meet certain eligibility criteria. This includes having a steady source of income and completing the necessary identity verification process.

Unlike traditional lenders, Albert does not require a credit check or collateral for cash advances. This makes it accessible to individuals with varying credit scores. By meeting these requirements, you can easily access funds up to $250 without any interest charges or lengthy approval processes.

How fast does Albert App Instant work?

Albert App Instant works quickly to provide users with access to cash advances. While the exact timing may vary, most cash advances can be received within two to three business days.

However, for those who need funds immediately, Albert offers the option of instant transfers for a small fee. This means that users can receive their cash advance instantly, providing them with the financial support they need when they need it most.

With Albert App Instant, you don’t have to worry about waiting long periods of time to receive your funds – they are just a few clicks away!

How is Albert different from other cash advance apps?

Albert sets itself apart from other cash advance apps with its comprehensive range of financial services. While most cash advance apps solely focus on providing quick access to funds, Albert goes the extra mile by offering banking, savings, investing, and budgeting assistance.

With Albert’s Genius team of money experts, users can receive personalized guidance and advice to help them make informed financial decisions. Additionally, Albert offers features like direct deposit, automatic savings, cash back rewards with the Albert Mastercard® debit card, and identity theft protection.

This holistic approach makes Albert a one-stop solution for all your financial needs.

Can I transfer money from Albert to Cash app?

You can transfer money from your Albert account to your Cash App by linking the two accounts. Simply add your Albert debit card or manually link your bank account in the Cash App settings.

It’s important to note that prepaid cards and accounts, including Cash App accounts and cards, are not accepted as direct deposit sources for cash advances in Albert. However, with the flexibility of Albert’s repayment options and its lack of direct deposit requirement, you can easily transfer funds between these two platforms for your convenience.

Our Takeaway

In conclusion, accessing instant cash in the Albert App is a simple and convenient process. By setting up the app, linking your bank account, and enabling direct deposit, you can easily request a cash advance whenever you need it.

With no interest or credit check requirements and flexible repayment options, Albert App provides a reliable solution for those facing financial emergencies. Take control of your finances with Albert’s comprehensive banking services and get instant access to the funds you need. And if you end up getting stuck in an account suspension, be sure to reach out to support. Keeping your account in good standing is important to continue using their features.

Article Sources & Helpful Links

Here are some helpful links that may help you learn more:

- Albert App on Google Play Store: Official download link for the Albert App on the Google Play Store.

- Albert App on Apple App Store: Official download link for the Albert App on the Apple App Store.

- Albert Help Center: Official help center for the Albert App, providing answers to frequently asked questions and support for users.

- Contact Albert: Official contact page for the Albert App, allowing users to reach out for support or inquiries.

- Albert App Review on Investopedia: A comprehensive review of the Albert App by Investopedia, providing an overview of its features and functionality.

- Instant Cash on ConsumerFinance: An article from a .gov website discussing the concept of instant cash and the precautions to take.

- Albert (company) on Wikipedia: Wikipedia page about Albert, the company behind the Albert App.

- Payday Loan on Wikipedia: Wikipedia page explaining the concept of payday loans, which are similar to the instant cash feature in the Albert App.

- Financial Technology on Wikipedia: Wikipedia page about Financial Technology (FinTech), the industry in which the Albert App operates.

- Contact Consumer Financial Protection Bureau: Contact page for the Consumer Financial Protection Bureau, a .gov site that provides information and assistance on financial matters.

- North York Moors National Park: Official website for the North York Moors National Park, a location mentioned in the article.

- Financial Literacy on EDU: An initiative by the U.S. Department of Education to promote financial literacy among college students, relevant to the financial management aspect of the Albert App.

How Do You Access Instant Cash in Albert App (FAQs)

How do I access instant cash in the Albert app?

To access instant cash in the Albert app, you can request an Albert Cash advance. This feature allows you to borrow money from your upcoming paycheck and have it instantly deposited into your Albert savings or checking account.

What is Albert Cash, and how does it work?

Albert Cash is a cash advance feature offered by the Albert app. It allows you to borrow money from your upcoming paycheck and have it instantly deposited into your Albert savings or checking account. You can then use this money for any financial needs you may have.

Are there any late fees associated with Albert Cash?

No, there are no late fees associated with Albert Cash. You can repay the cash advance when you receive your next paycheck without any additional charges.

Can I get an Albert debit card?

Yes, Albert offers a debit card that is linked to your Albert savings or checking account. You can use this card to make purchases and withdraw cash from ATMs.

Can I use other cash advance apps like Albert?

While Albert is a popular cash advance app, there are other similar apps available in the market. Some alternatives to Albert include Earnin, Brigit, and Dave.

How do I qualify for a cash advance in the Albert app?

To qualify for a cash advance in the Albert app, you need to have a verified income source and meet Albert’s eligibility criteria. The app will determine your maximum cash advance amount based on your income and spending patterns.

Are there any fees associated with getting an Albert cash advance?

Albert does not charge any fees for accessing a cash advance. However, there may be cash withdrawal fees depending on the ATM you use to withdraw the funds.

Can I repay my cash advance before my next paycheck?

Yes, you have the option to repay your cash advance before your next paycheck. Simply go to the Albert app and select the option to repay the advance. This will help you avoid any interest charges on the borrowed amount.

What is the cash advance limit in the Albert app?

The cash advance limit in the Albert app varies based on your income and spending habits. The app will determine your maximum borrowing amount, and you can access up to that limit.

How does Albert protect my money?

Albert takes the security of your money seriously. They use advanced encryption and security measures to protect your personal and financial information. Additionally, your deposits are insured up to $250,000 by the Federal Deposit Insurance Corporation (FDIC).