Are you eyeing that new pair of sneakers or the latest beauty product?

With Cash App Buy Now Pay Later (Pay In 4 Feature), you can make your purchase now and pay over time without any interest.

As a seasoned Cash App user, I’m excited to guide you on how to get started with this convenient feature.

- Cash App Buy Now Pay Later (Pay In 4 Feature) allows users to make purchases at participating merchants and pay for them over time without any interest.

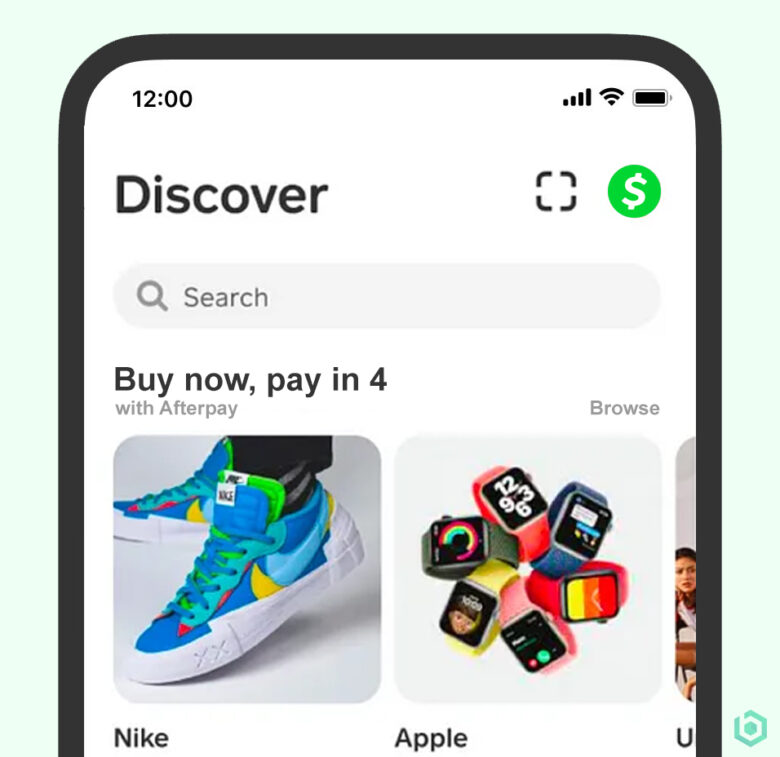

- To use Cash App Buy Now Pay Later, users can browse and shop with Afterpay merchants in the Cash App’s discover tab, select the Pay In 4 option at checkout, and set up automatic payments using their Cash App account as the payment source.

- Other buy now pay later apps, such as Klarna, Sezzle, Affirm, and QuadPay, are also available and can provide added flexibility and options for users.

What is Cash App Buy Now, Pay In 4?

Cash App Buy Now Pay Later, also known as Cash App Pay In 4, is a feature that allows Cash App customers to make purchases and pay for them in four interest-free payments over the course of six weeks.

Afterpay, the popular buy now pay later service, has been integrated into Cash App’s Discover tab, allowing users to shop with participating merchants and manage their Afterpay purchases through the app [1][2][5].

To use Cash App Pay In 4, users must be 18+ and have direct deposit and a Cash Card.

The feature is being rolled out to more users every day [3].

Cash App recently acquired Afterpay for $29 billion, with the aim of expanding Afterpay’s reach, similar to Cash App’s ubiquity at cafes and farmers markets across the U.S. [4].

We highly recommend getting the Albert App, a money app. It’s similar to Cash App or a bank account, but way better!

Albert has a debit card and savings account (no credit checks) and lets you borrow up to $250 with no interest or fees! It’s also easy & quick to sign-up!

Who Can Use Cash App Buy Now Pay Later?

Currently, Cash App Buy Now Pay Later, also known as Cash App Pay In 4, is only available to users of Cash App who frequently use the app, have direct deposit, and have a Cash Card.

The feature is not available to everyone yet but is being rolled out to more users every day.

To be eligible, users must also be 18 years of age or older and have a fully verified Cash App account.

If you meet these requirements, you can take advantage of the convenience and flexibility that Cash App Buy Now Pay Later provides for making purchases and paying them off over time.

Where Can I Use Cash App Buy Now Pay Later?

Some of the popular merchants that accept Afterpay include Nike, American Eagle, Finish Line, Ulta Beauty, Ray-Ban, and more.

Afterpay is accepted at over 63,000 stores, making it convenient to make purchases and pay for them over time using your Cash App account as the payment source.

You can easily browse and search for participating merchants in the Cash App’s discover tab.

How to Find Cash App Pay In 4 Merchants

To find Cash App pay in 4 merchants, open the Cash App and browse the discover tab to find participating Afterpay merchants.

Cash App Pay In 4 merchants include all merchants that accept Afterpay, which can be found on the Afterpay website.

List of the Top 100 Most Popular Merchants

- Target

- Rebel

- Officeworks

- Kogan.com

- EB Games

- Kmart

- Catch

- THE ICONIC

- BIG W

- Supercheap Auto

- Fantastic Furniture

- Bing Lee

- MYER

- Boohoo

- Jetstar

- City Beach

- Chemist Warehouse

- Culture Kings

- Foot Locker

- Showpo

- Platypus Shoes

- Michael Hill

- Mimco

- Hype DC

- Best & Less

- City Chic

- Cotton On

- Sephora

- RedBalloon

- ASOS

- Adairs

- JD Sports

- Nike – Instore

- BCF

- Factory Buys

- Hello Molly

- Petbarn

- Princess Polly

- Prouds The Jewellers

- Pandora

- ShopZero

- David Jones

- Adidas

- Tyroola Tyres

- Ally Fashion

- Miss Lola

- Glue Store

- General Pants

- Mitre 10

- Pillow Talk

- Sunglass Hut

- Pet Stock

- PrettyLittleThing

- Stylerunner

- Optus

- Supre

- Adore Beauty

- Mighty Ape

- Peter Alexander

- Strand

- Kathmandu

- Harris Scarfe

- Dotti

- Mr Toys Toyworld

- Jay Jays

- Lorna Jane

- Baby Bunting

- PUMA

- Glassons

- Country Road

- Kookai

- House

- Globe Electronics

- MAC Cosmetics

- Crazy Sales

- White Fox Boutique

- Ozsale

- The Athletes Foot

- Tiger Mist

- Bras N Things

- Bed Bath n Table

- Lacoste

- Just Jeans

- Seed Heritage

- Temple and Webster

- Crossroads

- SurfStitch

- Dyson

- Universal Store

- Nike Sydney

- Skechers

- Forever New

- Vans

- New Balance

- Guess

- Coach

- Converse

- Under Armour

- Ray-Ban

- SHEIN

Afterpay has a comprehensive list of all available stores broken down by category and other criteria.

This makes it easy to search for and find participating merchants that offer this convenient payment option.

How Does Cash App Buy Now Pay Later Work?

Cash App Pay In 4 allows users to make purchases at participating merchants and pay for them over time.

With this feature, users can split their purchase into four equal payments, with the first payment due at the time of purchase and the remaining three payments automatically deducted from their chosen payment source every two weeks.

Cash App Buy Now Pay Later works through Afterpay, which provides interest-free financing to customers who make purchases with participating merchants.

This feature is only available to Cash App users who frequently use the app, have direct deposit and a Cash Card, and are 18 years of age or older.

To use Cash App Buy Now Pay Later, users simply need to browse and shop with Afterpay merchants in the Cash App’s discover tab, select the Pay In 4 option at checkout, and set up automatic payments using their Cash App account as the payment source.

How to Use Cash App Buy Now, Pay In 4

Using Cash App Buy Now Pay Later, also known as Cash App Pay In 4, is a simple and convenient way to make purchases and pay for them over time.

To use this feature, follow these step-by-step instructions:

- Open the Cash App and tap on the Discover icon (magnifying glass) from the Home Tab to open Discover.

- Tap on the Afterpay merchant carousel to open the Afterpay Shop Hub.

- Search through Afterpay merchants by name and category. If you are new to Afterpay, you can sign up while you checkout by following the prompts.

- Select the item you wish to purchase, add it to your cart, and proceed to checkout.

- Select the Pay In 4 option at checkout and choose your payment source.

- Make your first payment at the time of purchase, and the remaining three payments will be automatically deducted from your chosen payment source every two weeks.

- To manage your Afterpay purchases made with Cash App Pay in-app, tap on the Activity feed tab in the upper-right-hand corner of the Cash App home screen. From here, you can view your Afterpay balance and available spending, complete payment installments, and update your payment schedule.

Overall, using Cash App Buy Now Pay Later is a quick and easy process that provides added flexibility and convenience when making purchases at participating merchants.

By following these simple steps, users can take advantage of this feature and enjoy the benefits of interest-free payments and more manageable payment schedules.

Our Takeaway on Cash App BNPL

And there you have it – a quick and easy guide on how to get started with Cash App Buy Now Pay Later (Pay In 4 Feature).

With this feature, you can enjoy the convenience of making purchases now and paying over time, all without any interest.

But if you’re looking for even more flexibility and options, don’t forget to check out our other article, “Buy Now Pay Later Apps that work with Cash App” to explore alternative options such as Klarna, Sezzle, Affirm, and QuadPay.

So go ahead, shop to your heart’s content, and never let the fear of high-interest rates hold you back again!

FAQ for Pay in 4 Feature

Does Cash App have buy now pay later?

Yes, Cash App has a buy now pay later (BNPL) feature called Pay In 4. This feature allows users to make purchases at participating merchants and pay for them over time without any interest.

Can you use Afterpay with Cash App?

Yes, you can use Afterpay with Cash App. Afterpay is integrated into the Cash App’s discover tab, so users can browse and shop with Afterpay merchants in the app. If you make a purchase through Cash App with Afterpay, it will generate an Afterpay account using your Cash App credentials if you don’t already have an Afterpay account.

How do I set up Afterpay for Cash App?

To set up Afterpay for Cash App, simply select the item you wish to purchase from an Afterpay merchant in the Cash App’s discover tab, add it to your cart, and proceed to checkout. At checkout, choose the Pay In 4 option, select your payment source, and make your first payment. The remaining three payments will be automatically deducted from your chosen payment source every two weeks. You can manage your Afterpay purchases made with Cash App by tapping on the Activity feed tab in the upper-right-hand corner of the Cash App home screen.

$100.00 Redeem to cashtag works

I really could use buy now pay later or cash app borrow

I jus would like to cash app but now pay later feature please.. the holidays ROUGH around here