Are you curious about whether Cash App is a checking or savings account?

With the popularity of Cash App on the rise, it’s essential to understand its account type and what it can offer.

In this article, we’ll delve into the similarities and differences between Cash App and traditional checking and savings accounts, giving you a clearer picture of whether Cash App is a checking or savings account.

So, buckle up as we explore the world of Cash App and its capabilities beyond just being a simple payment app.

- Cash App is not a checking or savings account in the traditional manner. It’s a digital wallet like a cash account that is not FDIC insured unless you have the Cash Card.

- Cash App is not a traditional bank but rather a financial service provided by Block, Inc.

- The Cash App account balance is considered a checking account for direct deposit purposes.

What Type of Account is Cash App?

Well, the answer to “is Cash App a checking or savings account?” is not entirely black and white. While it may not be a traditional checking or savings account you’d find at a standard bank, it can be used as a checking account for direct deposit purposes.

| Cash App | Bank | Account Type | FDIC Insured |

|---|---|---|---|

| Balance | Stored Directly with Cash App | Cash Account, Not Checking or Savings | Yes, only with an activated Cash Card |

| Cash Card | Sutton Bank | Prepaid Visa Debit Card | No |

| Direct Deposit | Sutton Bank | Checking | No |

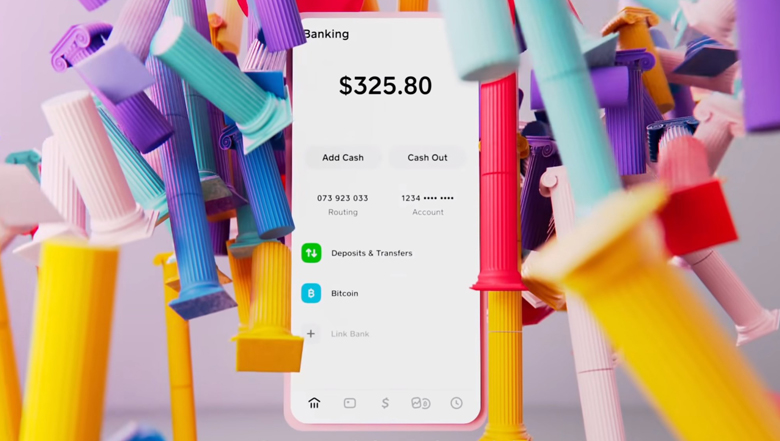

The Cash App balance is stored directly with Cash App, while the Cash Card is linked to Sutton Bank.

When you use the Cash Card, your Cash App balance funds are transferred to Sutton Bank and held there until transactions clear. If you have a Cash Card, your balance is FDIC insured through Wells Fargo.

So, what type of account is Cash App?

It’s a versatile digital wallet, offering the convenience and security of a checking account for direct deposit purposes and more. Whether you’re receiving a paycheck, social security, or other regular payments, Cash App provides an easy way to manage your finances.

Is Cash App a Bank Account?

The answer to this question is a bit complicated. While Cash App is not technically a traditional bank account, it does offer some banking services that you may be used to.

With Cash App, you can deposit money into your account, which is stored directly with Cash App, and use it to make purchases and transfers.

You’ll receive insider tips on making money online, side hustle ideas, and more. Subscribe now and take control of your financial future.

I promise not to spam, sell, or share your information.

However, Cash App is a partially-fledged bank account and only offers some of the services you’d expect from a traditional bank. For example, it doesn’t offer overdraft protection or pay interest on your balance.

So, is Cash App a bank account?

Not exactly, but it’s a financial platform that offers some of the same features and benefits.

If you’re looking for a simple and convenient way to manage your money, Cash App is a great option to consider. And, with the ability to link a Cash Card to your account, you can easily access your funds at ATMs and make purchases anywhere that accepts Visa.

What Banks Does Cash App Partner With?

Cash App partners with Sutton Bank to hold and transfer funds when users use their Cash App prepaid debit card.

This means that your account balance is held and insured at Sutton Bank for sufficient time for your card transactions to clear. On the other hand, Lincoln Savings Bank is no longer affiliated with Cash App.

However, by partnering with Sutton Bank, Cash App provides banking services such as the ability for users to access their account balance through a prepaid debit card.

So, to answer the question “What Banks Does Cash App Partner With?” – Cash App currently partners with Sutton Bank for its banking services, giving its users access to their Cash App account balance through a prepaid debit card.

Is Cash App a Checking Account with These Banks?

Cash App is a financial platform, but it is not a traditional checking account offered by a bank.

However, Cash App does partner with Sutton Bank and Lincoln Savings Bank to offer its users some of the features commonly associated with checking accounts, such as the ability to use a prepaid debit card and receive direct deposits.

While Cash App users can use their account to receive direct deposits and manage their funds, they have a different level of FDIC protection than a traditional checking account if you have the Cash App card.

Cash App users should consider the platform’s risks and limitations before deciding if it is the right choice for them.

Is Cash App’s Cash Card Checking or Savings Related?

Cash App’s Cash Card is neither a checking nor a savings account. It’s a debit card linked to the Cash App account, allowing users to use their Cash App balance to make purchases and withdraw money from ATMs.

Unlike a traditional checking account, a Cash App account does not offer overdraft protection or the ability to write checks.

And while a Cash App account may resemble a savings account, it is not insured by the FDIC unless you have the Cash Card and does not earn interest like a traditional savings account.

It is simply a financial platform that allows users to store and manage their money without the same features and benefits of a bank account.

How Cash App Goes Beyond a Bank Account

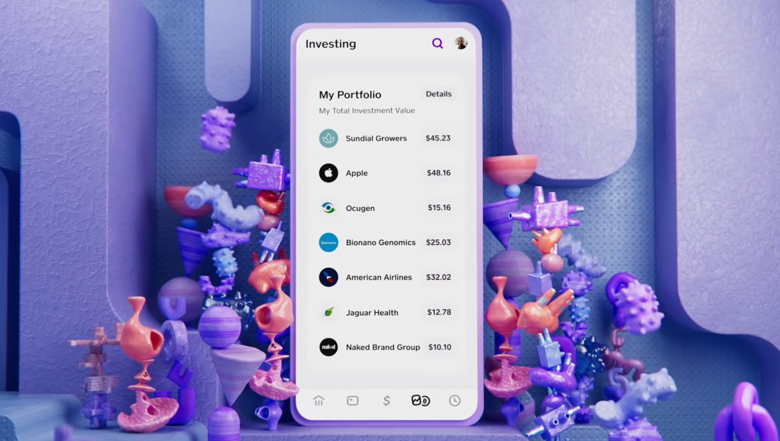

Cash App, a mobile payment app, goes beyond a traditional bank account in terms of the features it offers to its users.

With a Cash App account, users can also:

- Send and receive money

- File their taxes

- Invest in stocks and bitcoin

- Receive their paychecks early

- Buy gift cards

- Access Cash Card Boosts

- And much more

The app provides many benefits not offered by traditional checking or savings accounts, making it an all-in-one financial tool for many people.

To take advantage of these features, download Cash App and create a personal account.

Similarities to Traditional Checking Accounts

Cash App offers features that are similar to a traditional checking account, such as the ability to receive direct deposits, transfer money, and use the Cash App card as a debit card.

The Cash App balance is FDIC insured through Wells Fargo Bank if you have a Cash Card, meaning it is considered a checking account for direct deposit purposes.

This offers a convenient and secure way for users to manage their money through the Cash App, which is becoming increasingly popular as a personal finance tool.

With the ability to receive money, make purchases, and access your balance at ATMs, Cash App provides a similar experience to a traditional checking account while also offering additional features like early access to your paycheck and the ability to buy gift cards.

Similarities to Traditional Savings Accounts

“Cash App Similarities to Traditional Savings Accounts” – Cash App is not a traditional savings account, but it does offer a feature similar to savings accounts through its Round Ups feature.

If you have a Cash Card, the Round Ups feature rounds up your spare change to the nearest dollar when you use your Cash Card and invests it into your savings, stocks or bitcoin.

This allows Cash App users to potentially save money without having to actively think about it. While Cash App is not a savings account, it does offer some similar features for those who want to save and invest their money.

Our Takeaway on What Type of Account is Cash App

In conclusion, the world of finance is constantly evolving, and Cash App is a prime example of that. It offers a unique blend of features that make it stand out from traditional checking and savings accounts.

Whether you’re looking for an easy way to receive money, access your direct deposit, or round up spare change for investment, Cash App has got you covered.

So, the answer to the question, “Is Cash App a checking or savings account?” is that it’s a bit of both and so much more! With Cash App, you can enjoy the benefits of both traditional banking and cutting-edge finance, all in one convenient app.

So, if you’re looking for a new way to manage your money, give Cash App a try and see for yourself why it’s quickly becoming one of the most popular financial tools out there.

FAQs – What Type of Account is Cash App?

Does Cash App count as a checking account?

Yes, Cash App has a checking account-like feature through its Cash Card, which is a prepaid debit card linked to your Cash App balance. You can receive direct deposit paychecks to your Cash App balance and use the Cash Card like a traditional checking account debit card. However, Cash App itself is not considered a traditional checking account by FDIC standards.

Why is Cash App not considered a bank account?

Cash App is not considered a traditional bank account because it is not a deposit account at a chartered banking institution. Instead, it is a payment app that allows users to store money, send payments, and access additional financial services like the Cash Card.

What banking system is Cash App?

Cash App is not a traditional banking system, but it is FDIC insured through Wells Fargo Bank if you have a Cash Card. This means that your Cash App balance is eligible for FDIC protection up to the maximum amount allowed by law. Additionally, Cash App offers financial services beyond what is typically offered by a traditional checking or savings account, such as stock and bitcoin investing, filing taxes, and early paycheck deposit.