It’s hard to save up for what you want, especially when you don’t have much money left at the end of the month.

You know you need to save for what you want, but it’s hard to do when your paycheck barely covers your rent and bills.

With Cash App and Buy Now Pay Later, you can get the things you want and pay for them over time.

Plus, this service is available with Cash App, so you can use your favorite app to pay for your purchases.

Read on to learn how to do that.

Popular Buy Now Pay Later Apps

Several buy now pay later apps are available, but some of the most popular include Sezzle, Klarna, AfterPay, and Affirm.

All these apps allow you to shop online or in-store and spread the cost of your purchase over several weeks or months. This can be a great way to buy big-ticket items or to spread the cost of Christmas gifts throughout the year.

🏆 Our Top 3 Buy Now Pay Later Apps 2024 (Editor’s Choice)

Albert – Get a $250 instant cash advance with no credit checks, zero interest fees, and instant approval!

Klarna – $20 Amazon gift card after first purchase when you sign-up here.

Sezzle – $5 bonus after sign-up towards your first purchase when you sign-up here.

Note that these apps often charge interest on your purchase, so it’s essential to read the terms and conditions carefully before signing up.

Also, ensure you have enough money to cover the repayments each week or month, as missed payments can result in late fees and penalties.

How to Use Buy Now Pay Later Apps with Cash App Account

There are no buy now, pay later apps or services that support Cash App.

However, there is good news.

I’m also a Cash App user and have been looking for a way to use these apps.

The best way to do this is to use a temporary account like Chime® to set up your buy now pay later account.

Then you can quickly transfer funds between your Cash App account and Chime account.

Here’s how to do it.

Step 1. Get a Chime Account

You can set up your Chime account in under 3 minutes, and they instantly give you a virtual debit card that you can use with any Buy Now Pay Later service. Score!

This setup will let you transfer money between your Cash App and Chime accounts.

Step 2. Sign Up for a Buy Now Pay Later Service (& Get Sign-Up Bonus)

Here are my recommendations for buy now, pay later services, including the sign-up bonuses.

- Albert – Get a $250 instant cash advance with no credit checks, zero interest fees, and instant approval!

- Klarna – $20 Amazon gift card after first purchase when you sign-up here.

- Sezzle – $5 bonus after sign-up towards your first purchase when you sign-up here.

Step 3. Link Your Chime Account to Cash App

Add your Chime account to your Cash App account to quickly transfer funds between the two accounts.

Now you are ready to make your first purchase.

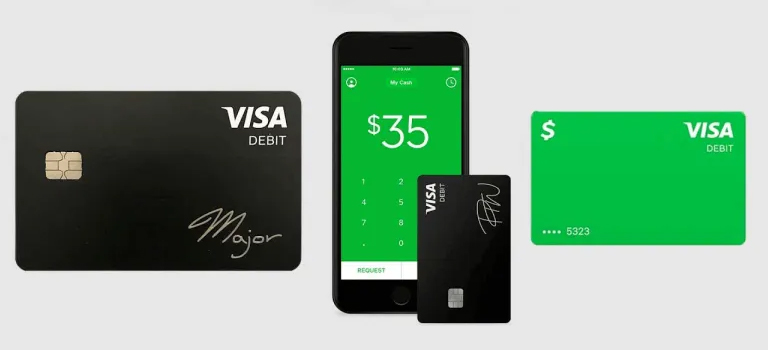

Do Buy Now Pay Later Apps Work with the Cash App Card?

No, the popular Buy Now Pay Later Apps do not work directly with Cash App cards to place orders. This is because the Cash App card is not a bank debit card but a prepaid card linked to funds in your Cash App wallet.

However, this is not the end of the road for Cash App users. There are a few ways to use the Cash App Card indirectly.

There is still hope if you want to use Buy Now Pay Later Apps like AfterPay, Sezzle, Affirm, Klarna, and others and pay with a Cash Card.

Did you know that 56% of Americans have used a Buy Now, Pay Later service?

However, you can still use the Cash App card indirectly with BNPL apps by adding it to Apple Pay or Google Pay wherever it is accepted as a payment option.

When shopping, use Apple Pay or Google Pay as your payment method on the Buy Now Pay Later app.

Alternatively, you can transfer funds from your Cash App card to a linked debit card or bank account and pay for the BNPL service.

Does Klarna Accept Cash App?

Note: Klarna does not support Cash App, but you can use a Chime account. Chime will instantly give you the debit card number to set up your Klarna buy now pay later account. You can quickly transfer money from your Cash App account to your Chime account.

Does Klarna take Cash App?

Klarna does not accept the Cash App card because it is a prepaid card, and Klarna only accepts major brand credit or debit cards.

Does Klarna take Cash App Card?

Can you use Klarna on Cash App in conjunction with Klarna? Yes, Klarna accepts Apple Pay and Google Pay as payment methods. And both of these apps are compatible with the Cash App Card. As a result, you can add your Cash App card to Apple Pay or Google Pay and pay Klarna from there.

Another option to consider is using the money in your Cash App account. Simply cash out or transfer the funds in your Cash App account to another bank debit card you own (Cash App supports instant transfers to debit cards for a 1.5 percent fee), and then use this debit card as a payment method in Klarna.

Alternatively, if you have the time, you can transfer the funds from Cash App to a linked bank account (this takes 1-3 business days) and then use that bank account as a payment method in Klarna.

The debit card should have been added as a payment method in your Cash App. You can do so by following the steps outlined below.

Does Sezzle Accept Cash App?

Note: Sezzle does not support Cash App, but you can use a Chime account, free for anyone, including people with bad credit and bad bank account history. Chime will instantly give you the debit card number to set up your Sezzle buy now pay later account. You can quickly transfer money from your Cash App account to your Chime account.

Sezzle does not accept Cash App as a payment method for orders. You can, however, use your Cash App card to pay off the balance in installments over the credit period.

To incorporate a Cash App Card into Sezzle:

- Navigate to the Payment Methods section of the Sezzle dashboard.

- Click “Add a new debit/credit card” and enter your Cash App card information.

- Once added, it should appear in the “Prepaid card” section.

Prepaid cards cannot be used to place orders or schedule installments, so they cannot be set as your default payment method. You can, however, use it to pay off existing installments.

Again, indirect methods will suffice. In Sezzle, you can use Apple Pay or Google Pay as a payment method.

Then transfer funds from your Cash App Account to your Apple Wallet/Google Pay account to use on Sezzle.

Does Affirm Accept Cash App?

According to Affirm, you can only pay for Affirm purchases with your debit card or checking account. As a result, the Cash App Card cannot pay for Affirm.

Your credit limit depends on how long you’ve been an Afterpay customer and whether you make your payments on time and in full.

Again, if you want to use funds from your Cash App account to pay Affirm, you can take the following indirect route:

Transfer funds from your Cash App Card to a linked debit card (instantly for a 1.5 percent fee) and use the debit card on Affirm.

Transfer funds from your Cash App Card to a linked bank account (this will take 1-3 business days) and then use the bank account on Cash App.

For some purchases, you can also pay for the down payment and installments with a credit card.

Does AfterPay Accept Cash App?

Note: Afterpay does not support Cash App, but you can use a Chime account, free for anyone, including people with bad credit and bad bank account history. Chime will instantly give you the debit card number to set up your Afterpay buy now pay later account. You can easily transfer money from your Cash App account to your Chime account.

Does Afterpay take Cash App?

AfterPay accepts all major international credit and debit cards but does not currently accept prepaid cards such as the Cash App card.

You can take a detour here because AfterPay accepts Apple Pay. So, use AftePay as your payment method and Apple Pay as your payment method. Additionally, add your Cash App Card to Apple Pay.

Also, since AfterPay was recently acquired by Square (the parent company of Cash App) in 2021 for a whopping $29 billion, you can expect positive updates in this space.

AfterPay will be integrated and offered as a payment option within Cash App, according to the plan. However, no timetable has been communicated for this.

Does QuadPay (Zip) Accept Cash App?

Can I use QuadPay on Cash App?

QuadPay (Zip) is another Buy Now Pay Later service that accepts only debit cards linked to bank accounts and credit cards as payment methods and does not accept Cash App Card (which is a prepaid card)

Zip does allow you to pay an active installment with Apple Pay, but it does not appear that it can be used to place the order.

As a result, you cannot use the indirect route to place orders. So you can transfer your Cash App funds to a compatible debit card and use that card to place your order on Zip.

What is Buy Now Pay Later?

A buy now pay later scheme is a type of financing that allows consumers to purchase items or services and pay for them over time. These schemes can be offered through retailers, credit card companies, or financial institutions.

When consumers enroll in a buy now pay later scheme, they are typically given a period (usually between three and 12 months) to make no payments on the purchase.

At the end of the promotional period, the consumer makes monthly payments until they are paid off. The interest rates on these schemes vary, but they are often higher than traditional credit card interest rates.

The Process of Buy Now Pay Later

The buy now pay later is a way to purchase items now and then spread the cost of the purchase out over time.

With this option, you’ll make equal payments until the purchase is paid off. The payment schedule varies depending on what you choose.

This type of financing can be helpful if you need to buy something but don’t have the cash on hand to do so immediately.

It can also be helpful if you want to take advantage of a sale or promotional offer but don’t want to pay for the item all at once.

Remember that you may need to pay interest charges associated with this type of financing, so it’s essential to read the terms and conditions carefully before deciding if buy now pay later is right for you.

Also, if you’re using a credit card to fund your purchase, you must make sure you can pay off the balance before interest starts accruing.

Cash Apps’ Purchase Now, Pay Later Option

In the meantime, Cash App has launched its own Buy Now Pay Later option, which is currently being tested.

This is only available at select locations and merchants and for purchases ranging from $35 to $500.

You can split your purchase at participating online merchants into four interest-free payments using the Cash App BNPL option.

The first payment will be made at checkout, and the remaining three payments will be charged automatically to your Cash App balance or linked card every two weeks.

Funds will be deducted from your linked debit card if your balance falls below a certain threshold.

According to Cash App, the availability of this BNPL option is determined by several factors such as Cart Size, Cash App Usage, Account History, Repayment History, Credit History, and so on.

Cash App also does a soft credit check or payment history check to create a credit report when getting a buy now pay later to ensure you can make future payments (Installment Payments).

Shall I Use Buy Now Pay Later?

It depends on your financial needs and goals. Pay Later may not be the best option for you if you need the item you’re purchasing right away.

However, buying Now Pay Later may be better if you have some breathing room in your budget and can afford to wait a few months to pay for something.

Remember that when using Buy Now Pay Later, you’ll still have to make at least the minimum monthly payment to keep the account in good standing.

And if you don’t make any payments within a certain period (usually six months), then your account may be canceled, and you may have to pay a fee.

So be sure to read all the terms and conditions before committing!

Conclusion – Cash App & Buy Now Pay Later

That’s about it.

With the Cash App becoming increasingly popular, you can expect many new features, including expanded payment options.

So, try Cash App’s newest feature, BNPL, today!

Some sites may not accept Cash Apps as a direct payment option. So, you can use alternate options described above or let us know in the comments. We’ll help you find the best method for shopping on those websites.

If you have any questions, you can ask Cash App credit bureaus.

Did we miss anything? If yes, check the comments!

Chime is a financial technology company, not a bank. Banking services provided by The Bancorp Bank, N.A. or Stride Bank, N.A., Members FDIC.